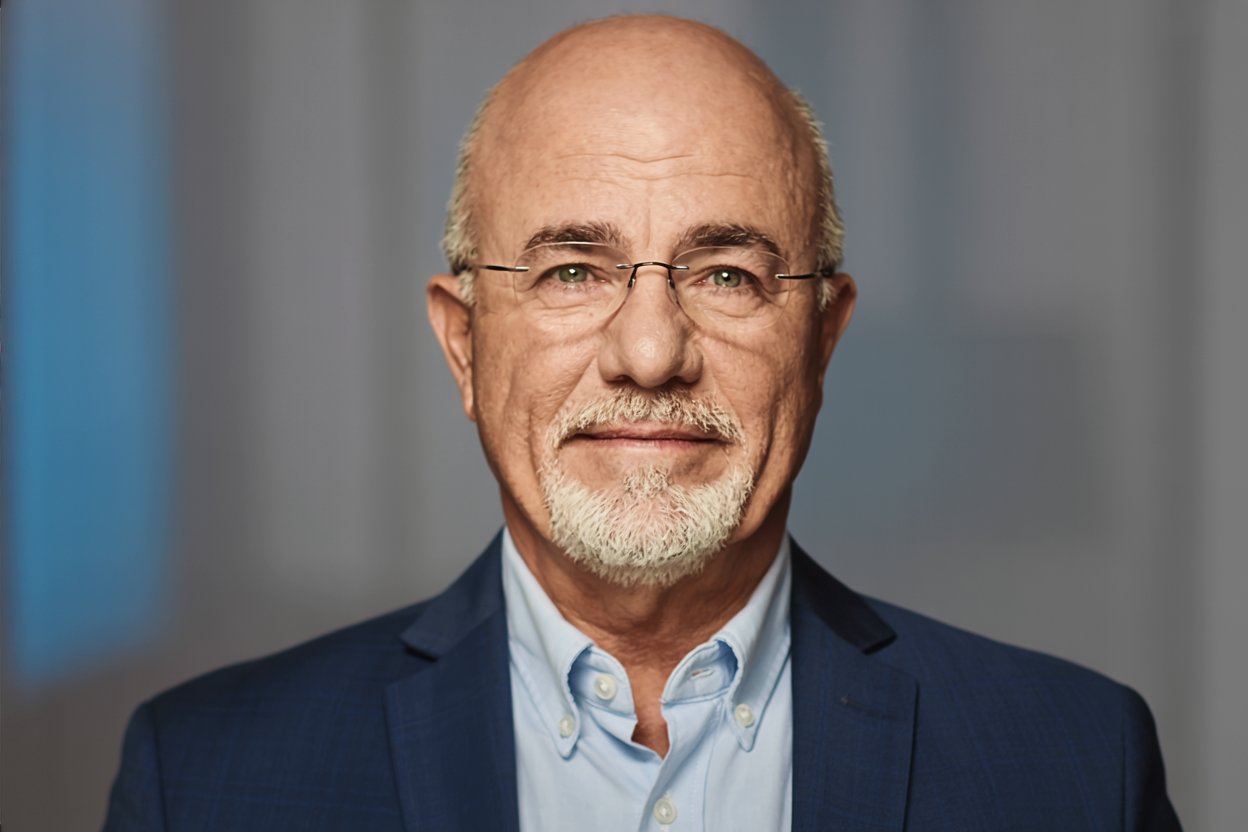

Financial guru Dave Ramsey has spent decades teaching Americans how to build wealth, and his message often centers on what NOT to buy. While many financial advisors focus on investment strategies and complex wealth-building tactics, Ramsey takes a different approach.

He argues that the middle class isn’t broke because they don’t earn enough—they’re broke because of specific purchasing decisions that drain their wealth-building potential.

The five purchases listed below have become so normalized in American culture that most middle-class families no longer question them. Yet according to Ramsey’s teachings, eliminating or minimizing these five purchases could be the difference between living paycheck to paycheck and building significant wealth over time.

1. New Cars with Financing

Dave Ramsey considers the car payment one of the single most significant obstacles to building wealth. The average new car loses approximately 60% of its value in the first five years, making it one of the worst investments a person can make. Yet millions of middle-class Americans sign up for five-, six-, or even seven-year loans to drive a brand-new vehicle off the lot.

Ramsey’s position is straightforward: cars are depreciating assets, and financing one is financial suicide. When you add interest to the equation, you’re paying even more for something that’s actively losing value.

His solution is to buy reliable used cars with cash. While this might mean driving a less impressive vehicle for a few years, it frees up hundreds of dollars per month that can be redirected toward paying off debt or building wealth.

The cultural acceptance of car payments as a regular part of life is what Ramsey fights against most. He argues that Americans have been conditioned to ask “how much per month?” instead of “how much does it cost?”

This shift in thinking enables people to justify purchases they cannot afford. By saving up and paying cash for vehicles, families can break the cycle of perpetual car payments that prevent wealth accumulation.

2. Too Much House

Housing represents the most significant expense for most middle-class families, and Ramsey believes many people buy more house than they can afford. Just because a bank approves you for a specific mortgage amount doesn’t mean you should borrow that much. Banks qualify buyers based on different metrics than what actually allows families to thrive financially.

Ramsey recommends keeping your total housing payment—including principal, interest, taxes, and insurance—at no more than 25% of your take-home pay on a 15-year fixed-rate mortgage. This guideline is significantly more conservative than what most banks will approve. Many families find themselves “house poor,” spending 35% to 45% of their income on housing, which leaves little room for saving, investing, or handling unexpected expenses.

The problem compounds when families stretch their budget to buy their “dream home” before they can afford it. They end up with a beautiful house, but no margin in their budget for building wealth. Ramsey teaches that wealth isn’t built by the home you live in—it’s built by the money you invest while living in a house you can comfortably afford.

3. Credit Cards and Consumer Debt

According to Dave Ramsey’s philosophy, credit cards and consumer financing are tools that keep the middle class broke. When families finance furniture, electronics, vacations, or everyday purchases on credit cards, they’re paying tomorrow’s money for yesterday’s expenses.

The interest rates on credit cards often range from 18% to 25%, meaning families pay hundreds or thousands of dollars in interest on items that have already lost value or been consumed.

Ramsey’s teaching on this topic is radical but straightforward in today’s culture: if you can’t afford to buy it with cash, you can’t afford it. This principle eliminates the justifications people make for using credit. Whether it’s “building credit history” or taking advantage of “rewards points,” Ramsey argues that these benefits don’t outweigh the danger of normalizing debt in your life.

Consumer debt also creates a psychological burden. Families carrying credit card balances are stressed about money, worried about making minimum payments, and unable to save for emergencies. Breaking free from this cycle requires a mindset shift from financing purchases to saving up and paying cash.

4. Student Loans

Dave Ramsey has been increasingly vocal about student loans as a wealth killer for the middle class. He argues that convincing 18-year-olds to sign up for tens or hundreds of thousands of dollars in debt for a degree is one of the most damaging financial decisions being pushed in America today.

These loans saddle young adults with payments that can last for decades, preventing them from building wealth during their most crucial years for wealth accumulation.

The problem isn’t education itself—Ramsey values education highly. The problem is borrowing massive amounts of money to pay for it. He advocates for alternative paths, including attending affordable state schools, working while in college, applying for scholarships, and choosing degrees that lead to careers with earning potential that justifies the cost.

When young adults graduate with significant student loan debt, they often struggle to save for a down payment on a house, invest for retirement, or start a business. Instead, they’re making student loan payments that feel like a second rent payment.

Ramsey’s position is that the temporary sacrifice of working through school or attending a less prestigious institution is worth the long-term benefit of graduating debt-free.

5. Lifestyle Inflation and Keeping Up Appearances

The fifth purchase that keeps the middle class broke isn’t a single item—it’s a pattern of spending. Ramsey calls this “keeping up with the Joneses,” and it includes all the small and medium purchases that add up to living at or above your means. This encompasses constantly upgrading phones, buying designer clothes, taking expensive vacations, eating out frequently, and maintaining premium subscriptions for services you rarely use.

The middle-class trap is earning a decent income but spending all of it—or more than all of it—to maintain a certain standard of living. Families feel pressure to have what their neighbors, coworkers, and social media connections have, leading to a constant cycle of consumption that prevents wealth building. Ramsey’s famous line captures this perfectly: “People buy things they don’t need with money they don’t have to impress people they don’t like.”

The antidote to lifestyle inflation is intentional spending. This means making conscious decisions about where your money goes rather than defaulting to whatever lifestyle your income can support. Wealthy people, Ramsey teaches, live below their means and invest the difference. The middle class lives at or above their means and wonders why wealth remains elusive.

Conclusion

Dave Ramsey’s teachings on these five purchases share a common thread: they all involve spending money you don’t have or spending money that could be used to build wealth. Whether it’s financing cars, overextending on houses, relying on credit cards, borrowing for education, or inflating your lifestyle, these decisions normalize debt and prevent wealth accumulation.

Ramsey’s alternative is straightforward but requires discipline: live below your means, pay cash for purchases, and invest the margin. While this approach might mean driving older cars and living in modest homes temporarily, it creates the foundation for building real wealth over time.

The question isn’t whether you can afford the monthly payment—it’s whether this purchase moves you closer to or further from financial independence.