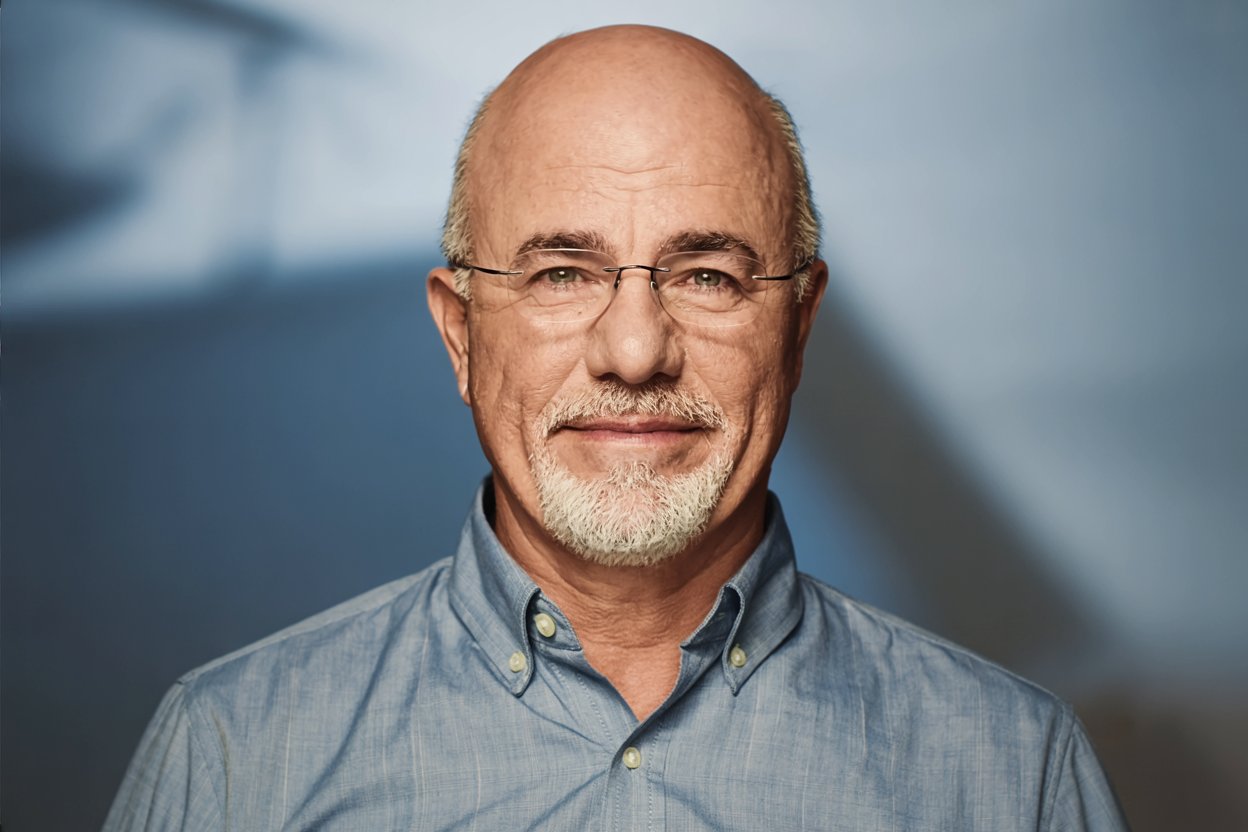

When it comes to building wealth, financial guru Dave Ramsey has never been one to mince words. His straightforward approach to money management has helped millions of middle-class Americans escape debt and build financial security.

However, Ramsey is equally clear about what people should avoid. While the middle class often looks for investment opportunities to accelerate wealth-building, Ramsey warns that certain financial products marketed as “investments” are actually wealth destroyers in disguise. Understanding what not to invest in can be just as important as knowing where to put your money.

1. Whole Life Insurance Policies

Dave Ramsey’s position on whole life insurance is unequivocal: it’s a terrible investment. These policies combine a death benefit with a savings component, marketed as a way to “invest while you’re protected.” The problem is that whole life insurance policies often come with high premiums, excessive fees, and returns that pale in comparison to those of traditional investments.

Ramsey consistently teaches that life insurance and investing should be kept separate. The fees embedded in whole life policies can consume much of the cash value growth, and the returns typically lag far behind what you could earn through mutual funds or other investment vehicles.

Insurance salespeople earn substantial commissions on these policies, which is why they’re pushed so aggressively despite being poor financial products for consumers.

“Buy term and invest the difference.” – Dave Ramsey.

This simple principle forms the foundation of Ramsey’s insurance philosophy. Term life insurance provides pure death benefit protection at a fraction of the cost of whole life policies. By purchasing affordable term coverage and investing the premium difference in quality growth stock mutual funds, middle-class families can build actual wealth while maintaining proper insurance protection.

The math overwhelmingly favors this approach, yet whole life insurance continues to trap families in expensive, underperforming financial products.

2. Cryptocurrency and Speculative Assets

While cryptocurrency has captured public imagination with stories of people becoming millionaires, Dave Ramsey views it as speculation rather than legitimate investing. The extreme volatility that makes cryptocurrency exciting is precisely what makes it a danger to middle-class wealth building. Families who can’t afford to lose their investment capital shouldn’t be gambling on assets that can lose half their value or more in a matter of weeks.

Ramsey emphasizes that building wealth isn’t about chasing the latest trend or trying to hit a home run with risky bets. Actual wealth accumulation happens through steady, proven methods over decades. Cryptocurrency shifts people’s mindset from that of a patient investor to an anxious trader, causing them to constantly check prices and make emotional decisions based on market swings.

The middle class needs wealth-building vehicles they can understand, trust, and hold for the long term. Cryptocurrency fails this test. When people invest based on hype rather than fundamentals, they’re setting themselves up for financial pain. Ramsey’s approach focuses on boring, predictable growth rather than exciting but dangerous speculation.

3. Timeshares

Few financial products draw Ramsey’s ire more than timeshares. Marketed as vacation investments, timeshares actually represent one of the worst financial decisions middle-class families can make. These properties rapidly depreciate, come with ever-increasing maintenance fees, and prove nearly impossible to sell when circumstances change.

The vacation industry’s sales tactics pressure families into making emotional decisions during getaways, convincing them that buying vacation time is financially sensible.

The reality is far different. Timeshare contracts lock families into decades of fees for vacations they may not be able to use. The resale market is virtually nonexistent, meaning owners who need out of their contracts often can’t find buyers at any price.

Ramsey points out that families would save thousands of dollars simply by paying cash for vacations when they can afford them. The flexibility alone makes this approach superior to being contractually bound to specific locations and dates. Timeshares transfer wealth from middle-class families to developers and salespeople without delivering commensurate value.

4. Real Estate Without Financial Stability

Dave Ramsey isn’t against real estate investing, but he is firmly against doing it prematurely. Middle-class families often get seduced by the idea of passive rental income or house-flipping profits before they’ve established financial stability. This approach puts the cart before the horse and can lead to economic disaster.

“The borrower is a servant to the lender”, according to Dave Ramsey.

This biblical principle guides Ramsey’s entire philosophy on debt and investing. Families who jump into real estate investments while carrying consumer debt, lacking emergency funds, or stretching their budgets to the breaking point are building on a foundation of sand. One unexpected vacancy, major repair, or market downturn can wipe out any potential gains and create devastating losses.

Ramsey teaches that real estate investing should only happen after achieving specific financial milestones: being completely debt-free, having a fully funded emergency fund, and having cash available to purchase investment properties outright or with substantial down payments. This conservative approach may seem slow, but it protects families from the catastrophic risks that come with overleveraged real estate ventures.

5. Get-Rich-Quick Schemes and Complex Investments

The middle class is constantly bombarded with opportunities promising extraordinary returns with minimal effort. Dave Ramsey’s response is consistent: if an investment sounds too good to be true, it is. Complex investment structures, multi-level marketing opportunities, and any ventures that require you to recruit others to generate income should be avoided.

Ramsey advocates for investments that pass a simple test: you should be able to explain them clearly and understand exactly how they work. Precious metals marketed as portfolio hedges, complicated derivative products, or complex strategies that require constant attention all fail this test. They appeal to people’s desire for quick wealth but deliver stress, confusion, and usually losses.

The wealth-building formula Ramsey promotes is almost boring in its simplicity: eliminate debt, build emergency savings, invest consistently in quality mutual funds through retirement accounts, and give time for compound growth to work. This approach won’t make for exciting dinner party conversation, but it actually works for building lasting middle-class wealth.

Conclusion

Dave Ramsey’s teachings boil down to a fundamental truth: building wealth isn’t about finding the perfect investment or discovering a secret opportunity others have missed. It’s about avoiding costly mistakes, maintaining financial discipline, and letting proven strategies work over time.

The middle class doesn’t need exotic investments or complex financial products. What’s needed is the wisdom to recognize what should be avoided and the patience to stick with methods that actually build lasting wealth.

By steering clear of these five investment traps, families can safeguard their financial futures and allocate resources to strategies that truly yield results.