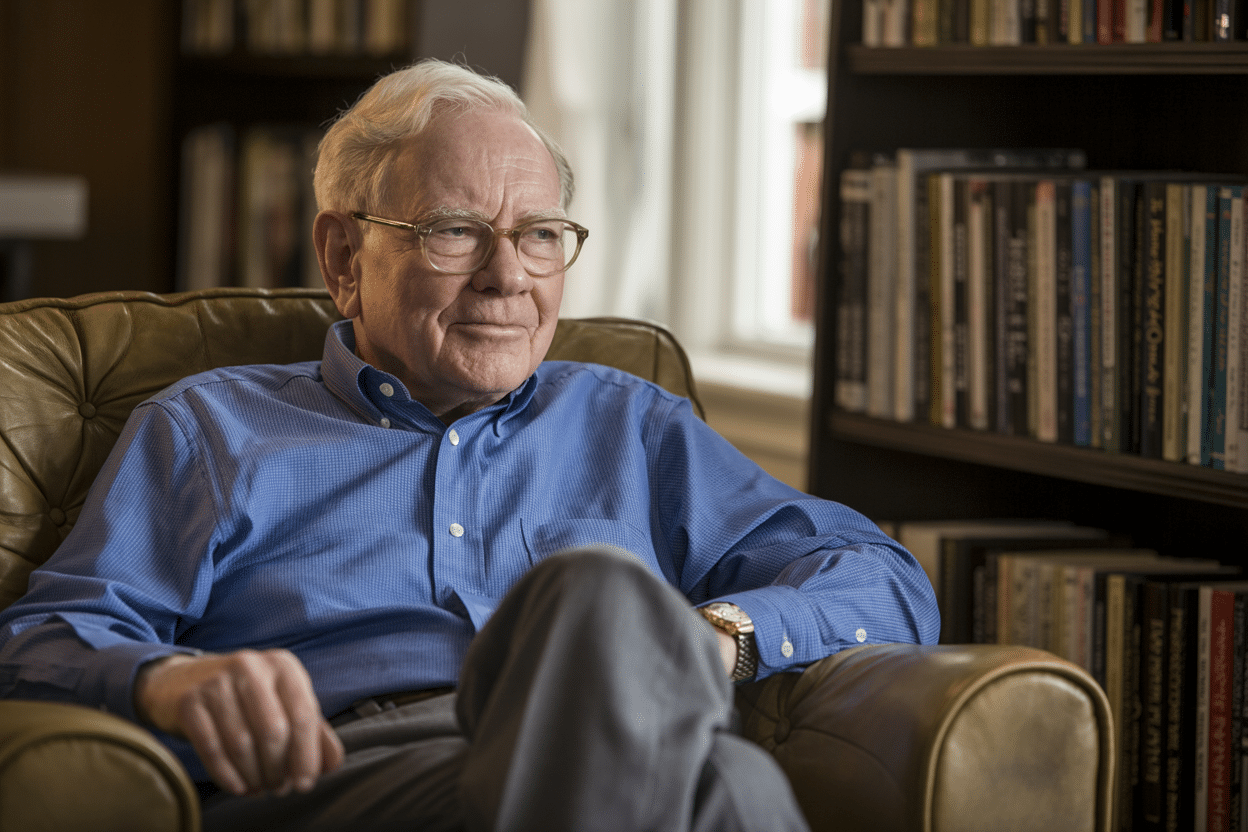

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has amassed a fortune exceeding $150 billion through disciplined investing and meticulous financial management. What makes his financial wisdom particularly valuable is that, despite his immense wealth, he still lives in the same modest Omaha house he purchased in 1958 for $31,500.

His approach to money isn’t just theoretical—he lives it every day. Through decades of shareholder letters, interviews, and public appearances, Buffett has consistently warned about common financial mistakes that prevent the middle class from building lasting wealth.

These aren’t complex investment strategies requiring advanced degrees, but rather practical insights about everyday spending habits that quietly drain bank accounts and derail long-term financial goals.

1. New Cars

“I’m not interested in cars, and my goal is not to make people envious. Don’t confuse the cost of living with the standard of living.” – Warren Buffett.

Buffett has famously driven modest vehicles throughout his life, understanding that cars are depreciating assets that lose value the moment they leave the dealership. While many middle-class families stretch their budgets to afford new vehicles with the latest features, Buffett views this as a waste of money.

A new car can lose twenty to thirty percent of its value in the first year alone. His philosophy emphasizes that true quality of life isn’t measured by the newness of your vehicle but by financial security and freedom. The money saved by purchasing reliable used cars instead of new ones, invested wisely over time, can grow into substantial wealth through compound interest.

2. Credit Card Interest & High-Interest Debt

“If I owed any money at 18%, the first thing I’d do with any money I had would be to pay it off. It’s going to be way better than any investment idea I’ve got.” – Warren Buffett.

This quote from Buffett’s 2020 shareholder meeting cuts to the heart of why credit card debt is so destructive. When credit cards charge interest rates of eighteen percent or higher, consumers are fighting an uphill battle against mathematics itself.

No reliable investment can consistently beat those returns, which means anyone carrying credit card balances is guaranteed to lose money. Buffett himself pays cash for most purchases and views high-interest debt as financial poison.

The middle class often falls into the trap of making minimum payments while interest compounds against them, turning small purchases into long-term financial burdens. Paying off this debt should take priority over almost any other financial decision.

3. Investment Fees & Actively Managed Funds

“Most institutional and individual investors will find the best way to own common stock is through an index fund that charges minimal fees. Those following this path are sure to beat the net results delivered by the great majority of investment professionals.” – Warren Buffett.

Wall Street has built an industry around convincing people they need expensive, actively managed funds and professional advisors charging high fees. Buffett has spent decades warning against this approach. When investment fees eat one percent or more of returns annually, the impact compounds dramatically over time.

He has repeatedly advocated for low-cost index funds that track the market rather than trying to beat it. The evidence supports his position—most actively managed funds fail to outperform low-cost index funds over the long term, yet they charge significantly higher fees. For the middle class trying to build retirement savings, these fees represent thousands or even hundreds of thousands of dollars lost over a lifetime.

4. Trying to Get Rich Quick

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett.

This elegant quote captures one of Buffett’s core philosophies about wealth building. The middle class often wastes money chasing hot stock tips, day trading, cryptocurrency schemes, and other get-rich-quick opportunities. These approaches are rarely practical and usually result in significant losses.

Buffett’s own fortune was built through patient, long-term investing in quality companies. The desire for quick profits causes people to make emotional decisions, buy at market peaks, and sell at market lows. Actual wealth accumulation requires the discipline to invest consistently over decades and resist the temptation to tinker with investments based on short-term market movements constantly.

5. Luxury Items to Impress Others

“Would 10 homes make me happier? Possessions possess you at some point. I don’t like a $100 meal as much as I like a hamburger from McDonald’s. That’s the way I’m put together.” – Warren Buffett.

Despite having the resources to own anything in the world, Buffett chooses simplicity. He understands that accumulating possessions to impress others is a hollow pursuit that drains resources without providing genuine satisfaction. The middle class often falls into the trap of lifestyle comparison, upgrading homes, buying luxury brands, and maintaining appearances that don’t align with their actual financial situations.

Buffett’s lifestyle demonstrates that happiness and fulfillment stem from economic security and meaningful relationships, rather than material displays of wealth. Every dollar spent on unnecessary luxury items is a dollar that can’t be used to build absolute financial independence.

6. Spending Too Much on Entertainment Instead of Investing in Yourself

“The most important investment you can make is in yourself. Anything that improves your own talents. Nobody can take it away from you.” – Warren Buffett.

Buffett views failing to invest in yourself as one of the biggest financial mistakes. The middle class often neglects spending on education, skill development, and personal growth that could significantly increase their earning potential. Instead, they waste money on entertainment that consumes the time they could spend on learning and education.

Unlike material possessions that depreciate, or entertainment that is unfulfilling in the long term. Investments in your own capabilities appreciate over time. Buffett himself attributes much of his success to continuous learning and self-improvement.

Whether it’s taking courses, learning new technologies, or developing communication skills, these investments can’t be taxed, stolen, or inflated away. They represent the one asset that will always belong to you and can generate returns throughout your entire career.

7. Lifestyle Inflation

“Do not save what is left after spending; instead, spend what is left after saving.” – Warren Buffett.

This simple reversal of priorities represents one of Buffett’s most powerful pieces of advice. The middle class typically experiences lifestyle inflation—as income increases, spending increases proportionally or even faster. Bigger homes, fancier vacations, and upgraded everything become the norm.

Buffett advocates flipping this approach entirely. By paying yourself first through automatic savings and investments, you force yourself to live within what remains. This prevents the endless cycle of earning more but never getting ahead financially. It requires discipline to maintain this approach as income grows, but it’s the foundation of wealth building for anyone, regardless of their income level.

Conclusion

Warren Buffett’s wisdom about money management transcends his status as a billionaire investor. His advice applies universally because it’s rooted in timeless principles of discipline, patience, and value-focused decision making. The middle class doesn’t need complex strategies or insider knowledge to build wealth—they need to avoid these seven common money traps.

By steering clear of depreciating assets like new cars, eliminating high-interest debt, minimizing investment fees, resisting get-rich-quick schemes, avoiding unnecessary luxury purchases, investing in personal development, and preventing lifestyle inflation, anyone can begin building lasting financial security.

Buffett’s own modest lifestyle demonstrates that these principles are practical regardless of one’s wealth level. The path to financial independence isn’t about earning the highest income but about making smart decisions with whatever you earn.