The wealthy don’t just read different books. They read differently. While most people scan bestseller lists for the latest productivity hack or motivational manifesto, successful investors and entrepreneurs return to the same dense, challenging texts year after year. These aren’t beach reads. They’re operating manuals for how the world actually works.

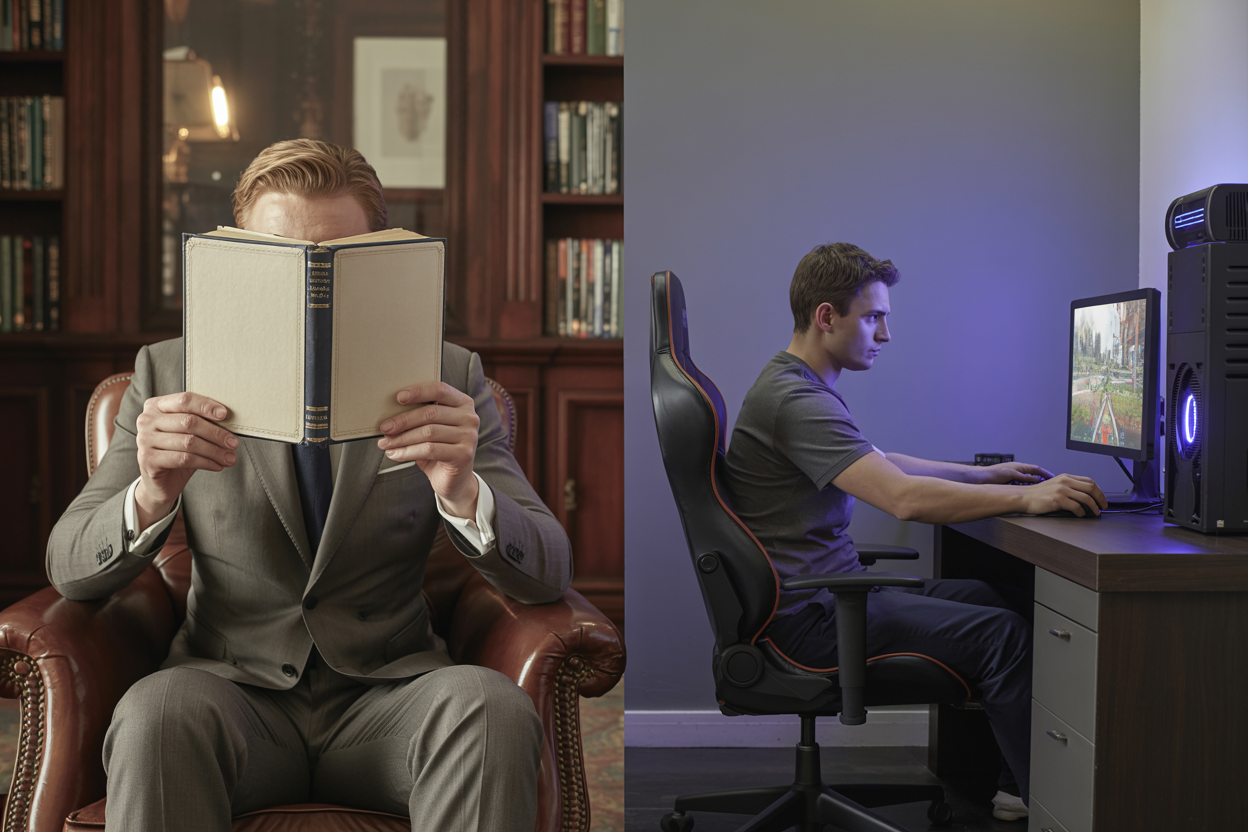

The gap between what rich and poor people read reveals something more profound than book preferences. It exposes fundamentally different approaches to knowledge itself. One group seeks entertainment disguised as self-improvement—the other treats reading as deliberate research into human behavior, competitive strategy, and decision-making under uncertainty.

1. Poor Charlie’s Almanack by Charlie Munger

Charlie Munger built a fortune as Warren Buffett’s partner at Berkshire Hathaway, but his real genius lies in his mental models approach. This book compiles decades of Munger’s speeches and writings on multidisciplinary thinking, showing how to combine insights from psychology, physics, biology, and economics into a unified framework for decision-making.

Most people avoid this book because it’s intellectually demanding and doesn’t promise quick results. Munger advocates for building a “latticework of mental models” that requires years of study across multiple disciplines. The wealthy understand that their investment pays compounding returns in terms of judgment quality.

2. Seeking Wisdom: From Darwin to Munger by Peter Bevelin

Peter Bevelin’s masterwork connects evolutionary biology, cognitive psychology, and investing wisdom into a comprehensive guide to rational thinking. The book systematically catalogs the psychological biases and mental errors that sabotage decision-making, then provides frameworks for avoiding them.

This isn’t passive reading. It requires active study, note-taking, and application. Middle-class readers typically abandon it for more digestible content, while wealthy individuals treat it as a reference manual they consult repeatedly when facing important decisions.

3. Competition Demystified by Bruce Greenwald

Bruce Greenwald teaches at Columbia Business School, and this book represents his strategic analysis framework for identifying genuine competitive advantages. It cuts through business mythology to reveal what actually creates economic moats and sustainable profits.

The academic and technical nature scares away most readers. Successful investors prize it precisely because it teaches pattern recognition for businesses with enduring advantages, helping them avoid the value traps that seduce amateur investors.

4. The Most Important Thing by Howard Marks

Howard Marks runs Oaktree Capital and writes memos that Warren Buffett reads immediately. This book distills his philosophy of second-level thinking and contrarian investing, emphasizing that superior returns come from seeing what others miss rather than from following the crowd.

Middle-class investors chase performance and hot sectors. Marks teaches risk management and psychological discipline, arguing that avoiding losses matters more than maximizing gains: this patient, defensive approach conflicts with the get-rich-quick mentality.

5. Zero to One by Peter Thiel

Peter Thiel co-founded PayPal and was Facebook’s first outside investor. His book challenges conventional business wisdom by arguing that actual value creation comes from monopoly-like innovation rather than incremental competition—Thiel advocates building something genuinely new rather than copying what already exists.

Tech billionaires praise this book for articulating a forward-thinking model of entrepreneurship. Most people skip it because they’re conditioned to think competition is healthy, even though Thiel argues it destroys profits and creativity.

6. The Innovator’s Dilemma by Clayton Christensen

Clayton Christensen’s research explains why successful companies fail when faced with disruptive innovation. The book shows how doing everything “right” according to conventional business wisdom can lead to disaster when market conditions fundamentally shift.

This matters for both investors and entrepreneurs. Understanding disruption patterns helps identify which industries face existential threats and which companies can’t adapt despite their current success. The wealthy study these patterns while others remain blindsided by change.

7. Antifragile by Nassim Nicholas Taleb

Nassim Taleb introduces a concept beyond resilience. Antifragile systems don’t just survive chaos, they improve because of it. This fundamentally changes how you view volatility, uncertainty, and apparent disorder.

Wealthy readers absorb Taleb’s framework for building positions that benefit from market chaos rather than merely surviving it. Instead of fearing crashes, they structure investments to gain from volatility. This mindset shift separates professional investors from amateurs.

8. Fooled by Randomness by Nassim Nicholas Taleb

Taleb’s earlier work explores how humans mistake luck for skill and see patterns in pure noise. The book dissects survivorship bias, outcome bias, and the narrative fallacy that makes us invent coherent stories to explain random events.

This brutal honesty about the role of chance in success makes most readers uncomfortable. The wealthy value it because accurate self-assessment of skill versus luck improves capital allocation and prevents catastrophic overconfidence.

9. The Black Swan by Nassim Nicholas Taleb

Taleb’s most famous work examines rare, high-impact events that reshape markets and societies. He argues that standard risk models systematically underestimate tail risk, leaving institutions vulnerable to events their models declare impossible.

Successful investors use Black Swan thinking to avoid fatal mistakes and position for asymmetric opportunities. They accept that precise prediction is impossible and instead build portfolios that survive any outcome, even benefiting from unpredictable shocks.

10. The Outsiders by William Thorndike

William Thorndike profiles eight unconventional CEOs who massively outperformed the market through superior capital allocation. These executives focused relentlessly on per-share value creation rather than on revenue growth or operational excellence, which business schools celebrate.

Most people gravitate toward charismatic CEO biographies and motivational business stories. The wealthy study Thorndike’s book because it reveals the mathematical discipline behind exceptional long-term returns, showing that capital allocation matters more than visionary products.

Conclusion

The pattern becomes clear when you examine these ten books together. Wealthy people choose works that challenge assumptions rather than confirm biases. They embrace difficulty and complexity. They focus on timeless principles of psychology and strategy rather than tactical advice that becomes obsolete.

The middle class seeks “7 Steps to Success” formulas and motivational content. They want current bestsellers and quick results. The real difference isn’t the books themselves but how they’re approached. Wealthy individuals study these works repeatedly, extract principles, and apply them systematically to decisions. They treat reading as research, not entertainment. That distinction makes all the difference.