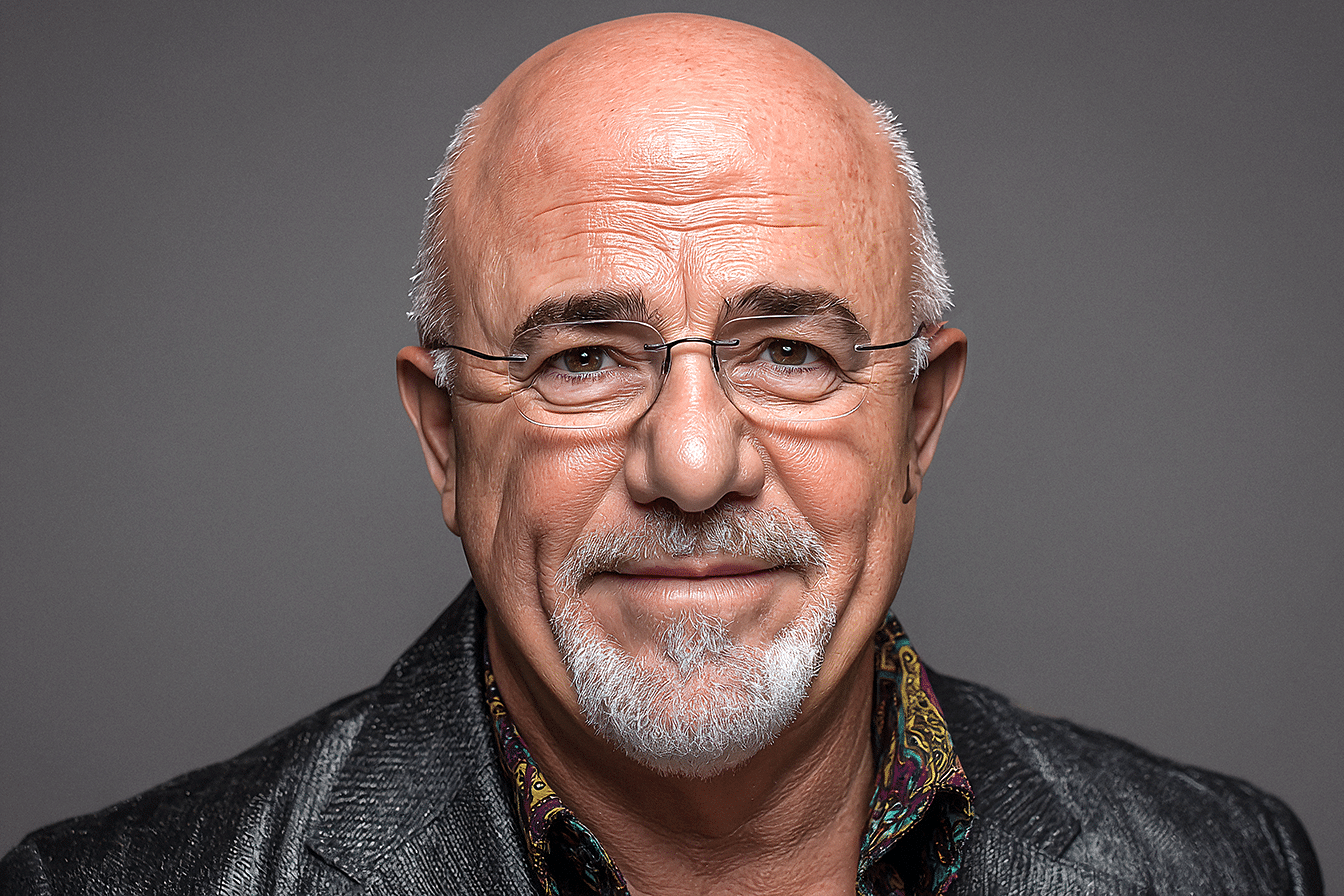

Dave Ramsey, one of America’s most influential financial advisors, has spent decades helping families break free from the paycheck-to-paycheck cycle. Ramsey consistently identifies specific behaviors that trap middle-class families in financial mediocrity through his radio show, books, and seminars.

His direct approach cuts through popular financial myths to reveal the harsh realities keeping hardworking Americans from building real wealth. The following five financial mistakes represent the most common wealth-destroying habits that Ramsey encounters among middle-class households. Let’s explore each one.

1. Drowning in Car Payments as Depreciating Assets

Dave Ramsey’s stance on car payments is uncompromising: they represent one of the biggest wealth destroyers for middle-class families. His philosophy centers on a simple truth that cars are transportation, not investments. While many Americans view car payments as inevitable monthly expenses, Ramsey argues that this mindset keeps families broke.

The mathematics of car depreciation works against consumers from day one. New vehicles lose substantial value when they leave the dealership lot, with depreciation accelerating throughout the first several years of ownership. This creates a scenario where families make payments on assets that rapidly decrease in value, effectively throwing money away that could be invested in appreciating assets.

Ramsey particularly criticizes the common middle-class trap of maintaining two car payments simultaneously. When both spouses drive financed vehicles, families often dedicate hundreds of dollars monthly to depreciating transportation instead of wealth-building activities. His solution involves a fundamental mindset shift: buy reliable used cars with cash, eliminating monthly payments.

Ramsey advocates for purchasing older, dependable vehicles that provide reliable transportation without the burden of monthly obligations. This approach frees up significant monthly cash flow that can be redirected toward emergency funds, debt elimination, or investment accounts. Ramsey emphasizes that wealthy people typically drive paid-for cars, not because they can’t afford payments, but because they understand the opportunity cost of financing depreciating assets.

2. Chasing Credit Card Rewards While Accumulating High-Interest Debt

Credit card rewards programs represent another area where Ramsey sees middle-class families sabotaging their financial futures. While marketing campaigns promote cash back percentages and travel rewards, Ramsey argues that these benefits pale compared to the costs associated with credit card debt.

The fundamental problem lies in behavioral psychology. Credit cards disconnect the pain of payment from the pleasure of purchase, leading to increased spending regardless of available rewards. Families often justify purchases by focusing on rewards earned while ignoring the underlying debt accumulation. When balances aren’t paid monthly, interest charges quickly eliminate reward benefits.

Ramsey’s approach to credit cards is straightforward: if you can’t pay the full balance every month, you shouldn’t use credit cards at all. He advocates for cash-based spending systems that force consumers to confront the real cost of purchases. This eliminates the disconnect between spending and payment while preventing the accumulation of high-interest debt.

Ramsey suggests using a single debit card for those who can responsibly use cards while maintaining strict discipline in spending habits. However, he recommends that people avoid debit or credit cards entirely during their debt elimination journey, focusing instead on cash transactions that provide immediate feedback about spending decisions.

3. Falling for “Buy Now, Pay Later” Debt Traps

The rise of “buy now, pay later” services has created new opportunities for middle-class families to accumulate debt through seemingly harmless payment plans. These services market themselves as convenient alternatives to traditional credit, but Ramsey views them as modern versions of classic debt traps.

The appeal of splitting purchases into smaller payments creates an illusion of affordability. Items that require careful consideration become impulse purchases when the immediate cost appears minimal. This psychological manipulation leads families to accumulate multiple payment obligations that strain monthly budgets.

Ramsey emphasizes that these services often include hidden costs through late fees, processing charges, and potential credit impacts when payments are missed. The convenience factor masks the fundamental problem: purchasing items without having the full purchase amount available immediately.

His alternative approach involves implementing “sinking funds” for planned purchases. Instead of committing to future payments, families save money in advance for specific items or categories. This method ensures purchases are made with available funds rather than promised future income, eliminating the risk of payment defaults while building disciplined spending habits.

4. The Expensive Trap of Keeping Up with the Joneses

Social comparison spending represents one of the most destructive financial behaviors Ramsey encounters among middle-class families. The desire to match or exceed the apparent lifestyle of friends, neighbors, and social media connections drives countless poor financial decisions that undermine long-term wealth building.

This phenomenon has been amplified by social media platforms constantly exposing others’ highlight reels. Families make purchasing decisions based on maintaining appearances rather than building financial security. The result is lifestyle inflation that matches or exceeds income growth, preventing meaningful wealth accumulation.

Ramsey’s philosophy emphasizes contentment and gratitude as antidotes to comparison-driven spending. He argues that actual wealth building requires focusing on net worth rather than the appearance of wealth. Many people who look wealthy are financially fragile, maintaining expensive lifestyles through debt rather than sustainable income and assets.

His approach involves developing clear financial priorities that align with long-term goals rather than short-term social pressures. This includes avoiding discretionary purchases designed primarily to impress others and instead focusing spending on items that provide genuine value and align with family objectives. Ramsey encourages families to find satisfaction in financial progress rather than material accumulation.

5. Buying Too Much House and Limiting Wealth-Building Opportunities

Housing decisions represent most middle-class families’ most significant financial commitment, making Ramsey’s housing philosophy particularly important. He advocates for a conservative approach to housing costs, recommending that families limit housing payments to no more than 25% of their take-home pay.

This recommendation contrasts sharply with typical mortgage industry standards, which often approve borrowers for much higher payment ratios. Ramsey argues that maximizing housing costs creates “house poor” scenarios where families have limited flexibility for other financial goals, including emergency funds, retirement savings, and investment opportunities.

The opportunity cost of excessive housing payments extends beyond the monthly cash flow. Families stretched by housing costs often lack resources for home maintenance, unexpected repairs, and improvements that maintain property value. They also miss opportunities to invest in appreciating assets that could generate long-term wealth.

Ramsey’s approach involves purchasing homes well within their financial means, often suggesting smaller starter homes or properties that allow faster payoff strategies. This conservative approach creates a financial margin that enables families to pursue multiple wealth-building activities simultaneously rather than dedicating most resources to housing costs.

Conclusion

Dave Ramsey’s identification of these five wealth-destroying behaviors provides a roadmap for middle-class families seeking financial improvement. Each habit represents a choice between immediate gratification and long-term wealth building. His solutions consistently emphasize living below your means, avoiding debt, and redirecting resources toward appreciating assets rather than lifestyle expenses.

The path to financial success requires discipline and the willingness to make choices different from those of the surrounding culture. Still, Ramsey’s principles have helped millions of families break free from financial mediocrity and build lasting wealth.