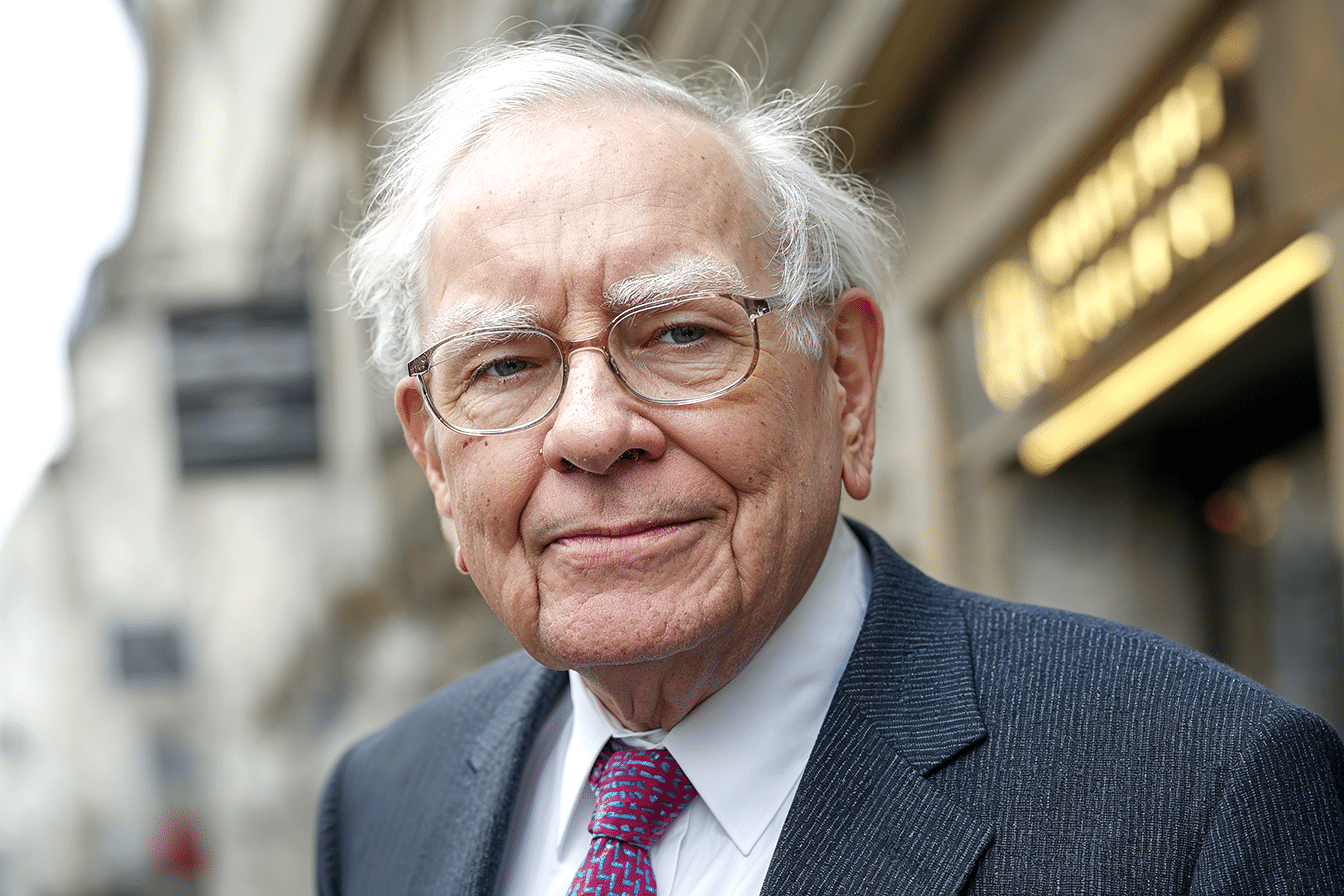

The Billionaire Who Lives Like Your Neighbor: Buffett’s Happiness Paradox

“I can’t buy time, I can’t buy love, but I can do anything else with money, pretty much.” – Warren Buffett.

With a net worth exceeding $139 billion, the Oracle of Omaha presents one of the most fascinating contradictions in our materialistic world. The Oracle of Omaha still lives in the same modest house he purchased in Omaha in 1958 for $31,500, drives a reasonable car, and finds genuine joy in simple pleasures like playing bridge and sipping Cherry Coca-Cola.

This paradox challenges our fundamental assumptions about wealth and happiness. While most believe more money leads to more joy, Buffett demonstrates that contentment comes not from what you can buy but from how thoughtfully you allocate your resources. His approach reveals that the secret isn’t accumulating wealth but investing wisely in what genuinely enriches your life.

1. Buy Back Your Time to Do What You Love

“In the business world, the people who are most successful are those who are doing what they love.” – Warren Buffett.

Buffett spends five to six hours daily reading books, newspapers, and financial reports—not because he has to, but because he genuinely enjoys it. This passion for learning predates his wealth by decades, proving that loving your work comes first, not after achieving success.

His philosophy extends beyond career choices to how we manage our daily commitments. Buffett famously said, “The difference between successful and unsuccessful people is that successful people say no to almost everything.” This isn’t about being antisocial—it’s about protecting your most valuable resource: time.

Practically speaking, this means investing in time-saving services that free up hours for meaningful activities, making career choices that prioritize purpose over maximum income, and learning to decline commitments that don’t align with your passions.

2. Invest in People Who Lift You Higher

“It’s better to hang out with people who are better than you. Pick out associates whose behavior is better than yours, and you’ll drift in that direction.” – Warren Buffett.

Buffett’s legendary partnership with Charlie Munger exemplifies the power of surrounding yourself with people who inspire and challenge you. His approach to relationships is refreshingly straightforward: “I only work with people I like. If I could make $100 million with a guy who causes my stomach to churn, I’d say no.”

Warren Buffett is well known for fostering genuine relationships at Berkshire Hathaway that go beyond business. He values developing deep personal connections with colleagues and partners, prioritizing trust, mutual respect, and friendship as cornerstones of his management and investment philosophy.

This includes engaging in casual conversations, remembering personal details about his team, and regularly participating in social gatherings outside the boardroom—activities that foster camaraderie and mutual care within his organization. This investment in relationships pays dividends that extend far beyond financial returns.

Financial habits are contagious—spending time around people who are reckless with money makes it harder to stay disciplined, while connecting with those focused on success changes your entire mindset. Rather than spending on solo luxuries, Buffett advocates investing in shared experiences and activities that strengthen meaningful connections.

3. Spend Money on Your Greatest Asset—Yourself

“Invest in as much of yourself as you can. You are your own biggest asset by far.” – Warren Buffett.

When asked about the key to success, Buffett held up a stack of papers and declared, “Read 500 pages like this daily. That’s how knowledge works.” His commitment to continuous learning isn’t just professional development—it’s a lifestyle choice that fuels his success and satisfaction.

Buffett views self-investment as having the highest guaranteed return of any expenditure. Unlike other investments, knowledge and skills can never be taken away and continue paying dividends throughout life.

This philosophy translates into practical spending decisions: allocating budget for books, courses, conferences, and educational experiences. The knowledge you gain today influences every decision you make tomorrow, creating a snowball effect of improved outcomes across all areas of life.

4. Your Body Is Your Only Permanent Home—Maintain It

“You only get one mind and one body. And it’s got to last a lifetime.” – Warren Buffett.

Buffett illustrates this principle with a powerful analogy about receiving the car of your dreams with one catch—it’s the only car you’ll ever own. Under those circumstances, you’d baby that vehicle, fixing every dent and maintaining it meticulously. “That’s exactly your position concerning your mind and body,” he explains.

This perspective reframes health expenses as essential investments rather than optional costs. At 94, his continued sharpness and energy demonstrate the long-term payoff of this philosophy.

Practical applications include prioritizing preventive healthcare, investing in quality nutrition, allocating budget for exercise and mental health support, and viewing these expenses as insurance for future happiness. Unlike material possessions that depreciate, investments in your physical and psychological well-being appreciate over time.

5. A Simple Home Base That Supports Your Dreams

“If I could spend $100 million on a house that would make me much happier, I would do it. But for me, that’s not the case.” – Warren Buffett.

Buffett’s continued residence in his modest Omaha home since 1958 reflects a deeper understanding of housing and happiness. Research supports his instinct—after basic needs are met, additional house size or luxury features provide diminishing returns on well-being. Instead, factors like neighborhood quality, commute time, and how the space supports your relationships and activities impact life satisfaction more.

His approach prioritizes functionality over impressiveness, focusing on how your living situation enables the life you want to lead rather than serving as a status symbol. Your home should support your dreams and relationships while remaining within your means, allowing you to allocate resources toward experiences and investments that provide lasting value.

The Psychology Behind Buffett’s Choices: Why This Works

“The secret to happiness is having low expectations.” – Warren Buffett

Buffett’s approach aligns perfectly with happiness research. By focusing on experiences over possessions, relationships over status, and learning over accumulation, he’s naturally gravitating toward what research shows truly contributes to happiness. “I’m having a vacation every day,” he explains, illustrating how the right mindset transforms work into joy.

The psychological benefits of simplicity can’t be overstated. By avoiding the complexity and stress of maintaining an extravagant lifestyle, Buffett preserves mental energy for what matters most. His choices demonstrate that happiness comes down to intentional decisions about spending our time, energy, and resources.

How to Apply Buffett’s Happiness Formula

“Do not save what is left after spending; instead, spend what is left after saving.” – Warren Buffett.

These principles scale to any income level because they prioritize intentional choices rather than dollar amounts. Start by evaluating your spending against the five areas: time for what you love, quality relationships, self-development, health, and a secure home base.

Buffett’s advice to save first and spend second creates the foundation for implementing these principles. By living within your means and avoiding lifestyle inflation, you have the flexibility to invest in what truly matters. The goal isn’t to spend more, but to spend more thoughtfully.

Conclusion

“I love every day. I mean, I tap dance in here and work with nothing but people I like.” – Warren Buffett.

Buffett’s joy comes not from his extraordinary wealth but from his high life. The five investments he advocates represent wise resource allocation rather than massive spending. His example demonstrates that the goal isn’t to buy happiness but to invest wisely in what makes life genuinely worth living—regardless of our bank account balance.