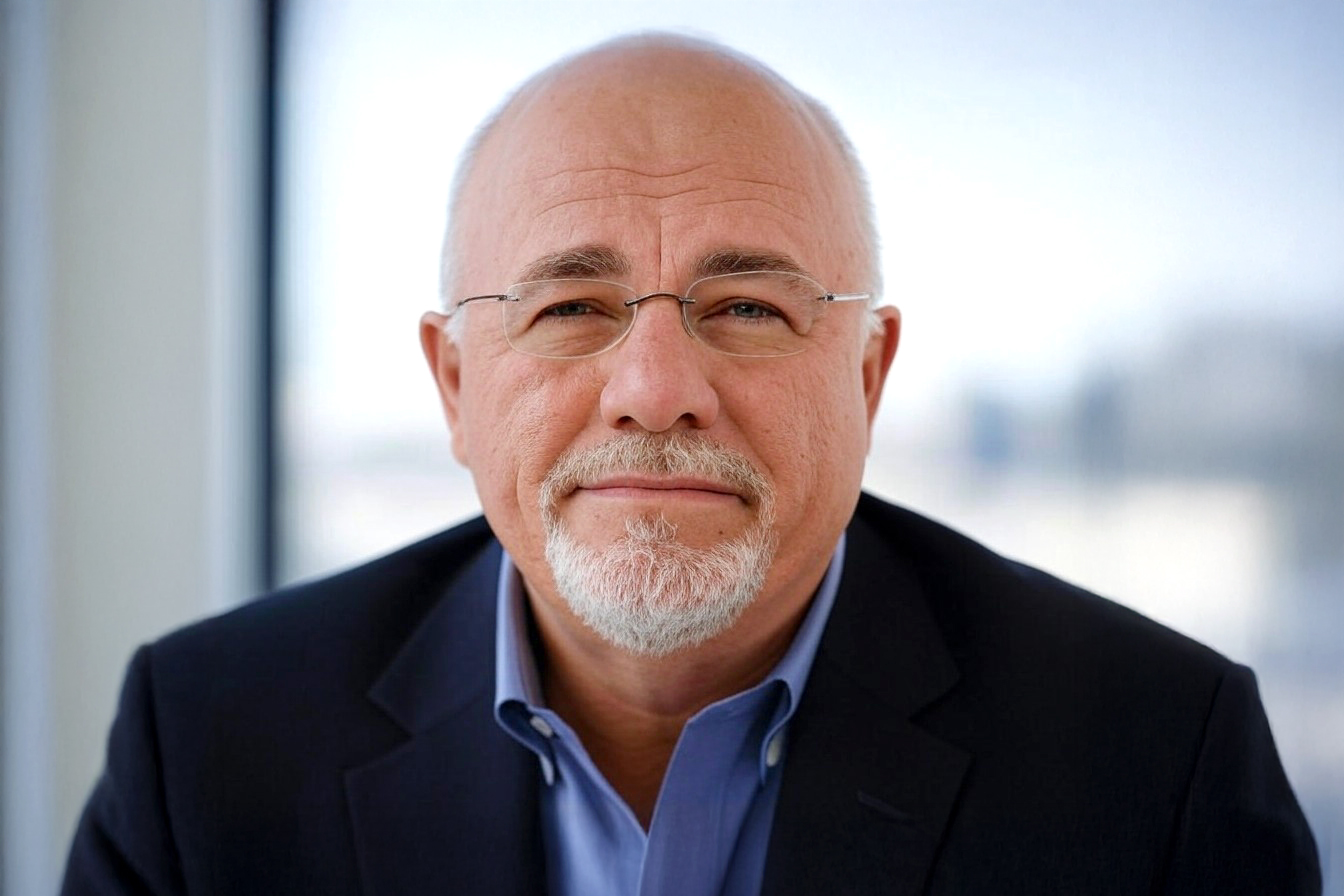

When most people envision millionaires, they picture high-powered executives, celebrity entrepreneurs, or Wall Street moguls driving luxury cars and living in mansions. However, Dave Ramsey’s groundbreaking National Study of Millionaires paints a dramatically different picture of wealth in America.

This comprehensive research project, involving over 10,000 millionaire participants, represents the most extensive study ever conducted and reveals surprising truths about who achieves millionaire status.

The study’s findings challenge common assumptions about wealth building. Rather than requiring six-figure salaries or family inheritance, most millionaires achieved their status through disciplined financial habits and process-oriented thinking.

79% of the millionaires studied received no inheritance, and 93% attributed their wealth to hard work rather than high salaries. Perhaps most surprisingly, only 31% averaged $100,000 annually over their careers, with one-third never earning six figures in any single working year.

The research identified five specific careers that produce the most millionaires. These professions share a common characteristic that proves more valuable than high income: a systematic, process-oriented approach to work and life. This methodical mindset, essential for success in these careers, naturally translates into the disciplined financial habits necessary for wealth building.

Here are the top five careers of self-made millionaires based on Dave Ramsey’s study:

1. Engineer

Engineers top the list of millionaire careers, which makes perfect sense when examining the professional mindset required for engineering success. Engineering demands systematic thinking, precise execution, and unwavering adherence to proven processes. These qualities, which prevent buildings from collapsing and ensure bridges remain standing, also create the foundation for successful wealth building.

The engineering profession inherently develops a process-oriented mindset. Engineers follow established methodologies, conduct thorough analyses before making decisions, and understand that shortcuts often lead to failure. This systematic approach to problem-solving translates seamlessly into personal finance management. Engineers naturally gravitate toward proven wealth-building strategies like consistent investing, careful budgeting, and long-term financial planning.

The current engineering career landscape also provides favorable conditions for wealth accumulation. A persistent shortage of engineering talent means professionals in this field often enjoy job security and growth opportunities. The systematic nature of engineering work reinforces the importance of following established procedures, whether designing a structural system or building a retirement portfolio.

Engineers excel at understanding complex systems and identifying potential points of failure, skills that prove invaluable when evaluating investment opportunities and avoiding financial pitfalls. Their training emphasizes the importance of data-driven decisions and calculated risk assessment, which serve them well in professional and personal financial contexts.

2. Accountant/CPA

Accountants and Certified Public Accountants occupy the second position on the millionaire career list, bringing unique advantages to wealth building through their professional expertise in financial management. These professionals spend their careers understanding money flow, tax strategies, and financial planning principles, knowledge that naturally extends to their personal financial decisions.

The accounting profession develops a deep appreciation for systematic record-keeping, budget analysis, and long-term financial planning. Accountants understand the power of compounding, the importance of tax-efficient investing, and the value of maintaining detailed financial records. This professional knowledge provides a significant advantage when implementing personal wealth-building strategies.

Accountants approach financial decisions with the same methodical precision they apply to professional work. They understand the importance of accurate financial tracking, strategic tax planning, and disciplined spending habits. Their professional training emphasizes the value of consistent processes and long-term thinking, qualities essential for successful wealth accumulation.

The process-oriented nature of accounting work reinforces systematic approaches to personal finance. Accountants are accustomed to following established procedures, maintaining detailed documentation, and making decisions based on thorough analysis rather than emotion. These professional habits create natural advantages when implementing proven wealth-building strategies like consistent investing and careful expense management.

3. Teacher

Including teachers among the top millionaire careers might surprise many, given that education professionals typically earn modest salaries compared to other professions. However, teachers possess unique qualities that contribute significantly to successful wealth building, demonstrating that high income isn’t a prerequisite for achieving millionaire status.

Teachers excel at long-term planning, systematic execution, and patient persistence. These professionals spend their careers developing curriculum, tracking student progress, and maintaining consistent routines throughout the academic year. The same organizational skills and systematic approach that create successful classrooms also foster disciplined financial habits.

The teaching profession reinforces the value of consistent, methodical approaches to achieving goals. Teachers understand that learning requires patience, repetition, and steady progress. This mindset translates perfectly to wealth building, where consistent investing and disciplined spending create substantial long-term results through compound growth. Teachers often have access to solid retirement benefits, including pension systems and tax-advantaged retirement accounts.

Their systematic approach to professional development and goal setting naturally extends to personal financial planning. The patience required for effective education also serves teachers well in wealth building, helping them avoid impulsive financial decisions and maintain focus on long-term objectives.

The modest salaries typical in education reinforce disciplined spending habits. Teachers become experts at living within their means, finding creative solutions for limited budgets, and maximizing the value of every dollar spent. These skills prove invaluable when implementing wealth-building strategies that depend more on consistent habits than high income.

4. Management

Management professionals, particularly those in middle management rather than executive positions, represent the fourth most common millionaire career. The study clarifies that only 15% of millionaires held senior leadership roles like vice president or C-suite positions, indicating that middle management skills create excellent foundations for wealth building.

Management roles develop essential skills for personal financial success, including budget planning, resource allocation, and strategic thinking. Managers spend their careers setting goals, creating systematic processes to achieve objectives, and monitoring progress toward desired outcomes. These same skills prove invaluable when applied to personal wealth building.

The management profession emphasizes the importance of systematic problem-solving and goal-achievement approaches. Managers understand how to break large objectives into manageable steps, create accountability systems, and maintain consistent progress over extended periods. This process-oriented thinking naturally extends to financial planning and wealth accumulation strategies.

Management experience provides valuable insights into human behavior, decision-making processes, and the importance of consistent execution. These professionals understand that successful outcomes require disciplined adherence to proven systems rather than sporadic bursts of activity. This understanding serves them well when implementing wealth-building strategies that depend on consistent, long-term commitment.

The analytical skills developed in management roles also contribute to financial success. Managers learn to evaluate options objectively, assess risks systematically, and make decisions based on data rather than emotion. These capabilities prove essential when making investment decisions and avoiding common financial mistakes.

5. Attorney

Attorneys complete the top five millionaire careers, bringing systematic thinking and analytical skills that translate effectively into wealth-building success. The legal profession demands meticulous attention to detail, systematic case preparation, and long-term strategic thinking, which are valuable in personal financial management.

Legal training emphasizes the importance of following established procedures and thorough preparation. Attorneys understand that successful outcomes require systematic approaches, careful analysis, and patient persistence. These qualities create successful legal strategies and also foster disciplined financial habits and consistent wealth-building behaviors.

The legal profession develops strong analytical skills and attention to detail that serve attorneys well in personal finance. Legal professionals learn to evaluate complex information, identify potential risks, and make strategic decisions based on thorough analysis. These skills prove invaluable when assessing investment opportunities and creating comprehensive financial plans.

Attorneys understand the value of long-term strategic thinking and systematic execution. Legal cases often require extended timelines and consistent effort over months or years, developing patience and persistence that translate well to wealth building. The systematic nature of legal work reinforces process-oriented approaches to achieving long-term financial objectives.

Conclusion

Dave Ramsey’s National Study of Millionaires reveals that wealth-building success depends more on systematic thinking and disciplined habits than high salaries or lucky breaks. The five careers that produce the most millionaires share a common characteristic: They develop process-oriented mindsets that naturally extend to personal financial management.

The study’s most encouraging finding is that 89% of millionaires represent first-generation wealth, meaning they didn’t inherit their money. This demonstrates that millionaire status remains achievable for anyone willing to adopt systematic approaches to financial management, regardless of their career choice or starting point.

These millionaire careers succeed because they reinforce the fundamental principles of wealth building: living below your means, investing consistently over long periods, avoiding debt, and maintaining disciplined financial habits. The process-oriented thinking that creates professional success in these fields also establishes the foundation for personal financial success.

As Dave Ramsey noted in response to the survey results, “It turns out that math works for all of us — especially when you understand that your income is your most powerful wealth-building tool.” The key lies not in earning the highest possible salary but in systematically managing whatever income you do earn through proven wealth-building processes.