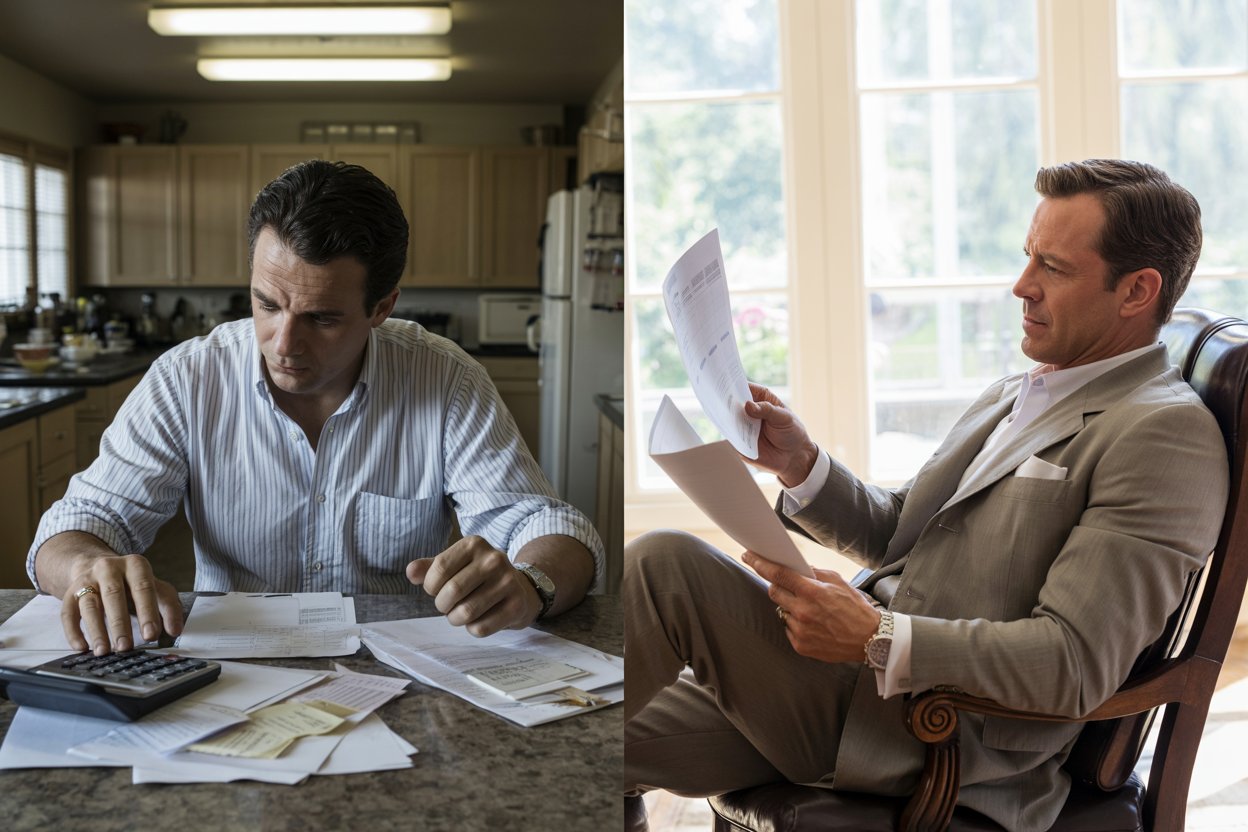

Most people believe they understand what separates the middle class from the wealthy. They point to inheritances, lucky breaks, or exceptional intelligence. However, after studying the actual habits of self-made high-net-worth individuals versus those of typical middle-class families, a different pattern emerges.

The gap has less to do with how much money people make initially and everything to do with what they do with it over time. This article examines ten specific behavioral and financial differences between the middle class and the wealthy.

Understanding the following ten differences won’t instantly make you rich, but recognizing which side of these behaviors you’re on represents the first step toward changing your financial trajectory.

1. Buying New Cars on Credit

The middle class tends to view car purchases as lifestyle decisions rather than financial ones. Suburban driveways overflow with vehicles less than five years old, most of which carry monthly payment obligations.

Self-made wealthy individuals recognize that cars depreciate the moment they leave the lot, losing roughly 20% of their value in the first year alone. They purchase quality used cars with cash or strategically lease luxury vehicles when tax advantages apply to their businesses.

Many keep cars for a decade or longer, viewing transportation as a utility rather than a status symbol. The monthly payments the middle class makes on depreciating vehicles could instead be used to fund investments that generate passive income for years to come.

2. Housing Costs That Consume Income

Housing represents the single most significant expense for most middle-class families, often consuming 30% to 50% of take-home pay when factoring in mortgages, property taxes, insurance, and maintenance. This creates financial fragility.

The wealthy view housing differently. They understand that a primary residence isn’t an investment, but rather a consumption item that ties up capital without generating cash flow. High-net-worth individuals typically allocate between 10% and 15% of their net worth to total housing costs annually. While the middle class stretches to buy the biggest house they can afford, the self-made wealthy often live well below what they could afford.

3. Trading Time for Money

Middle-class income structures reveal perhaps the most significant wealth barrier: nearly complete dependence on earned income. The typical middle-class family derives 90% to 100% of their income from salaries or wages. Income stops the moment work stops.

Wealthy individuals have restructured their income sources. Most of their money flows from investments, businesses they own or operate, real estate holdings, dividend-paying stocks, or royalties. This shift from earned income to passive income represents the crucial transformation from working for money to having money work for you.

4. Status Signaling Through Consumption

The middle class often falls into conspicuous consumption, purchasing items primarily to signal success to neighbors and colleagues. This manifests in upgraded houses, luxury brands, expensive vacations, and designer goods chosen more for their logo than their utility.

Genuinely wealthy individuals display the opposite behavior. Comfortable in their financial position, they feel no need to prove anything to anyone. The millionaire next door often drives an older sedan, wears a basic watch, and lives in a modest home, considering their net worth as their primary goal. This indifference to external validation allows them to redirect resources toward wealth accumulation rather than wealth display.

5. Accepting Sticker Prices

The middle class has been conditioned to accept posted prices with minimal negotiation. While they might wait for sales or use coupons, they rarely engage in serious bargaining beyond major purchases.

The wealthy negotiate virtually everything: real estate commissions, medical bills, private school tuition, furniture, professional services, and even luxury items. This isn’t about being cheap, but rather about understanding that prices are often starting points for discussion. This single habit can save hundreds of thousands of dollars over the course of a lifetime.

6. Financial Illiteracy by Default

Most middle-class individuals learn about money management through informal channels, such as parents, friends, or social media. They avoid complex financial topics, finding tax strategies and investment vehicles either tedious or intimidating. This knowledge gap costs them dearly.

The wealthy obsessively pursue financial education. They study tax codes, trust structures, depreciation schedules, and investment strategies. When topics exceed their expertise, they hire specialists.

This investment in financial knowledge yields exponential returns, as even minor optimizations in tax strategy can save or generate millions over the course of decades.

7. Confusing Saving with Investing

The middle class often believes that putting money into savings accounts, CDs, or standard 401(k) plans constitutes a form of investing. While these vehicles serve essential purposes, they rarely generate returns that meaningfully outpace inflation.

Wealthy individuals aggressively deploy capital into cash-flowing assets. They seek businesses, real estate properties, private placements, and other opportunities targeting higher returns. They understand the difference between parking money safely and investing it productively. The middle class saves to save. The wealthy save to invest.

8. Strategic Versus Expensive Debt

Consumer debt represents one of the most apparent behavioral divides. Many middle-class households carry thousands in credit card balances, paying high interest rates that compound against their financial progress.

The wealthy use debt strategically rather than carelessly. They might leverage mortgage interest deductions or tap business lines of credit at favorable rates, but they rarely pay credit card interest on consumer purchases. They understand that paying high interest on depreciating purchases represents financial self-sabotage.

9. Single-Income-Stream Dependency

The middle-class career path typically follows a linear trajectory: education, employment, advancement, retirement. This concentrates all income risk into one stream, creating vulnerability to industry disruptions, company failures, or health issues.

Wealthy individuals build multiple income streams early in their careers. They might maintain a primary profession while simultaneously building a business, investing in real estate, or creating intellectual property. This diversification creates resilience and options. Many achieve financial independence by their 40s or 50s, continuing to work because they choose to, not because they must.

10. Misunderstanding the Path to Wealth

The middle class often fixates on budgeting, coupon clipping, and cutting small expenses. While these habits have value, they reflect a scarcity mindset that assumes wealth comes from spending less rather than earning more.

The wealthy focus on the other side: increasing income, optimizing asset allocation, and minimizing taxes. They understand that you can’t cut your way to wealth because there’s a floor to how low expenses can go, but no ceiling on how much you can earn and invest.

Rather than obsessing over small costs, they think about building businesses, negotiating higher compensation, or identifying undervalued investments.

Conclusion

These behavioral patterns reveal that the gap between the middle-class and the wealthy isn’t primarily about intelligence, luck, or starting capital. It’s about habits, mindset, and how people think about money over the course of decades.

The middle class tends to buy liabilities disguised as assets, such as oversized homes and luxury cars, which drain resources on a monthly basis. The wealthy focus on acquiring genuine assets that generate income and deposit money into their accounts, regardless of whether they’re working.

The transformation from middle-class to wealthy thinking requires questioning societal programming about success, educating yourself about financial systems, and having the discipline to live below your means while building multiple income streams.

These changes won’t produce overnight results, but compounded over years and decades, they create the foundation for genuine wealth rather than just the appearance of it.