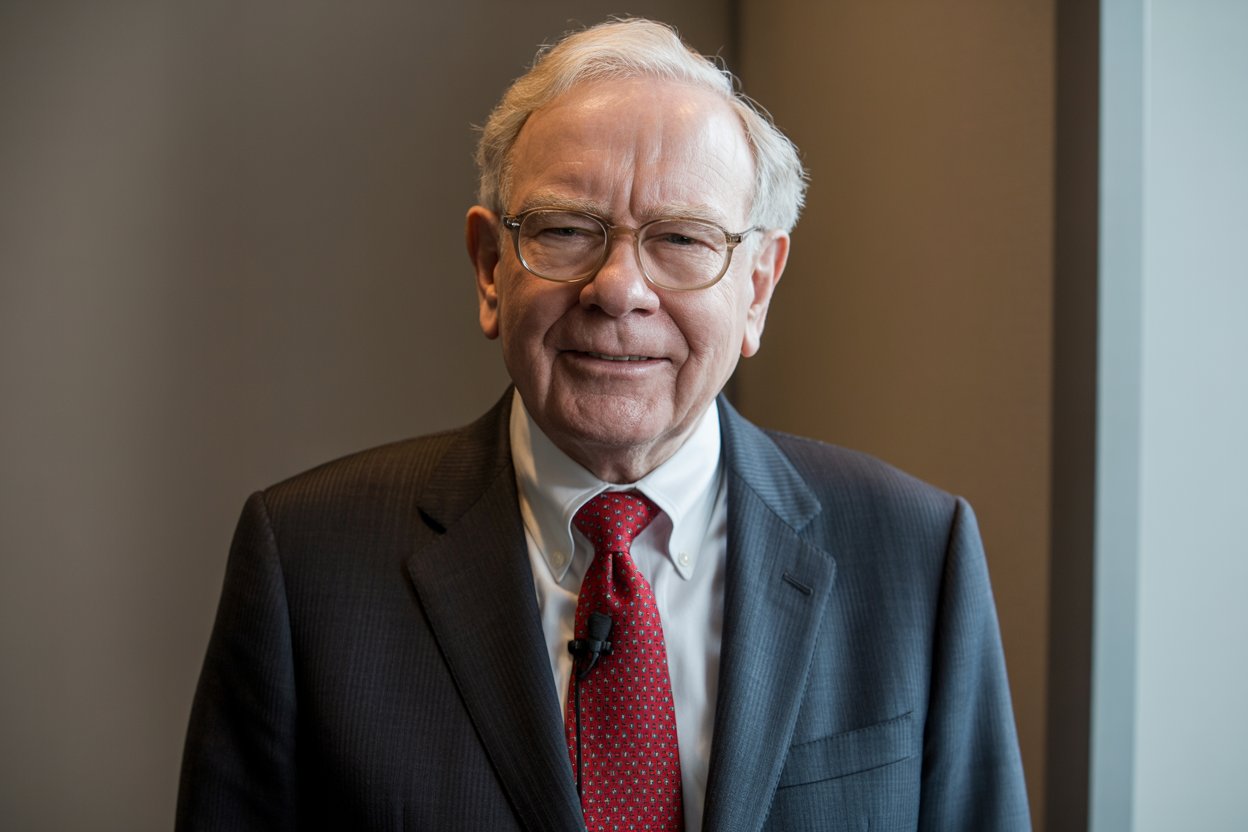

Warren Buffett is famous for a net worth that rivals the GDP of small nations, yet his personal spending habits remain closer to those of a middle-class retiree in Omaha. He views money not as a tool for status, but as a tool for compounding. While most billionaires showcase their wealth through extravagant purchases, Buffett has consistently avoided the luxuries that define the ultra-rich lifestyle.

His frugality isn’t about deprivation. It’s about intentionality. Every dollar saved is a dollar that can compound over decades, turning modest savings into substantial wealth.

Here are five surprising things Warren Buffett has never wasted money on, even after becoming one of the wealthiest people on Earth.

1. Luxury Automobiles

While many billionaires collect Ferraris and Lamborghinis, Buffett drives practical, modest vehicles. He’s known for keeping the same car for years, often keeping it until family members suggest it’s time for an upgrade. His vehicle choices have included Cadillacs and other American-made cars that prioritize function over flashiness.

To Buffett, a car serves one purpose: reliable transportation from point A to point B. Expensive sports cars depreciate rapidly and require costly maintenance, yet offer no additional utility.

He views excessive spending on automobiles as money that could be better deployed elsewhere. A luxury vehicle might provide temporary satisfaction, but it can’t compound in value the way invested capital can.

2. Real Estate Portfolios

Most billionaires own multiple properties worldwide. Penthouses in Manhattan, beach estates in Malibu, chalets in Aspen, and villas on the French Riviera fill their real estate portfolios. Buffett took a different approach.

He still lives in the same five-bedroom house in Omaha, Nebraska, that he purchased in 1958 for $31,500. He’s called it one of his best investments, not because of its resale value, but because of the stability and memories it provided. The house is comfortable but far from ostentatious.

Multiple homes create burdens that Buffett refuses to accept. Each property requires maintenance, property taxes, insurance, utilities, and often full-time staff. These ongoing costs drain resources without providing meaningful value.

The time spent managing properties is time not spent on more productive pursuits. Buffett would rather focus on reading annual reports and analyzing businesses than coordinating with property managers across different time zones.

3. Fine Dining and Private Chefs

With his resources, Buffett could employ a team of Michelin-starred chefs to prepare elaborate meals throughout the day. Instead, his eating habits resemble those of a typical American with simple tastes. He’s famous for stopping at McDonald’s on his morning commute to the office during his career.

He also drinks Coca-Cola regularly and enjoys Dairy Queen ice cream. These aren’t the refined palates you’d expect from someone who could afford the world’s most exclusive restaurants. But Buffett eats what he genuinely enjoys, not what impresses others.

Expensive meals don’t provide him with proportionally greater satisfaction. A burger he actually wants tastes better to him than a truffle-infused dish he’s supposed to appreciate. This authenticity extends to all his consumption choices.

He refuses to spend money on “culinary experiences” that don’t align with his actual preferences. Status-driven consumption holds no appeal when you’ve already achieved the highest financial status possible.

4. Designer Fashion and Luxury Accessories

The billionaire uniform often includes custom-tailored Italian suits, Swiss watches worth more than most homes, and designer accessories from exclusive brands. Buffett has been wearing the same style for decades. His wardrobe prioritizes comfort and professionalism over fashion trends.

Expensive watches and jewelry don’t appear in his personal style. These items serve primarily as status symbols, which Buffett doesn’t need. His reputation and track record speak louder than any luxury accessory could.

Fashion trends change constantly, making high-end clothing a poor investment. The money spent keeping up with evolving styles could instead be earning returns in the market. Buffett applies opportunity cost thinking even to his closet.

5. Cutting-Edge Technology and Gadgets

Despite his close friendship with Bill Gates and his company’s massive investment in Apple, Buffett has been notoriously slow to adopt new technology in his personal life. He used a basic flip phone for many years, only upgrading to a smartphone relatively recently after considerable persuasion from associates. He did not transition from a flip phone to an iPhone until 2020.

He avoids the upgrade cycle that drives many consumers to purchase new devices every year. His technology serves functional purposes rather than providing status or entertainment. This resistance to tech spending isn’t about being out of touch; it’s about focus on what matters.

Buffett recognizes that constant upgrades rarely provide meaningful improvements in productivity or quality of life. The newest phone doesn’t help him analyze balance sheets any better. The latest tablet doesn’t improve his ability to evaluate business models.

He prefers spending his time reading physical newspapers and annual reports rather than scrolling through apps and social media. This focus on substance over novelty has served his investment philosophy well. His desk featured a landline phone and a model train, but notably lacked a computer, stock ticker, or calculator.

Conclusion

Buffett’s spending patterns reveal a crucial insight about wealth: accumulating it and displaying it are entirely different activities. His frugality isn’t about being cheap or denying himself pleasure. It’s about understanding opportunity cost at a profound level.

Every dollar not spent on a luxury car in his youth has compounded for decades at impressive rates. The savings from living in one home rather than maintaining multiple estates have grown exponentially. His simple eating habits have allowed more capital to remain invested rather than consumed.

This approach can’t be dismissed as easy for someone already wealthy. Buffett maintained these habits before he became rich, and they directly contributed to his wealth accumulation. These smart money principles work regardless of income level.

The lesson isn’t that everyone should eat fast food and drive old cars. It’s that conscious spending aligned with personal values and long-term goals creates more wealth than spending designed to impress others. Buffett proved that the path to extraordinary wealth often runs through ordinary consumption choices.