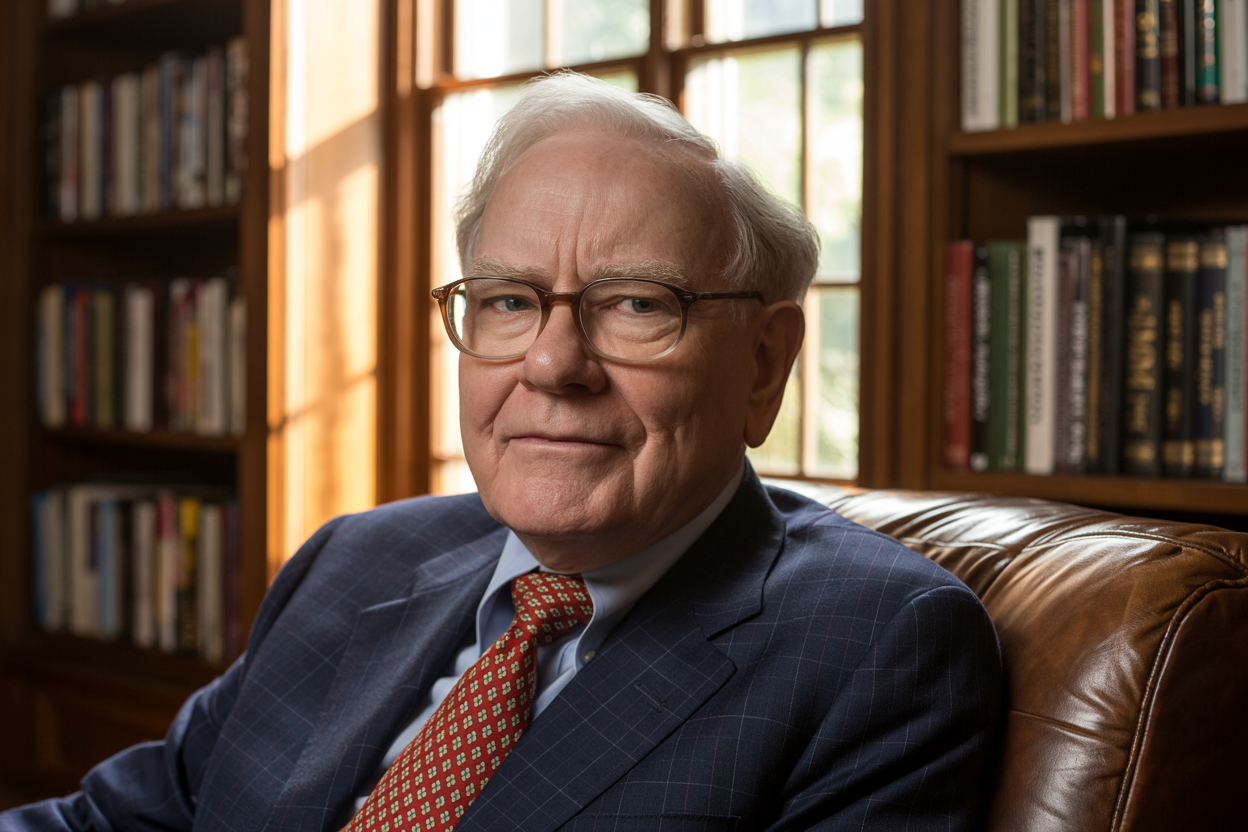

Warren Buffett, the “Oracle of Omaha,” has built legendary wealth through disciplined investing and avoiding financial traps that ensnare millions of Americans. While his investment wisdom often focuses on stock picking and business fundamentals, Buffett’s spending habits reveal equally valuable lessons for middle-class families seeking financial security. His philosophy centers on distinguishing between needs and wants, avoiding negative expected returns, and prioritizing long-term wealth building over short-term gratification.

The middle class faces unique financial pressures, caught between aspirational spending and genuine wealth-building opportunities. Buffett’s approach offers a roadmap for avoiding costly mistakes that have derailed financial progress for decades. His lifestyle choices, from his modest Omaha home to his practical car purchases, demonstrate that true wealth comes from what you keep and invest, not what you spend. Let’s look at the five worst things the middle class wastes money on, according to Warren Buffett.

1. Stop Throwing Money Away on Gambling and Lottery Tickets

Buffett famously describes gambling and lotteries as “a tax on people who don’t understand mathematics.” This characterization cuts to the heart of why these activities represent such poor financial decisions for middle-class families. The mathematical reality of lotteries is stark: players face astronomical odds with guaranteed negative expected returns over time.

The fundamental problem with gambling lies in its design to transfer money from participants to operators. Unlike investing in productive businesses, gambling creates no economic value and generates no cash flows to participants. Buffett’s investment philosophy emphasizes understanding probability and expected returns, making gambling antithetical to wealth building.

The opportunity cost of lottery spending becomes particularly damaging when compounded over time. Instead, money spent on tickets could be invested in index funds or other productive assets. Buffett has consistently advocated for understanding the power of compound interest, noting that even small amounts invested regularly can grow substantially over decades. The middle class, often with limited discretionary income, can’t afford to direct money toward activities with mathematically certain losses.

This principle extends beyond traditional gambling to include any financial activity where the odds heavily favor the house. Buffett’s approach prioritizes investments where the odds favor the investor through ownership in productive businesses or broad market index funds.

2. Avoid Becoming “House Poor” with Oversized Housing

Buffett challenges conventional wisdom about housing as an investment by living in the same Omaha home he purchased in 1958. Despite his enormous wealth, his continued residence in this modest property illustrates his belief that housing should serve practical needs rather than ego or status.

The concept of being “house poor” occurs when housing costs consume such a large portion of income that little remains for other financial goals, including investing and emergency savings. Buffett’s housing philosophy emphasizes buying what you need, not what you might want or what others expect based on your income level.

Excessive housing costs create multiple financial problems for middle-class families. Large mortgage payments, property taxes, maintenance costs, and utilities can easily consume 40-50% or more of household income, leaving little room for wealth building. This constrains the ability to invest in appreciating assets that can generate long-term wealth.

Buffett’s approach suggests viewing housing as a consumption expense rather than primarily as an investment. While homes can appreciate over time, they require ongoing maintenance, property taxes, and insurance that reduce net returns. The opportunity cost of excess housing spending becomes significant when those funds could be invested in productive businesses through stock ownership.

The key insight from Buffett’s housing philosophy is that contentment with adequate housing frees up capital for investments that can generate real wealth over time. His modest home choice focuses on substance over appearance, prioritizing financial security over social signaling.

3. Skip the New Car Lot and Buy Used Instead

Buffett’s approach to vehicle purchases reflects his broader investment philosophy of avoiding unnecessary depreciation and focusing on utility over status. He has consistently chosen practical, reliable vehicles and kept them for extended periods, treating cars as transportation tools rather than wealth displays. He even liked to buy hail-damaged cars that were much cheaper.

New car depreciation represents one of the most predictable and severe wealth destroyers for middle-class families. When a new car leaves the dealership, it loses substantial value, creating an immediate financial loss with no corresponding benefit. This depreciation continues rapidly during the first few years of ownership.

Buffett prefers to keep his vehicles for as long as possible. Well-maintained used cars can provide years of reliable service at a fraction of the cost of new cars. His approach emphasizes buying quality vehicles and maintaining them properly to maximize their useful life.

The financial impact of car-buying decisions compounds over a lifetime. Middle-class families who consistently buy new cars and trade them frequently can spend hundreds of thousands more than those who purchase reliable used vehicles and keep them longer. This difference, if invested instead, could significantly impact retirement security.

Buffett’s car-buying philosophy also reflects his time management principles. He prefers straightforward purchases that don’t require extensive research or negotiation, focusing his energy on more productive activities. This approach serves middle-class families well, as it reduces both financial costs and time investment in vehicle purchases.

4. Say No to Expensive Financial Products and High-Fee Funds

Buffett has consistently warned against financial products that charge high fees while delivering mediocre results. His skepticism extends to complex investment schemes, high-fee mutual funds, and products that promise unrealistic returns while enriching their promoters more than their buyers.

The fee structure of many financial products creates a significant drag on investment returns over time. Even seemingly small annual fees compound negatively, reducing long-term wealth accumulation substantially. Buffett advocates for low-cost, broadly diversified investments like index funds that minimize fees while providing market returns.

His famous hedge fund bet demonstrated the superiority of simple, low-cost investing over expensive, actively managed alternatives. This experiment showed that high fees and complex strategies often fail to overcome their cost disadvantage, particularly over more extended periods.

For middle-class investors, high fees represent a particularly damaging wealth destroyer because they reduce the compounding effect on already limited investment capital. Buffett’s advocacy for index fund investing stems from his belief that most investors should focus on owning pieces of American businesses through broad market exposure rather than trying to find smart professional money managers.

The key insight is that financial complexity often benefits sellers more than buyers. Buffett’s approach emphasizes understanding what you own and keeping costs low, allowing the productive capacity of businesses to generate wealth over time without excessive fee drag.

5. Don’t Chase Get-Rich-Quick Schemes and Speculative Investments

Buffett has described the modern stock market as having “a massive casino attached” to the productive economy, warning against the temptation to chase quick gains through speculation rather than investment. His approach emphasizes buying pieces of businesses with strong fundamentals and holding them for extended periods.

Speculative investments like meme stocks, cryptocurrencies, and trending investment fads often attract middle-class investors seeking rapid wealth creation. However, these assets typically lack the cash-generating fundamentals Buffett considers essential for long-term investment success. The volatility and unpredictability of speculative assets make them poor vehicles for steady wealth building.

Buffett’s partner, Charlie Munger, characterized Bitcoin as “rat poison” and reflected their skepticism of assets that don’t produce cash flows or serve productive economic functions. Their investment philosophy focuses on businesses that solve real problems and generate predictable profits.

The psychological appeal of speculation often leads to poor timing decisions, with investors buying during periods of excitement and selling during downturns. This pattern systematically destroys wealth, as it contradicts the fundamental investment principle of buying low and selling high.

Buffett’s alternative approach involves investing in “wonderful companies at fair prices” and allowing the compounding effect of business growth to create wealth over time. This strategy requires patience but offers more predictable results than speculation, making it particularly suitable for middle-class investors who can’t afford significant losses.

Conclusion

Warren Buffett’s spending philosophy offers middle-class families a proven framework for avoiding wealth-destroying purchases while building long-term financial security. His approach prioritizes mathematical thinking over emotional spending, utility over status, and long-term wealth building over short-term gratification.

The common thread throughout Buffett’s advice is the recognition that every spending decision represents an opportunity cost. Money spent on gambling, excessive housing, new cars, high-fee investments, or speculation cannot be invested in productive assets that compound over time.

For middle-class families working with limited resources, these opportunity costs can determine the difference between financial struggle and financial security. Buffett’s lifestyle choices demonstrate that wealth comes not from what you spend but from what you invest wisely and allow to compound over decades.

His continued residence in his modest Omaha home, practical vehicle choices, and preference for simple investments illustrate that true financial success often requires rejecting societal pressures to spend on status symbols or get-rich-quick schemes. By following his example of disciplined spending and patient investing, middle-class families can build substantial wealth over time while avoiding the financial traps that ensnare millions of Americans.