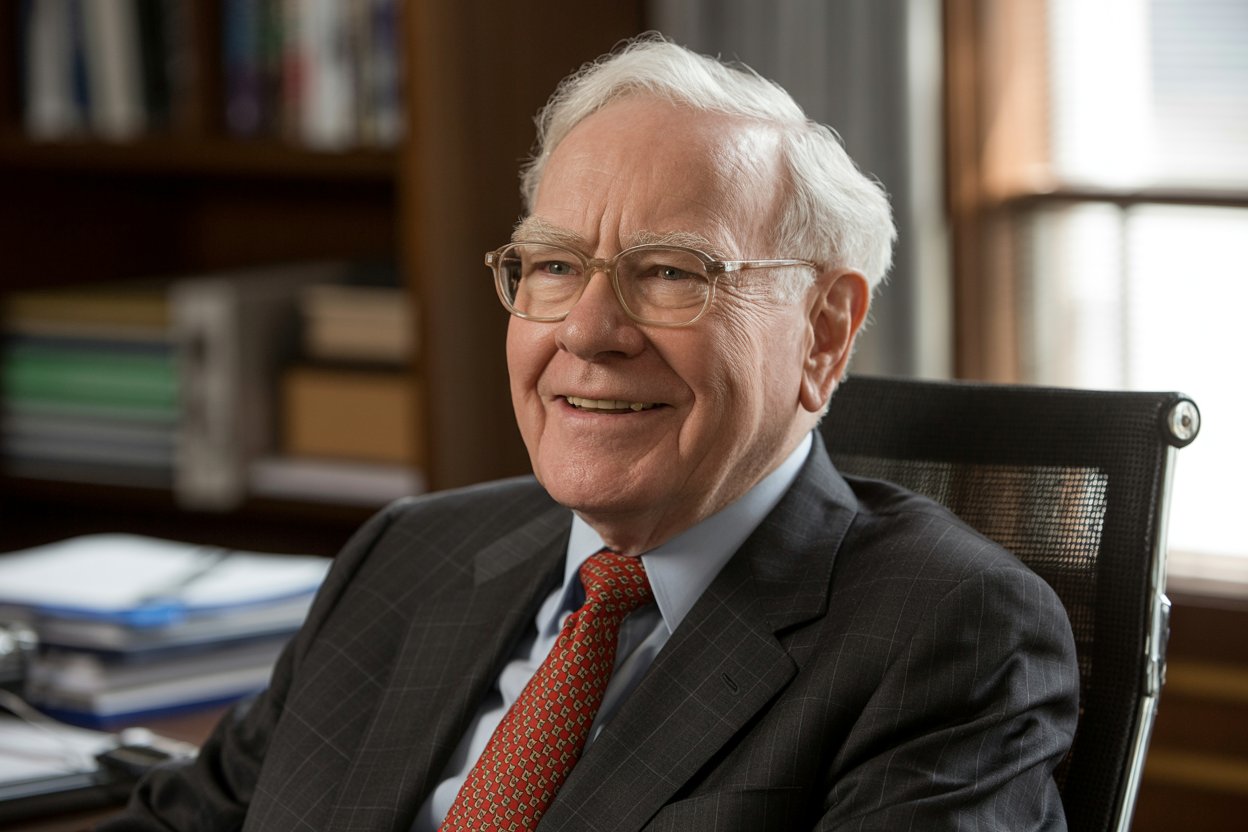

Warren Buffett shocked the investment world with his November 2025 announcement that he would no longer write Berkshire Hathaway’s annual report or speak at the annual meeting. As the British would say, he’s “going quiet.”

At 95 years old, the Oracle of Omaha delivered what may be his final comprehensive message to shareholders, and it contained far more than investment advice. This intensely personal letter offers profound wisdom about life, legacy, and what truly matters when you reach the end of a remarkable journey.

1. Acknowledge the Role of Luck in Your Success

Buffett opens his heart by admitting something many successful people refuse to acknowledge: luck played an enormous role in his achievements. He describes being born healthy, reasonably intelligent, white, male, and in America as winning the lottery of life. His candid admission that in many heavily populated parts of the world, he would likely have had a miserable life reveals a humility rarely seen among the ultra-wealthy.

This lesson extends beyond mere gratitude. Buffett points out that dynastic inheritors achieve lifetime financial independence the moment they emerge from the womb, while others face hellish circumstances or disabling infirmities.

Lady Luck, as he calls her, is wildly unfair. The wealthy and powerful have received far more than their share of luck, which too often they prefer not to acknowledge. This honest reckoning with fortune’s capricious nature should humble anyone who has achieved success.

2. Your Geographic Roots Can Be Your Greatest Asset

Throughout the letter, Buffett weaves a love story about Omaha, Nebraska. He bought his first and only home there in 1958, located just two miles from where he grew up, and has worked in the same office building for 64 years. This wasn’t settling or a lack of ambition. After working in Manhattan, where he was treated wonderfully by Ben Graham and made lifelong friends, he still chose to return home after just 1½ years.

The center of the United States proved to be an ideal location for establishing a business. Buffett believes that both he and Berkshire performed better because of their Omaha base than if he had resided elsewhere.

Through dumb luck, he drew a ridiculously long straw at birth by being born in a place that offered friendship, education, and opportunity. Your roots can nourish you throughout your entire life if you allow them to.

3. Choose Your Heroes Carefully and Copy Them

Buffett’s letter is filled with tributes to the people who shaped him, particularly Charlie Munger, his partner for 64 years. Charlie had a massive impact on Buffett and was the best teacher and protective big brother anyone could ask for. They had differences but never had an argument, and “I told you so” was not in Charlie’s vocabulary.

The lesson here is deliberate: get the right heroes and copy them. Buffett specifically mentions Tom Murphy as someone to emulate, calling him the best. This isn’t about blind hero worship, but instead about consciously choosing role models whose values and behaviors you want to emulate. You can start improving at any age by selecting better examples to follow.

4. Don’t Rule From the Grave

One of the most striking elements of Buffett’s succession planning is his explicit rejection of trying to control things that will happen after his death. He notes that ruling from the grave doesn’t have an excellent record, and he has never had an urge to do so. Instead, he’s accelerating lifetime gifts to his children’s foundations because they’re currently at their peak in experience and wisdom, though they haven’t yet entered old age.

His children will have the advantage of being above ground when he’s long gone and can adopt policies both anticipatory and reactive to changing circumstances. They may well need to adapt to a significantly changing world around them.

This wisdom applies beyond wealth distribution. Trying to control outcomes after you’re gone, whether in business, family, or philanthropy, often backfires. Trust the next generation to make their own decisions.

5. The Second Half Can Be Better Than the First

In one of the letter’s most hopeful messages, Buffett says he feels better about the second half of his life than the first. This revelation from a 95-year-old man who has achieved extraordinary success carries tremendous weight. He offers clear advice: don’t beat yourself up over past mistakes. Learn at least a little from them and move on.

It’s never too late to improve. Buffett himself admits that he has been thoughtless countless times and made many mistakes, but he became fortunate in learning from wonderful friends how to behave better. He’s still a long way from perfect, yet he continues growing. This perspective offers hope to anyone carrying regrets about their past.

6. Kindness Costs Nothing But Is Priceless

Buffett’s philosophy on greatness contradicts everything our culture promotes. Greatness doesn’t come about through accumulating significant amounts of money, publicity, or power in government. When you help someone in any of thousands of ways, you help the world. Kindness is costless but also priceless.

Whether you’re religious or not, it’s hard to beat The Golden Rule as a guide to behavior. This simple wisdom, delivered by one of the world’s wealthiest individuals, serves as a poignant reminder that material success is meaningless without human decency. The measure of a life isn’t found in quarterly earnings reports but in acts of kindness extended to others.

7. Everyone Deserves Equal Respect

In a moment of profound humility, Buffett writes: “Keep in mind that the cleaning lady is as much a human being as the Chairman.” This single sentence demolishes hierarchies and reminds us that titles, wealth, and positions don’t determine human worth. The person who cleans your office deserves the same respect and consideration as the person who runs the company.

This lesson connects directly to his reflections on luck. Those at the top haven’t necessarily worked harder or possessed more virtue than those at the bottom. Circumstances, opportunities, and yes, luck have played enormous roles. Treating everyone with equal dignity isn’t just morally right—it’s recognizing the truth about how success actually works.

8. Write Your Obituary Today and Live Up to It

Buffett shares the story of Alfred Nobel, who reportedly read his own obituary that was mistakenly printed when his brother died. Nobel was horrified by what he read and realized he needed to change his behavior. While Nobel went on to establish the prizes that bear his name, most of us won’t get that newsroom mix-up.

The lesson is clear: don’t count on a newsroom error. Decide what you would like your obituary to say and live the life to deserve it. This exercise forces you to confront what truly matters to you, what legacy you want to leave, and whether your current path will get you there. It’s a powerful tool for course correction while you still have time to make adjustments.

9. Growth and Learning Never Stop

Despite being 95 and experiencing declining balance, sight, hearing, and memory, Buffett still goes to the office five days a week, where he works with wonderful people. He occasionally gets a valuable idea or receives an offer Berkshire might not otherwise have seen. Due to the company’s size and market cap level, ideas are few—but not zero.

Father Time is undefeated, and everyone ends up on his scorecard as a win. When physical and mental decline arrive, they can’t be denied. Yet, within those constraints, Buffett continues to contribute, learn, and find meaning. The lesson is that you can remain engaged and valuable regardless of age or physical limitations. Growth doesn’t have an expiration date.

10. Know When to Step Aside

Perhaps the most courageous lesson in the entire letter is Buffett’s decision to step aside while still competent. He’s not being forced out due to incapacity. He’s choosing to hand leadership to Greg Abel at year’s end because Greg is a great manager, tireless worker, and honest communicator. Buffett expresses complete confidence in his successor and encourages shareholders to wish Greg a long and extended tenure.

This willingness to transition power gracefully, without clinging to control or creating unnecessary drama, demonstrates rare wisdom. Too many leaders—in business, politics, and other fields—hold on too long, damaging the very institutions they built. Buffett’s example shows that knowing when to step aside is as vital as knowing when to step up.

Conclusion

Warren Buffett’s final comprehensive shareholder letter transcends investment advice to offer timeless wisdom about living a meaningful life. From acknowledging the role of luck to treating everyone with equal respect, from choosing the right heroes to writing your own obituary, these lessons apply to anyone regardless of wealth or status.

The letter’s most powerful message may be its honesty. Buffett doesn’t pretend to be perfect or to have always made the right choices. He admits to mistakes, expresses gratitude for second chances, and continues to learn at 95. He reminds us that America is capricious and sometimes venal in distributing its rewards, yet he remains thankful for the opportunities it provided.

As Buffett prepares to go quiet, his words echo with the accumulated wisdom of nearly a century of living. Yes, even the jerks can change—it’s never too late. Choose your heroes carefully, emulate them, and you can always be better. You’ll never be perfect, but that was never the goal. The goal is to help others, practice kindness, and leave the world a bit better than you found it.