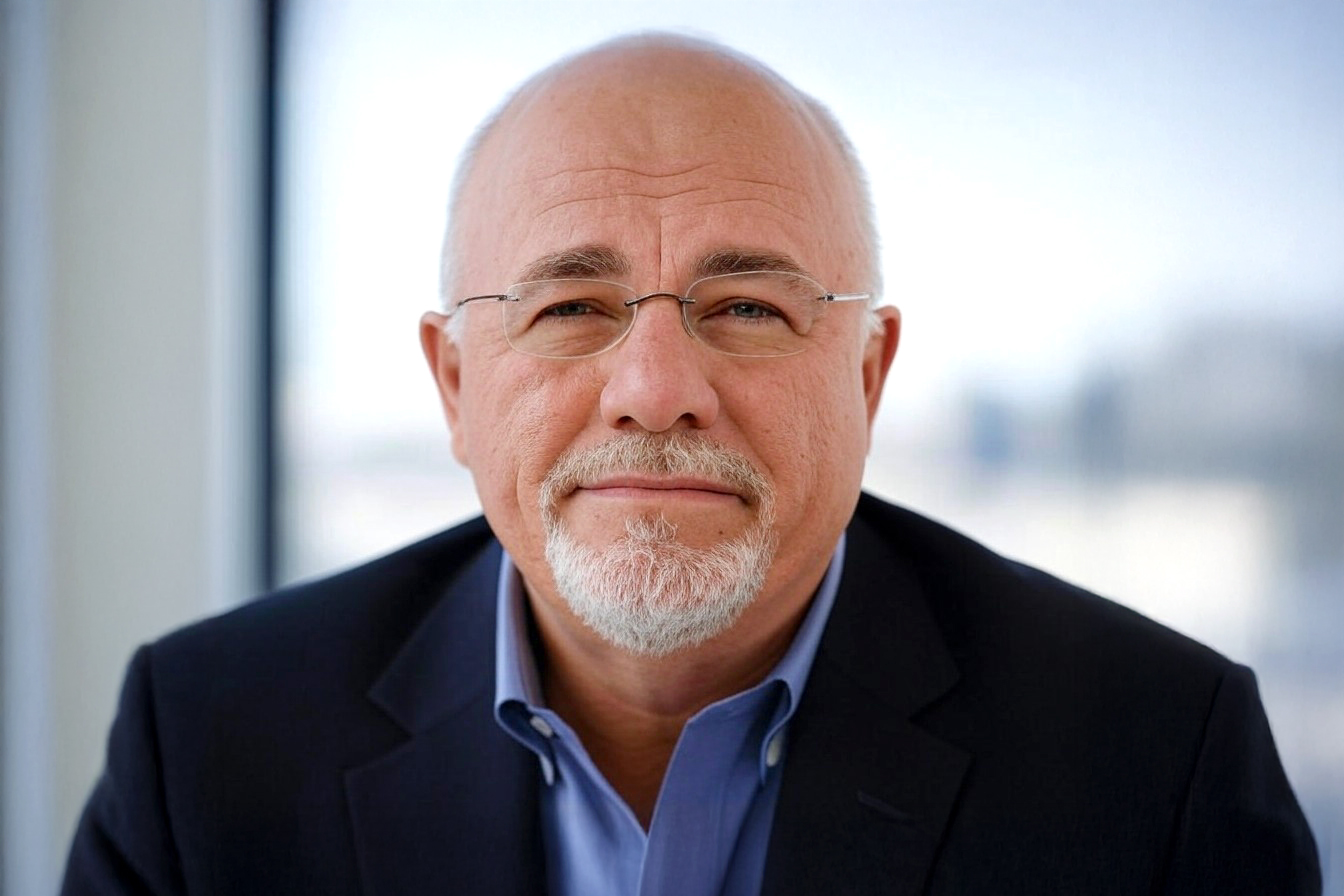

Dave Ramsey has built a reputation as one of America’s most trusted voices on money management and wealth building. His straight-talking approach and practical strategies have helped millions of people transform their financial situations.

His philosophy centers on financial discipline, strategic planning, and consistent action. Whether you’re drowning in debt or already on your financial journey, Ramsey’s wealth-building strategies provide a clear roadmap to financial peace and wealth.

These time-tested principles aren’t get-rich-quick schemes but proven methods that have helped ordinary people build extraordinary wealth over time. Let’s explore the five key strategies that form the foundation of Dave Ramsey’s approach to building lasting wealth.

1. Eliminate Debt Using the Debt Snowball Method

According to Dave Ramsey, the first step to building wealth is eliminating debt completely. Ramsey views debt as the single greatest obstacle to building wealth because it continuously drains your income —our most powerful wealth-building tool. His preferred approach is the debt snowball method, which differs from other debt reduction strategies in its psychological approach.

With the debt snowball method, you list all your debts from smallest to largest, regardless of interest rates. You make minimum payments on all debts, but throw every extra dollar at the smallest debt until it’s paid off. Once that debt is eliminated, you take the amount you were paying toward it and add it to the minimum payment on your next smallest debt, creating a “snowball” effect as you tackle each debt.

While mathematically not always the most efficient approach (compared to targeting high-interest debt first), Ramsey advocates for this method because it provides quick wins that motivate people. Ramsey says, “Personal finance is 80% behavior and only 20% head knowledge.” The debt snowball method builds momentum through these small victories, making you more likely to stick with the plan.

Ramsey strongly believes you must eliminate all consumer debt (credit cards, car loans, student loans, and personal loans) before moving on to serious investing. The only debt he considers acceptable to maintain while investing is a mortgage, and even that debt should be paid off early in his financial plan. By freeing yourself from debt payments, you unlock significant cash flow that can be redirected toward wealth building. This is step number one: debt elimination.

2. Build a Fully-Funded Emergency Fund

The second crucial strategy in Ramsey’s wealth-building plan is establishing a solid emergency fund. This strategy follows a two-phase approach. First, while paying off debt, Ramsey recommends saving a starter emergency fund of $1,000. This provides a small buffer against life’s unexpected expenses without derailing your debt payoff progress.

Once all consumer debt is eliminated, the next step is to build a fully-funded emergency fund containing 3-6 months of household expenses. This larger fund is a financial safety net that prevents you from returning to debt when life happens – whether it’s a medical emergency, job loss, or major home repair.

Ramsey emphasizes that an emergency fund should be kept in a liquid account that’s easily accessible, such as a high-yield savings account or money market account. The purpose isn’t to grow wealth through this money but to provide security and peace of mind. The psychological benefit of having this cushion can’t be overstated – it reduces financial stress. It allows you to make better long-term financial decisions without the pressure of immediate needs.

The emergency fund is a crucial part of a strong financial foundation. Without it, many people find themselves in a perpetual cycle of getting out of debt only to go back into debt when unexpected expenses arise. By breaking this cycle, you create stability that supports all your other wealth-building efforts.

3. Invest 15% of Your Income for Retirement

Once you’ve eliminated debt and established a full emergency fund, Ramsey’s third strategy involves consistently investing 15% of your gross household income toward retirement. This percentage is chosen to balance current lifestyle needs with future financial security.

Ramsey recommends a specific order for retirement investing: First, contribute to your employer-sponsored retirement plan (like a 401(k)) up to the company match. This takes advantage of what he calls “free money.” Next, max out Roth IRA contributions if you’re eligible. If you still haven’t reached 15% of your income after these steps, return to your 401(k) or other retirement plans until you hit that 15% mark.

The power of this strategy lies in consistency and the magic of compounding gains. When you invest 15% of your income over decades, even modest incomes can grow substantial nest eggs. Ramsey often points out that investing $500 per month from age 30 to 70 in good growth stock mutual funds with an average annual stock market return could potentially grow to over $5 million by retirement.

Ramsey emphasizes starting this step only after completing the previous ones because investment success requires financial stability. A proper emergency fund prevents you from having to cash out investments prematurely due to life’s emergencies, hindering your compound growth.

By dedicating a specific percentage rather than an arbitrary dollar amount, this strategy automatically adjusts as your income grows, ensuring your retirement investing scales with your earnings throughout your career.

4. Diversify Through Strategic Mutual Fund Investments

Ramsey’s fourth strategy focuses on a specific approach to mutual fund investing for the actual investment vehicles. He advocates dividing retirement investments equally across four types of mutual funds: growth, growth and income, aggressive growth, and international. This provides diversification while maintaining a focus on equity investments for long-term growth.

Ramsey prefers mutual funds over individual stocks because they provide built-in diversification and professional management. He explicitly recommends funds with long track records (at least 10 years) of fund performance. While he acknowledges that past performance doesn’t guarantee future results, he believes consistency over time is a good indicator of fund quality.

This approach reflects Ramsey’s philosophy of keeping investments relatively understandable and straightforward. He frequently warns against complex investment vehicles, speculative investments, and trying to time the market. Instead, he advocates for steady, consistent investing in funds you understand, regardless of market conditions.

Ramsey also emphasizes the importance of working with financial advisors who take an educational approach. He believes investors should understand their investments rather than unthinkingly follow recommendations. This knowledge helps people stay committed to their investment strategy during market downturns when many make the mistake of selling low out of fear.

The focus on growth-oriented mutual funds aligns with Ramsey’s belief that building wealth requires accepting an appropriate level of risk for your age and goals rather than playing it too safe with investments that barely keep pace with inflation.

5. Live Below Your Means to Maximize Wealth Building

The fifth strategy underpinning Ramsey’s wealth-building principles is living below your means. This isn’t just about budgeting—fundamentally rejecting consumer culture’s pressure to spend everything you make (or more). According to Ramsey, wealth building is impossible without the gap created by spending less than you earn.

Ramsey is particularly vocal about avoiding lifestyle inflation as income grows. Instead of upgrading your lifestyle with each raise or bonus, he encourages maintaining your standard of living while directing increased income toward wealth-building goals. This doesn’t mean living miserably—instead, making intentional choices about where your money goes instead of mindlessly spending.

One specific application of this principle is Ramsey’s stance on vehicles. He advocates buying used cars with cash rather than financing new vehicles that rapidly depreciate. This approach alone can redirect hundreds of thousands of dollars toward wealth-building over a lifetime.

For housing, Ramsey recommends keeping mortgage or rent payments below 25% of your take-home pay to ensure housing doesn’t crowd out other financial goals. This often means choosing a more modest home than what banks might approve you for.

The power of living below your means isn’t just mathematical—it’s psychological. By consciously avoiding the comparison trap and status purchases, you gain freedom from the constant pressure to upgrade your lifestyle. This contentment allows you to build wealth without feeling deprived, as your financial choices align with your long-term values rather than short-term desires.

Conclusion

Dave Ramsey’s five wealth-building strategies form a comprehensive system that has helped countless people transform their financial futures. These principles—eliminating debt through the snowball method, building a fully funded emergency fund, investing 15% for retirement, diversifying through strategic mutual fund investments, and living below your means—work together as a cohesive plan rather than isolated tactics.

What makes Ramsey’s approach powerful is its emphasis on behavior over mathematics. Acknowledging the psychological aspects of personal money management, these strategies address the practical steps needed to build wealth and the mindset required to stick with the plan over decades.

The result is a straightforward path anyone can follow regardless of income level or starting point. Financial freedom isn’t about complex strategies or privileged starting positions—it’s about consistently applying these fundamental principles over time.