1. The Foundation: Why Middle-Class Millionaires Are Made, Not Born

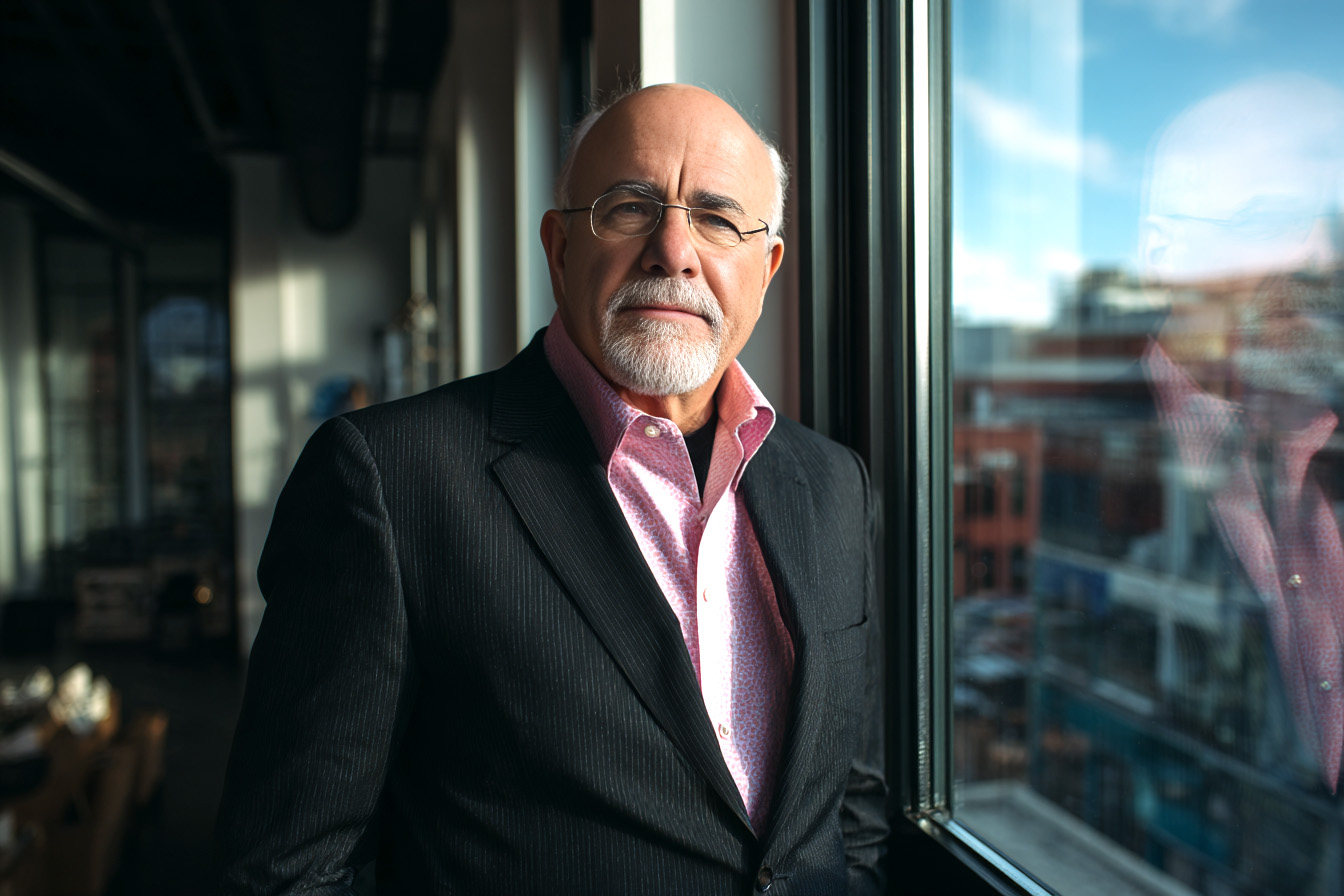

Dave Ramsey’s wealth-building philosophy centers on a fundamental truth: millionaires are created through behavior, not circumstances. Most wealthy Americans didn’t inherit their money or earn exceptionally high incomes. Instead, they followed systematic principles that transformed ordinary earnings into extraordinary wealth.

This reality challenges the belief that you need a six-figure salary to achieve millionaire status. The formula works for middle-class earners because it emphasizes discipline and consistency over income level. Success comes from making deliberate choices about spending, saving, and investing rather than waiting for the perfect financial circumstances that may never arrive.

2. Breaking Down the Baby Steps: Your Roadmap to Seven Figures

The path to middle-class millionaire status follows Dave Ramsey’s sequential Baby Steps framework. The journey begins with establishing a $1,000 emergency fund to handle minor financial emergencies without derailing your progress. Next comes the debt snowball method, where you eliminate all debts except your mortgage by paying minimums on everything while attacking the smallest balance first. This approach builds momentum and psychological wins that fuel continued progress.

Once debt-free, you expand your emergency fund to cover three to six months of expenses, creating a solid financial foundation. The wealth-building phase starts with Baby Step 4: investing 15% of your household income into retirement accounts.

Simultaneously, if you have children, you save for their college education. Step 6 focuses on paying off your mortgage early, freeing up that monthly payment for additional wealth building. The final step involves building wealth and giving generously, completing the transformation from financial struggle to financial freedom.

3. The 15% Rule: How Much You Need to Invest to Become a Millionaire

Dave Ramsey’s wealth-building strategy requires investing 15% of your gross household income into retirement accounts once you’ve eliminated debt and established your emergency fund. This percentage isn’t arbitrary—it represents the sweet spot between aggressive wealth building and maintaining a reasonable lifestyle. The 15% should be split strategically, starting with an employer 401(k) match to capture free money, then moving to Roth IRAs for tax-free growth, and finally returning to traditional 401(k)s if needed to reach the complete 15%.

This contribution rate assumes a 20 to 30-year investment horizon and focuses on growth stock mutual funds. The key lies in consistency rather than trying to time the market or find the perfect investment. When maintained steadily over decades, this 15% rate creates the mathematical foundation for millionaire-level wealth accumulation, proving that extraordinary results come from ordinary discipline applied over time.

4. The Math Behind the Magic: Compounding Gains as Your Wealth-Building Engine

The mathematical formula powering Dave Ramsey’s middle-class millionaire strategy uses the future value of an ordinary annuity calculation. The formula is: FV = (0.15 × I) × [((1 + r)^t – 1) / r], where FV represents your future value, I equals your annual income, r equals the expected return rate, and t represents time in years.

Dave Ramsey assumes a 12% average annual return for growth stock mutual funds based on historical market performance over long periods. This assumption reflects the S&P 500’s long-term average, though actual returns vary yearly. The formula demonstrates how compounding gains creates exponential rather than linear growth.

Each year’s earnings generate their earnings, creating a snowball effect that accelerates wealth accumulation over time. The mathematical certainty of compound growth, combined with consistent contributions, transforms modest savings into substantial wealth through the power of time and market returns.

5. From $60K to $2 Million: A Real-World Example

Consider a middle-class household earning $60,000 annually that follows the formula faithfully. Their annual investment equals $60,000 multiplied by 0.15, resulting in $9,000 invested yearly. Using the future value formula with a 12% average return over 30 years, the calculation becomes: $9,000 × [((1.12)^30 – 1) / 0.12]. This equals $9,000 multiplied by 241.33, producing a final result of approximately $2.17 million.

This example illustrates how an ordinary middle-class income can produce extraordinary wealth through mathematical inevitability rather than exceptional circumstances. The household never needed to increase its income dramatically or make risky investment decisions.

Instead, they maintained discipline over three decades, allowing the power of compounding to work magic. The transformation from $60,000 annual earnings to millionaire status demonstrates that wealth building is accessible to anyone who consistently follows the formula.

6. The Debt-Free Accelerator: How Paying Off Your Mortgage Early Supercharges Wealth

Paying off your mortgage early creates a powerful wealth acceleration effect in the final years before retirement. Through focused effort, most people following Dave Ramsey’s plan can eliminate their mortgage in 10 to 15 years. Once the mortgage disappears, the entire monthly payment becomes available for additional investing, dramatically increasing your wealth-building capacity.

For example, a $1,500 monthly mortgage payment equals $18,000 in additional annual investment capacity. This means your total yearly investment becomes your original 15% plus $18,000, creating a substantial boost during the most potent compound growth years.

Since this typically occurs in the final 10 to 15 years before retirement, the impact is exponential due to compounding working on much larger contribution amounts. The debt-free accelerator transforms good wealth builders into exceptional ones through this mathematical amplification.

7. Time is Your Greatest Asset: Why Starting Early Makes All the Difference

The exponential nature of compound growth makes starting early dramatically more valuable than starting late, even with identical contribution rates and incomes. Someone beginning at age 25 with 40 years of growth potential will accumulate significantly more wealth than someone starting at age 35 with 30 years, despite making the same annual contributions.

Each additional year of compound growth multiplies rather than adds to your final result. This mathematical reality means that even minor delays in starting can cost hundreds of thousands in final wealth.

The early years appear slow and unremarkable, but they’re the most valuable because they have the longest compounding time. Understanding this principle motivates people to start immediately rather than waiting for perfect circumstances that may never arrive.

8. The Behavioral Blueprint: Why Discipline Beats Income Every Time

Dave Ramsey’s formula succeeds because it emphasizes behavior modification over income optimization. The system works proportionally at any income level, whether you earn $40,000 or $100,000 annually. The key behaviors include living below your means, avoiding debt, investing consistently regardless of market conditions, and maintaining long-term thinking over short-term gratification.

These behaviors matter more than sophisticated investment strategies or market timing. The formula requires discipline, not special knowledge or exceptional circumstances. This behavioral focus explains why many high-income earners struggle financially while disciplined middle-class earners achieve millionaire status. Success comes from consistent execution of simple principles rather than complex financial maneuvering.

9. Common Obstacles and How to Overcome Them

People implementing the formula face predictable challenges that can derail progress without proper preparation. The most common obstacle is believing you don’t earn enough to save 15%, which can be overcome by starting with a smaller percentage and gradually increasing contributions as income grows or expenses decrease. Market volatility concerns fade when you focus on long-term averages rather than short-term fluctuations.

Impatience with slow initial progress is natural, but trusting the mathematical certainty of compound growth helps maintain motivation. Lifestyle inflation threatens progress as income increases, making budget discipline essential at every income level. Emergency fund depletion requires immediate rebuilding to protect your investment progress. Each obstacle has a straightforward solution rooted in returning to disciplined spending and consistent investing.

10. Your Million-Dollar Action Plan: Getting Started Today

Implementation begins with calculating your current financial position and determining which Baby Step applies to your situation. If you haven’t already, start with the $1,000 emergency fund, then list all debts for the snowball method. Once debt-free, determine your 15% investment target based on your current income and research retirement account options available through your employer and financial institutions.

Set up automatic contributions to remove the temptation to skip months or reduce amounts. The formula’s power lies in starting immediately rather than waiting for perfect timing or circumstances. Every month of delay costs future wealth through lost compound growth. Begin today with whatever amount possible, then increase contributions as your financial situation improves through the Baby Steps progression.

Conclusion

Dave Ramsey’s Middle-Class Millionaire Formula proves that extraordinary wealth doesn’t require exceptional circumstances. Through systematic debt elimination, disciplined saving, and consistent investing, ordinary middle-class earners can achieve millionaire status through mathematical certainty rather than luck or high income.

The formula’s power lies in its simplicity and accessibility, making wealth building achievable for anyone willing to follow proven principles over time. Success comes from starting today and maintaining consistency, allowing compounding capital to transform modest contributions into substantial wealth through the power of time and disciplined behavior.