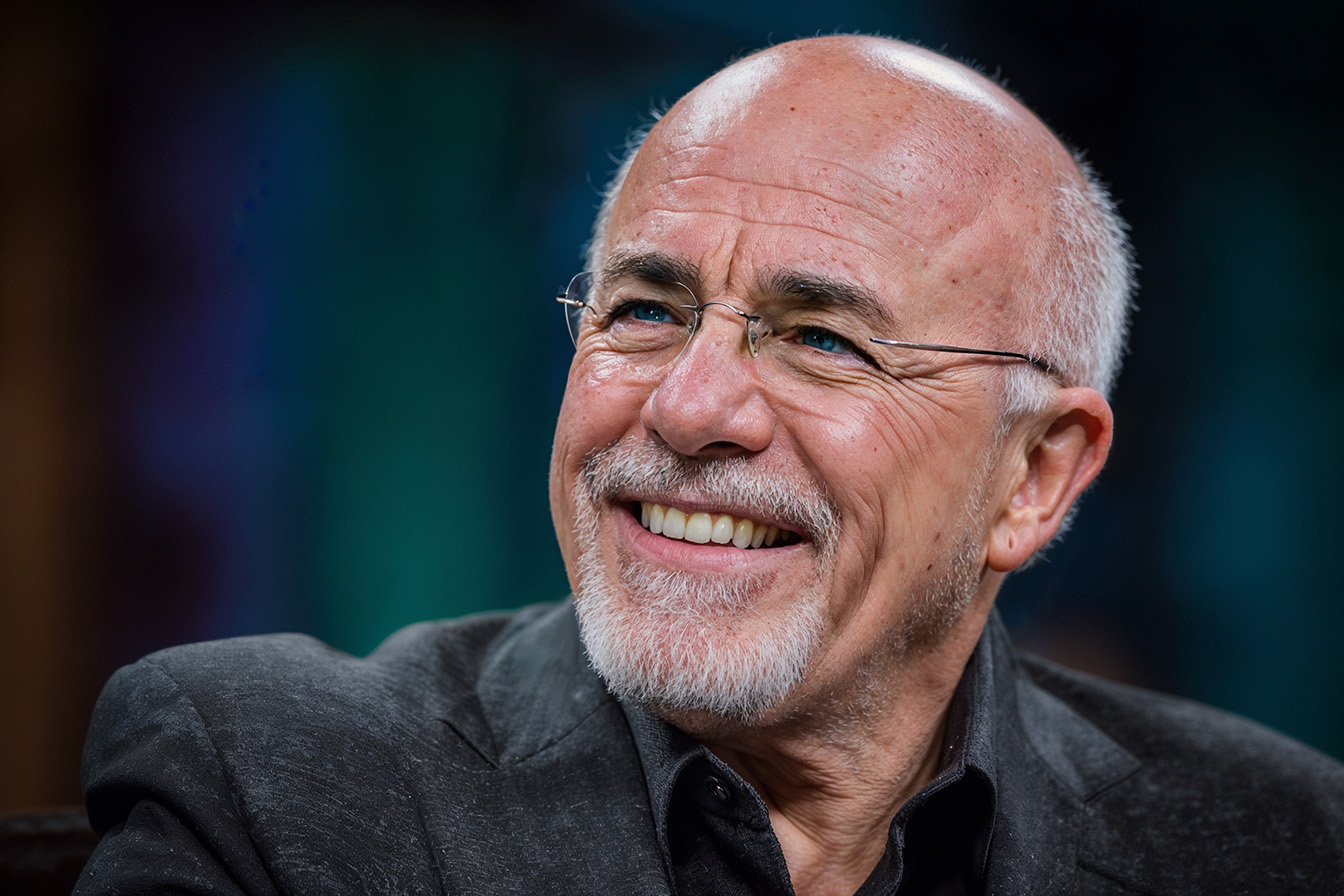

Dave Ramsey’s influence extends far beyond his radio show and bestselling books. His followers don’t just take his advice—they adopt his principles as a complete financial lifestyle. These aren’t temporary strategies but permanent mindset shifts that guide every money decision.

People who listen to Dave Ramsey have these 10 defining money rules:

1. They Live Below Their Means, Not at Their Limit

Dave Ramsey followers understand that financial freedom begins with spending less than you earn. They create intentional gaps between their income and expenses, viewing this space as the foundation for building wealth. They reject lifestyle inflation—when they receive raises or bonuses, they maintain their current standard of living and direct extra money toward savings and investments.

The psychological benefit of living below your means creates financial security that permeates every aspect of life. Ramsey followers often describe feeling less stressed about money because they know they have breathing room in their budget.

2. They Avoid Debt Like the Plague

Ramsey followers view debt as a financial emergency, not a tool for building wealth. They reject the belief that some debt is “good debt” and see all debt as a barrier to financial freedom. Credit cards, car loans, and personal loans are completely off-limits.

The only exception is a mortgage, but they follow strict guidelines: 15-year fixed-rate mortgages rather than 30-year loans, with monthly payments not exceeding 25% of take-home pay. This approach means they pay significantly less interest and build equity faster.

3. They Use the Debt Snowball Method for Maximum Payoff Momentum

When Ramsey followers have debt, they attack it using the debt snowball method. This strategy involves paying minimums on all debts while throwing every extra dollar at the smallest balance, regardless of interest rate. Once the smallest debt is eliminated, they roll that payment into the next smallest debt.

This approach prioritizes psychology over mathematics. While paying high-interest debt first might save money on paper, the debt snowball creates emotional victories that sustain long-term motivation. Each paid-off debt builds confidence and momentum.

4. They Always Have a Written Budget Before the Month Begins

Zero-based budgeting is non-negotiable among Ramsey followers. Before each month begins, they assign every dollar of expected income to specific categories—housing, food, transportation, savings, and debt payments. This ensures that income minus expenses equals zero on paper.

They don’t wait to see how much money is left over after spending; instead, they plan their spending around their priorities. Ramsey followers often use recommended spending percentages as guidelines: housing costs should stay below 25% of take-home pay, transportation under 15%, and food expenses should not exceed 10-15%.

5. They Build a Starter Emergency Fund Fast

The first financial milestone for Ramsey followers is saving $1,000 as quickly as possible. This starter emergency fund is a buffer that prevents them from returning to debt when unexpected expenses arise. They prioritize this fund even before paying off debt because financial emergencies are inevitable.

This small emergency fund covers true emergencies like car repairs, medical bills, or temporary job loss, not vacations or Christmas gifts. The psychological impact of having even $1,000 set aside provides peace of mind and prevents the panic that often leads to poor financial decisions.

6. They Pay Cash When Possible, Never

With Credit Cards

Ramsey followers embrace a cash-only lifestyle, using physical cash, debit cards, or money from sinking funds for purchases. They reject credit cards entirely, viewing them as tools that encourage overspending. If they can’t afford something with cash, they don’t buy it.

Many use the envelope system for variable expenses like groceries, entertainment, and clothing. They place cash in labeled envelopes at the beginning of each month, and spending in that category stops when the envelope is empty. They create sinking funds for larger purchases—dedicated savings accounts for specific goals.

7. They Fully Fund an Emergency Fund for True Peace of Mind

After eliminating all debt except their mortgage, Ramsey followers focus on building a fully funded emergency fund containing three to six months of expenses. They calculate this fund based on their monthly payments, not their income.

This money sits in easily accessible accounts like money market funds or high-yield savings accounts. The fully funded emergency fund transforms their relationship with money—they no longer live paycheck to paycheck or worry about financial catastrophes.

8. They Invest Consistently for the Long Term

Ramsey followers invest 15% of their household income for retirement, focusing on long-term growth rather than short-term gains. They typically start with their employer’s 401(k) match, contribute to Roth IRAs, and return to maximize their 401(k) contributions.

They prefer growth stock mutual funds with long track records over individual stocks, bonds, or complex investment products. These investors ignore market volatility and continue contributing regardless of economic conditions, viewing market downturns as opportunities to buy more shares at lower prices.

9. They Save for Kids’ College the Smart Way

Ramsey followers prioritize their retirement savings before contributing to their children’s college funds. They understand that while children can borrow for education, parents can’t borrow for retirement. Once they invest 15% in retirement, they begin saving for their kids’ education using tax-advantaged accounts like 529 college savings plans or Educational Savings Accounts (ESAs).

These parents refuse to co-sign student loans or sacrifice their financial security to pay for their children’s education. They believe in helping their kids graduate debt-free when possible, but not at the expense of their economic stability.

10. They Give Generously Once Financially Stable

Once Ramsey followers achieve financial stability, they become generous givers. They understand that wealth building isn’t just about accumulating money—it’s about having the freedom to impact others’ lives positively. They often follow the principle of tithing, giving 10% of their income to their church or other charitable organizations.

This generous spirit extends beyond money to include time and talents. They volunteer for financial education programs, mentor others in debt elimination, and share their knowledge about money management.

Conclusion

These ten money rules work together as a comprehensive system, transforming how people think about and handle money. Ramsey followers don’t just apply these principles during financial crises—they live by them consistently, creating a lifestyle prioritizing financial freedom over immediate gratification.

The result is not just wealth accumulation but genuine financial peace that allows them to live generously and positively impact others’ lives.