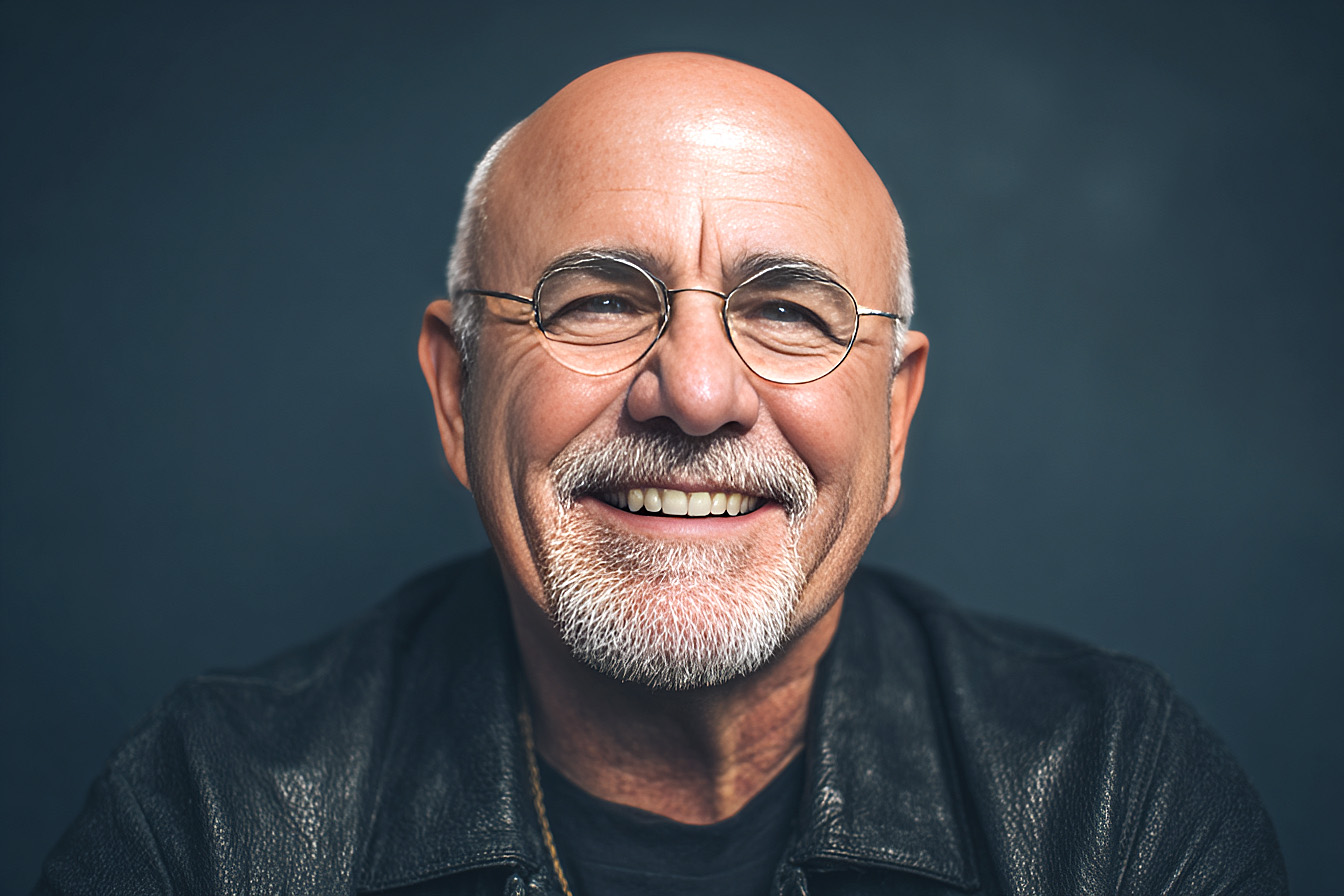

Dave Ramsey has built his reputation on a simple but powerful premise: personal finance is 80% behavior and 20% knowledge. His approach emphasizes self-discipline as the cornerstone of financial success, offering five specific rules that form the foundation of his wealth-building philosophy.

These behavior-driven strategies focus on practical steps that anyone can implement, regardless of their current financial situation. Ramsey’s methodology has helped millions escape debt and build wealth by consistently applying these principles. Here are Dave Ramsey’s five self-discipline rules that will take care of your finances:

1. Build a $1,000 Starter Emergency Fund—Fast

The foundation of financial stability begins with establishing a basic emergency fund as quickly as possible. Ramsey famously states, “We were so far in debt we couldn’t breathe” when describing his financial struggles. This $1,000 starter emergency fund, known as Baby Step 1 in his system, is a crucial buffer between you and life’s unexpected expenses.

The psychological benefit of having this fund is the crucial foundation of personal finance. When your car breaks down or an appliance fails, you won’t need to reach for a credit card or take out a loan, preventing you from sliding deeper into debt. This emergency fund should be saved before tackling other financial goals, including paying off debt beyond minimum payments.

To accumulate this fund quickly, consider taking on temporary side work, selling items you no longer need, or implementing aggressive but temporary budget cuts. The key is speed and urgency. This isn’t your full emergency fund but a starter fund designed to handle minor emergencies while you work on other financial priorities. True emergencies include unexpected medical bills, essential home repairs, or job loss, not vacations or holiday shopping.

2. Create and Stick to a Written Budget

Budgeting forms the backbone of financial discipline, and Ramsey advocates for a zero-based budget where every dollar of your income is assigned a purpose before the month begins. This approach ensures that your income minus expenses equals zero, meaning every dollar has a designated role in your financial plan.

The philosophy behind this rule centers on his teaching: “A budget is telling your money where to go rather than wondering where it went.” A written budget increases awareness of your spending habits and forces you to make intentional decisions about your money. This process involves listing your monthly income and all expenses, including necessities like housing and utilities, debt payments, savings contributions, and discretionary spending.

Ramsey recommends using tools like the EveryDollar app or simple spreadsheets to track monthly spending. The budget isn’t a one-time exercise but requires monthly review and adjustment to stay on track.

Categories should include all necessary expenses, debt payments, savings goals, and even entertainment or dining out, as long as every dollar is accounted for. The discipline of budgeting transforms your relationship with money from reactive to proactive.

3. Get Out of Debt Completely (Except for a Mortgage)

Ramsey views debt as a wealth destroyer that prevents you from building proper financial security. Using the debt snowball method, he focuses on eliminating all consumer debt, including credit cards, car loans, and student loans. This strategy prioritizes first paying off the smallest debts, regardless of interest rates, to build momentum and motivation.

The debt snowball method lists all non-mortgage debts from smallest to largest. You make minimum payments on all debts while putting extra money toward the smallest debt until it’s completely paid off. Once the smallest debt is eliminated, you roll that payment amount into the next smallest debt, creating a snowball effect that accelerates as you progress.

This approach emphasizes psychological wins over mathematical optimization. While paying off higher-interest debt first might save more money on paper, Ramsey argues that the behavioral aspect of seeing quick progress is more important for long-term success. The method also requires avoiding new debt entirely, including car financing or education. Instead, save cash for these purchases to maintain your debt-free status.

4. Live on Less Than You Make

Living below your means is essential for avoiding debt and enabling savings and investment. This rule requires spending less than your income, creating the margin necessary for financial progress. Ramsey emphasizes that many millionaires live modestly despite their wealth, demonstrating that frugality and wealth building go hand in hand.

Implementing this rule involves identifying areas to reduce unnecessary expenses. Common targets include dining out frequently, multiple subscription services, impulse purchases, and luxury items that don’t align with your financial goals. The key is distinguishing between needs and wants, prioritizing essential expenses while cutting discretionary spending.

Ramsey addresses transportation in a significant way. He advocates buying reliable used cars with cash rather than financing new vehicles. Car payments represent one of the biggest wealth-building obstacles for many families. By avoiding car loans and purchasing vehicles outright, you eliminate both the monthly payment and the interest, freeing up considerable money for savings and investments.

The money saved by living below your means shouldn’t disappear into lifestyle inflation but be deliberately redirected toward your financial goals. This discipline creates the foundation for building an emergency fund, eliminating debt, and long-term investing.

5. Save and Invest Consistently

The final rule focuses on building wealth through consistent saving and investing. Ramsey’s approach follows a specific sequence: establish the starter emergency fund, eliminate debt, create a full emergency fund covering three to six months of expenses, and then begin investing 15% of gross income for retirement.

The full emergency fund should be kept in a high-yield savings account, which provides security and accessibility. This fund protects against major financial setbacks without derailing other financial goals. After establishing this foundation, the focus shifts to long-term wealth building through retirement investing.

Ramsey recommends prioritizing employer 401(k) matches first, as this represents free money that immediately doubles your investment. After maximizing employer matches, he suggests contributing to Roth IRAs, then returning to traditional 401(k) contributions. The investment approach emphasizes growth stock mutual funds held for the long term, utilizing dollar-cost averaging through consistent monthly contributions.

The key to this rule is consistency rather than timing the market or seeking complex investment strategies. By automatically investing a percentage of your monthly income, you build wealth steadily over time while benefiting from compound growth. This approach requires discipline to maintain investments even during market volatility, trusting in the long-term growth potential of diversified stock mutual funds.

Conclusion

Dave Ramsey’s five self-discipline rules create a comprehensive framework for financial success through behavior modification rather than complex strategies. These rules work together synergistically: budgeting provides control, debt elimination creates freedom, living below your means generates a margin for investing, emergency funds offer security, and consistent investing builds wealth.

The approach emphasizes that financial success comes from sustained discipline and consistent application of these principles. While critics may argue that some aspects are overly rigid, millions have found financial peace by following this straightforward, behavior-focused methodology. Success requires commitment to all five harmonious rules, creating a sustainable path toward economic independence and security.