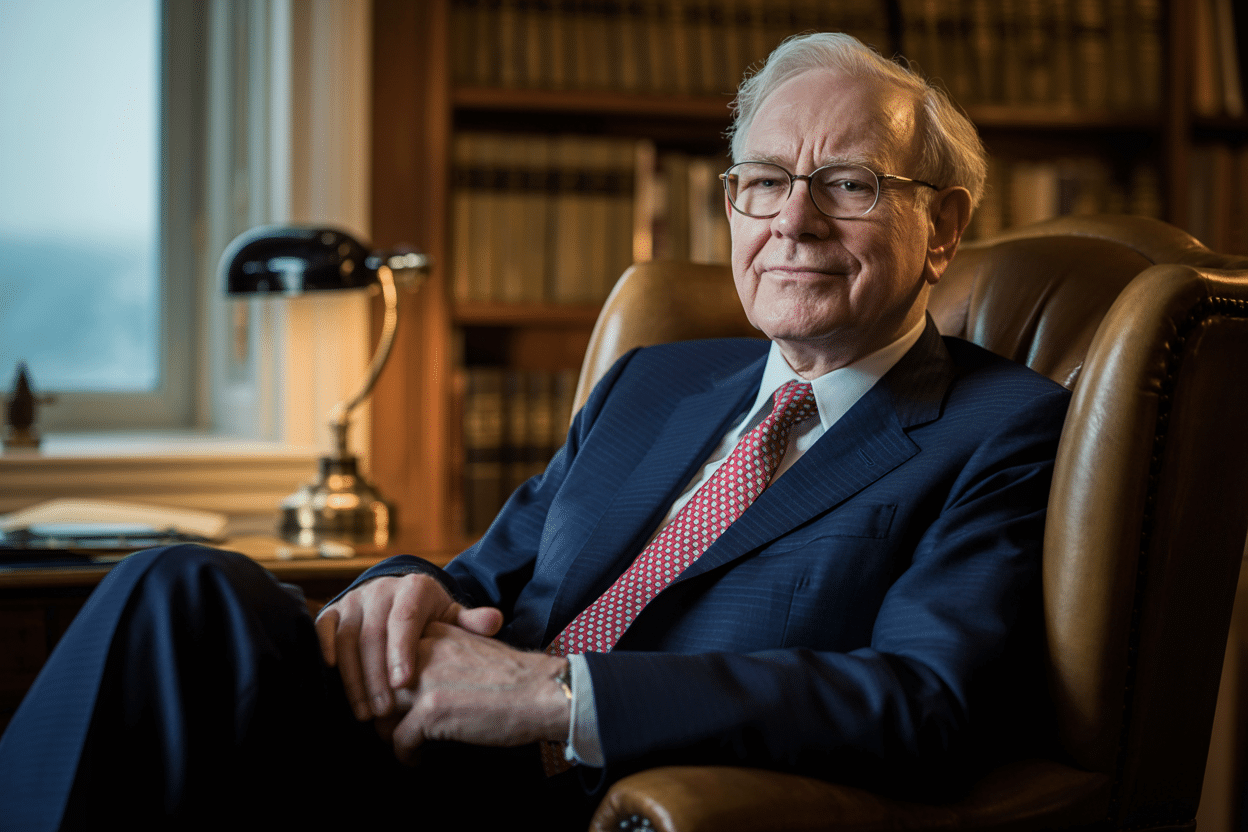

Warren Buffett, one of the world’s most successful investors, built his early fortune not through complexity but through radical simplicity. His minimalist approach to life and business offers valuable lessons for reducing stress while building wealth. His ten minimalist habits demonstrate how eliminating unnecessary complexity can free up mental energy and financial resources for what truly matters. Let’s look at how Warren Buffett has always lived a simple but highly effective lifestyle.

1. Eliminate Decision Fatigue with a Simple, Consistent Wardrobe

Buffett famously wears basic business suits and has stated he doesn’t want to waste mental energy on clothing decisions. This approach recognizes that our brains have limited decision-making capacity each day. Every trivial choice depletes this cognitive resource, leaving less energy for critical financial and life decisions. Steve Jobs and Mark Zuckerberg share this minimalist habit.

You can adopt this habit by creating a capsule wardrobe with a few high-quality, versatile pieces in neutral colors. Choose clothing that works across multiple situations and buy several of the same items you love. This eliminates morning decision paralysis and ensures you always look put-together without the stress of coordinating outfits. The mental energy you save can be redirected toward career advancement or investment decisions that impact your financial future.

2. Drive Modest Vehicles and Keep Them for the Long Haul

Despite his immense wealth, Buffett drives relatively modest cars and keeps them for many years. He views vehicles as transportation tools rather than status symbols, understanding that frequent car upgrades represent one of the fastest ways to drain wealth through depreciation, financing costs, and the time it takes to purchase one.

“I don’t like to trade away when there’s really no benefit to me at all. I’m totally happy with the car. I just don’t want to trade away the amount of time I’d have to spend fooling around to get familiar with it and get title to and do all the rest of the things.” – Warren Buffett.

The average American car payment exceeds $500 monthly, but driving a reliable, modest vehicle until major repairs are needed can save tens of thousands of dollars over time. Instead of upgrading every few years, focus on maintenance to extend your vehicle’s life. This approach reduces the stress of monthly payments while building wealth through the money you don’t spend on depreciation. The key is buying reliable models known for longevity and treating them as long-term transportation solutions.

3. Stay in Your Home Instead of Constantly Upgrading

Buffett continues living in the Omaha home he purchased in 1958, calling it one of his best investments. Rather than upgrading to larger or more prestigious properties, he’s found contentment in a functional space that meets his needs.

Housing represents most people’s most significant expense, and frequent moves or upgrades create enormous financial drag through transaction costs, higher property taxes, and lifestyle inflation. Staying in your current home longer allows you to build equity while avoiding realtor fees, moving expenses, and the temptation to fill larger spaces with more possessions.

This stability reduces the stress of house hunting, mortgage applications, and settling into new neighborhoods while freeing up capital for investments that generate returns rather than consume resources.

4. Simplify Your Investment Strategy and Stick to What You Understand

Buffett’s investment philosophy centers on buying quality companies at reasonable prices and holding them long-term. He avoids complex financial instruments and strategies, focusing instead on businesses he can easily understand and evaluate.

Most individual investors benefit from this approach through low-cost index funds tracking broad market performance, which is what he recommends for those not interested in stock research.

Complex trading strategies with no edge often generate more fees than returns, creating stress through constant monitoring and decision-making. A simple portfolio of diversified index funds requires minimal maintenance yet historically delivers solid long-term returns. This approach eliminates the anxiety of picking individual stocks or timing market movements while building wealth through consistent, patient investing.

5. Live Well Below Your Means Rather Than Lifestyle Inflation

Buffett’s spending habits haven’t inflated dramatically with his wealth. He understands that every dollar spent on unnecessary luxuries is a dollar not working to generate future wealth through compound growth.

Lifestyle inflation destroys wealth by consuming income increases that could be invested. When you receive raises or bonuses, maintain your current standard of living and invest the difference.

This expands the gap between income and expenses, providing financial security and investment capital. Living below your means reduces financial stress by creating emergency buffers while accelerating wealth building through consistent saving and investing.

6. Create an Uncluttered Daily Routine with Plenty of Thinking Time

Buffett keeps his schedule relatively unstructured, allowing extensive time for reading and contemplation. He avoids overbooking himself with meetings and commitments, understanding that strategic thinking requires uninterrupted time.

Most successful financial decisions require careful consideration rather than quick reactions. Building thinking time into your schedule allows for better planning, whether you’re evaluating job opportunities, major purchases, or investment strategies.

Start by blocking out one hour daily without meetings, emails, or distractions. Use this time for strategic planning, learning about your industry, or simply processing information you’ve consumed. This mental space reduces reactive decision-making while improving the quality of your choices.

7. Avoid Unnecessary Technology Distractions and Digital Overwhelm

Buffett has famously avoided getting caught up in technology trends, preferring simple tools that serve specific purposes without creating distraction or complexity.

Constant connectivity fragments attention and impairs decision-making ability. Every notification interruption requires mental energy to refocus, leaving less cognitive capacity for essential tasks.

Eliminate non-essential apps, turn off notifications except for critical communications, and establish technology-free periods for focused work or thinking. This digital minimalism improves productivity while reducing the stress of information overload, allowing you to focus on activities that build wealth or enhance your career.

8. Say No to Almost Everything Using Strategic Priority Focus

“The difference between successful people and really successful people is that really successful people say no to almost everything.” – Warren Buffett.

Buffett’s approach to opportunities involves extreme selectivity. He understands that saying yes to everything good prevents focus on what’s great. He advocates identifying your top priorities and actively avoiding everything else until those priorities are achieved.

Create a list of your most essential goals and ruthlessly eliminate activities that don’t directly support them. This might mean declining social invitations, side projects, or even promising opportunities that scatter your focus.

Concentrated effort on fewer objectives produces better results than dispersed attention across many areas. This focused approach reduces the stress of juggling multiple commitments while accelerating progress toward your most important financial and personal goals. The word “no” is the ultimate time management tool.

9. Invest in Experiences and Knowledge Over Material Possessions

“Read 500 pages like this every day. That’s how knowledge works. It builds up, like compound interest. All of you can do it, but I guarantee not many of you will do it.” – Warren Buffett.

Buffett spends significantly on learning and meaningful experiences while avoiding the accumulation of luxury possessions. He recognizes that knowledge appreciates while material goods depreciate.

Redirect discretionary spending from possessions to books, courses, conferences, and experiences that expand your capabilities or perspective. Knowledge investments often generate returns through career advancement or better decision-making, while material purchases typically lose value immediately.

Experiences provide lasting satisfaction without requiring storage, maintenance, or insurance. This shift reduces clutter while building human capital that can’t be removed or depreciated over time.

10. Maintain a Small, Trusted Circle Instead of Networking Constantly

Buffett’s professional relationships, including his decades-long partnership with Charlie Munger, demonstrate the value of deep, trusted relationships over extensive networking. He focuses on quality connections with people with similar values and thinking approaches.

Building a small network of trusted advisors and friends reduces the stress of maintaining superficial relationships while providing access to better opportunities through people who truly understand your goals and capabilities.

Deep relationships offer honest feedback, reliable support during challenges, and introductions based on genuine recommendations rather than casual acquaintances. Focus on strengthening existing relationships rather than constantly expanding your network, investing time in people who add value to your life and career.

Conclusion

Buffett’s minimalist habits demonstrate that wealth building comes through subtraction as much as addition. By eliminating unnecessary complexity, decisions, and distractions, you create space for the focused attention and patient capital allocation that builds lasting wealth.

These habits work together to reduce daily stress while preserving mental and financial resources for valuable opportunities. The key is recognizing that simplicity isn’t about deprivation but choosing what deserves your most valuable resources: time, energy, and money.