This is a Guest Post by Alex @MacroOps which was posted originally here: Lessons From A Trading Great: Ed Thorp and is reposted here with permission.

Ed Thorp, the father of quant investing, might be the most impressive market wizard. He turned seemingly random processes into predictable events, transforming the art of speculation into a science decades before Wall Street’s quants became mainstream.

His domination in the financial world began in the casino. Thorp figured out how to beat the most “unbeatable” games. In roulette, he created a wearable computer that gave him a 44% edge. And in blackjack, he developed the very first card counting system that’s still widely used today.

These gambling skills transferred perfectly to markets. Thorp’s first hedge fund, Princeton Newport Partners, never had a down year. It compounded money at 19.1% for almost 20 years — destroying the S&P 500.

His second fund, which he ran from August 1992 to September 2002, performed just as well with an annualized return of 18.2%.

Thorp’s list of discoveries, inventions, and people he’s influenced and invested in is comically long:

- He discovered an options pricing formula before the Black-Scholes model became public.

- He started the first ever quant hedge fund.

- He was the first to use convertible and statistical arbitrage.

- He was the first limited partner in Ken Griffin’s Citadel — one of the most successful hedge funds ever.

- His books on blackjack and trading heavily influenced “bond king” Bill Gross.

- He discovered that Bernie Madoff was a fraud many years before it became public.

And the list goes on…

Thorp’s advice on approaching games of incomplete information is methodical and scientific, making it very useful to incorporate into your own trading process. The following is his most valuable wisdom with our commentary attached:

Rare Events (Fat Pitches)

Fat pitches — the types of trades Buffett, Druck, and Soros salivate over- rarely happen. And that makes sense because is takes extraordinary circumstances to push markets far enough from equilibrium to create these opportunities.

When these dislocations occur, it pays to go on high alert. It’s possible to make your year or even your career in a few days by hitting these fat pitches on the nose.

Here are a few of Thorp’s best plays:

1987 Crash

Black Monday was a traumatizing experience for most traders… but not for Thorp. When the crash started to accelerate Thorp was having his daily lunch date with his wife Vivian. The office called to report the news and Thorp didn’t even flinch. He had already accounted for all possible market scenarios, including this one, and didn’t have any reason to panic. He calmly finished his lunch and then went home to think about how to exploit the situation. This is what he came up with:

After thinking hard about it overnight I concluded that massive feedback selling by the portfolio insurers was the likely cause of Monday’s price collapse. The next morning S&P futures were trading at 185 to 190 and the corresponding price to buy the S&P itself was 220. This price difference of 30 to 35 was previously unheard of, since arbitrageurs like us generally kept the two prices within a point or two of each other. But the institutions had sold massive amounts of futures, and the index itself didn’t fall nearly as far because the terrified arbitrageurs wouldn’t exploit the spread. Normally when futures were trading far enough below the index itself, the arbitrageurs sold short a basket of stocks that closely tracked the index and bought an offsetting position in the cheaper index futures. When the price of the futures and that of the basket of underlying stocks converged, as they do later when the futures contracts settle, the arbitrageur closes out the hedge and captures the original spread as a profit. But on Tuesday, October 20, 1987, many stocks were difficult or impossible to sell short. That was because of the uptick rule.

It specified that, with certain exceptions, short-sale transactions are allowed only at a price higher than the last previous different price (an “uptick”). This rule was supposed to prevent short sellers from deliberately driving down the price of a stock. Seeing an enormous profit potential from capturing the unprecedented spread between the futures and the index, I wanted to sell stocks short and buy index futures to capture the excess spread. The index was selling at 15 percent, or 30 points, over the futures. The potential profit in an arbitrage was 15 percent in a few days. But with prices collapsing, upticks were scarce. What to do?

I figured out a solution. I called our head trader, who as a minor general partner was highly compensated from his share of our fees, and gave him this order: Buy $5 million worth of index futures at whatever the current market price happened to be (about 190), and place orders to sell short at the market, with the index then trading at about 220, not $5 million worth of assorted stocks—which was the optimal amount to best hedge the futures—but $10 million. I chose twice as much stock as I wanted, guessing only about half would actually be shorted because of the scarcity of the required upticks, thus giving me the proper hedge. If substantially more or less stock was sold short, the hedge would not be as good but the 15 percent profit cushion gave us a wide band of protection against loss.

In the end we did get roughly half our shorts off for a near-optimal hedge. We had about $9 million worth of futures long and $10 million worth of stock short, locking in $1 million profit. If my trader hadn’t wasted so much of the market day refusing to act, we could have done several more rounds and reaped additional millions.

Kovner Oil Tanker

In the 1980s, Bruce Kovner discovered a trading opportunity in buying oil tankers for scrap value. Thorp instantly recognized the fat pitch and invested.

Along with Jerry Baesel, the finance professor from UCI who joined me at PNP, I spent an afternoon with Bruce in the 1980s in his Manhattan apartment discussing how he thought and how he got his edge in the markets. Kovner was and is a generalist, who sees connections before others do.

About this time he realized large oil tankers were in such oversupply that the older ones were selling for little more than scrap value. Kovner formed a partnership to buy one. I was one of the limited partners. Here was an interesting option. We were largely protected against loss because we could always sell the tanker for scrap, recovering most of our investment; but we had a substantial upside: Historically, the demand for tankers had fluctuated widely and so had their price. Within a few years, our refurbished 475,000-ton monster, the Empress Des Mers, was profitably plying the world’s sea-lanes stuffed with oil. I liked to think of my part ownership as a twenty-foot section just forward of the bridge. Later the partnership negotiated to purchase what was then the largest ship ever built, the 650,000-ton Seawise Giant. Unfortunately for the sellers, while we were in escrow their ship unwisely ventured near Kharg Island in the Persian Gulf, where it was bombed by Iraqi aircraft, caught fire, and sank. The Empress Des Mers operated profitably into the twenty-first century, when the saga finally ended. Having generated a return on investment of 30 percent annualized, she was sold for scrap in 2004, fetching almost $23 million, far more than her purchase price of $6 million.

Sometimes the best trades aren’t on public exchanges. Looking outside traditional trading vehicles can reveal huge opportunities other traders pass up.

SPACs

An unusual opportunity to buy assets at a discount arose during the financial crash of 2008–09, in the form of certain closed-end funds called SPACs. These “special purpose acquisition corporations” were marketed during the preceding boom in private equity investing. Escrowing the proceeds from the initial public offering (IPO) of the SPAC, the managers promised to invest in a specified type of start-up company. SPACs had a dismal record by the time of the crash, their investments in actual companies losing, on average, 78 percent. When formed, a typical SPAC agreed to invest the money within two years, with investors having the choice—prior to the SPAC buying into companies—of getting back their money plus interest instead of participating.

By December 2008, panic had driven even those SPACs that still owned only US Treasuries to a discount to NAV. These SPACs had from two years to just a few remaining months either to invest or to liquidate and, before investing, offer investors a chance to cash out at NAV. In some cases we could even buy SPACs holding US Treasuries at annualized rates of return to us of 10 to 12 percent, cashing out in a few months. This was at a time when short-term rates on US Treasuries had fallen to approximately zero!

Runaway Inflation

Short-term US Treasury bill returns went into double-digit territory, yielding almost 15 percent in 1981. The interest on fixed-rate home mortgages peaked at more than 18 percent per year. Inflation was not far behind. These unprecedented price moves gave us new ways to profit. One of these was in the gold futures markets.

At one point, gold, for delivery two months in the future, was trading at $400 an ounce and gold futures fourteen months out were trading for $500 an ounce. Our trade was to buy the gold at $400 and sell it at $500. If, in two months, the gold we paid $400 for was delivered to us, we could store it for a nominal cost for a year, then deliver it for $500, gaining 25 percent in twelve months.

Notice the commonalities between Thorp’s fat pitches:

- They’re rare and typically occur during crises. Crises create large dislocations that cause investors to act irrationally, creating huge opportunities.

- They all have asymmetric risk/reward ratios.

- Fast action was needed to capture each of them. Fat pitches don’t last long. Other traders will eventually find them and pounce.

- They’re all “one of a kind” opportunities. The exact scenario had never happened before and creative thinking was needed to capitalize. Although history rhymes, it does not repeat. The next fat pitch won’t be exactly like the last one.

Gambling As Training

Understanding gambling games like blackjack and some of the others is one of the best possible training grounds for getting into the investment world. You learn how to manage money, you learn how to compute odds, you learn how to reason what to do when you have an advantage.

Gambling is investing simplified. Both can be analyzed using mathematics, statistics, and computers. Each requires money management, choosing the proper balance between risk and return. Betting too much, even though each individual bet is in your favor, can be ruinous.

Notice how Thorp didn’t say anything about MBAs, economic degrees, or finance classes. Those don’t prepare you for the core challenges you’ll face as a trader like position sizing and risk management.

Our favorite cross-training exercise at Macro Ops is poker. Poker forces you to think in terms of probabilistic outcomes while managing your risk and establishing an edge.

Edge

You can’t succeed in trading without an edge. And a good way to find that edge is by asking yourself how the market is inefficient and how you can exploit it.

In A Man For All Markets Thorp details sources of inefficiency:

In our odyssey through the real world of investing, we have seen an inefficient market that some of us can beat where:

- Some information is instantly available to the minority that happen to be listening at the right time and place. Much information starts out known only to a limited number of people, then spreads to a wider group in stages. This spreading could take from minutes to months, depending on the situation. The first people to act on the information capture the gains. The others get nothing or lose. (Note: The use of early information by insiders can be either legal or illegal, depending on the type of information, how it is obtained, and how it’s used.)

- Each of us is financially rational only in a limited way. We vary from those who are almost totally irrational to some who strive to be financially rational in nearly all their actions. In real markets the rationality of the participants is limited.

- Participants typically have only some of the relevant information for determining the fair price of a security. For each situation, both the time to process the information and the ability to analyze it generally vary widely.

- The buy and sell orders that come in response to an item of information sometimes arrive in a flood within a few seconds, causing the price to gap or nearly gap to a new level. More often, however, the reaction to news is spread out over minutes, hours, days, or months, as the academic literature documents.

He then explains how to exploit these inefficiencies (emphasis mine):

- Get good information early. How do you know if your information is good enough or early enough? If you are not sure, then it probably isn’t.

- Be a disciplined rational investor. Follow logic and analysis rather than sales pitches, whims, or emotion. Assume you may have an edge only when you can make a rational affirmative case that withstands your attempts to tear it down. Don’t gamble unless you are highly confident you have the edge. As Buffett says, “Only swing at the fat pitches.”

- Find a superior method of analysis. Ones that you have seen pay off for me include statistical arbitrage, convertible hedging, the Black-Scholes formula, and card counting at blackjack. Other winning strategies include superior security analysis by the gifted few and the methods of the better hedge funds.

- When securities are known to be mispriced and people take advantage of this, their trading tends to eliminate the mispricing. This means the earliest traders gain the most and their continued trading tends to reduce or eliminate the mispricing. When you have identified an opportunity, invest ahead of the crowd.

Pay special attention to his second point: Don’t trade unless you’re sure you have an edge that’ll create better than random outcomes.

An easy way to do this is by backtesting or paper trading your strategy before investing in it.

It’s also a good idea to try finding a solid trading edge in markets you love. As Thorp explains:

To beat the market, focus on investments well within your knowledge and ability to evaluate, your “circle of competence.”

If you love following small companies then just trade those. If you come from an energy background then focus on crude oil and natural gas. And if you like math and volatility, options are a good place to start. Only venture into a new market after spending a significant amount of time studying it!

Efficient Markets

Anyone who’s actually traded knows the Efficient Market Hypothesis is bogus. It’s a poor mental model used by lazy academics. Thorp has a much better take:

When people talk about efficient markets they think it’s a property of the market. But I think that’s not the way to look at it. The market is a process that goes on. And we have, depending on who we are, different degrees of knowledge about different parts of that process.

. . . market inefficiency depends on the observer’s knowledge. Most market participants have no demonstrable advantage. For them, just as the cards in blackjack or the numbers at roulette seem to appear at random, the market appears to be completely efficient.

Markets aren’t actually random. They only appear random to those without expertise. The right knowledge transforms the market from a sequence of random numbers into a predictable process.

Combining Technicals With Fundamentals

In the mid 2000s Thorp developed a trend following futures strategy. During the process he discovered that combining fundamental information with technical signals was superior to just technicals alone.

Here he is in Hedge Fund Market Wizards:

The fundamental factors we took into account varied with the market sector. In metal and agricultural markets, the spread structure—whether a market is in backwardation or contango—can be important, as can the amount in storage relative to storage capacity. In markets like currencies, however, those types of factors are irrelevant.

Combining technicals with fundamentals can boost your win rate. Find the key fundamental drivers in your market and add them into your process.

Anchoring

In A Man For All Markets Thorp describes his first ever trade buying a company called Electric Autolite. In the subsequent two years the stock declined 50%. He decided to hold out, hoping it would return to his entry point so he could break even. The stock eventually did rebound and Thorp got out for a scratch, but he later realized how stupid that was. Here’s Thorp reflecting on it:

What I had done was focus on a price that was of unique historical significance to me, only me, namely, my purchase price.

Thorp’s early mistake is called anchoring. Humans tend to place special significance on price levels they originally entered at. But in reality, these prices have little significance. Don’t ever emotionally attach yourself to any price.

Interpreting Financial Headlines

It’s important to take news headlines with a grain of salt. Journalists build narratives behind every market move because it’s their job. Thorp warns about getting caught up in the noise:

Routine financial reporting also fools investors. “Stocks Slump on Earnings Concern” cried a New York Times Business Day headline. The article continued, “Stock prices fell as investors continued to be concerned about third-quarter results.” A slump? Let’s see. “The Dow Jones Industrial Average (DJIA) declined 2.96 points, to 10,628.36.” That’s 0.03 percent, compared with a typical daily change of about 1 percent. Based on the historical behavior of changes in the DJIA, a percentage change greater than this happens more than 97 percent of the time. The Dow is likely to be this close to even on fewer than eight days a year, hardly evidence of investor concern.

One way to separate signal from noise is to track the market’s expected move for the day. To calculate the expected percentage move of the S&P 500, take the VIX and divide it by the the square root of 252. If price stays within that band, any “news” for the day is likely not worth paying attention to.

Correlation

All the trading greats stress the importance of correlation. A low correlation among positions diversifies the portfolio and creates a much better risk/reward profile.

Here’s Thorp from HFMW:

We tracked a correlation matrix that was used to reduce exposures in correlated markets. If two markets were highly correlated, and the technical system went long one and short the other, that was great. But if it wanted to go long both or short both, we would take a smaller position in each.

A common problem traders face when monitoring correlation is the lookback period. Thorp found that 60 days was best. A shorter window is too noisy and a longer one will produce correlations that aren’t relevant anymore.

The Moore Research Center has a free to use correlation matrix for all major macro markets. Check it here.

Leverage

Use leverage incorrectly and you’ll blow up. But properly harness it and you can engineer a risk to reward ratio that perfectly suits you.

Heres Thorp:

The lesson of leverage is this: Assume that the worst imaginable outcome will occur and ask whether you can tolerate it. If the answer is no, then reduce your borrowing.

Don’t rely on a risk control model that uses probability to estimate your max loss. Always assume the absolute worst case and manage from there.

Position Sizing

Thorp popularized the position sizing formula called the Kelly Criterion. Here he is from Hedge Fund Market Wizards:

The Kelly criterion is the bet size that will produce the greatest expected growth rate in the long term. If you can calculate the probability of winning on each bet or trade and the ratio of the average win to average loss, then the Kelly criterion will give you the optimal fraction to bet so that your long-term growth rate is maximized.

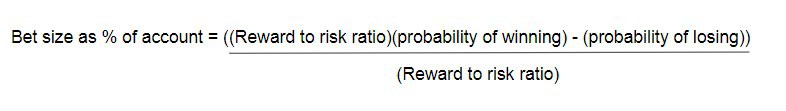

Here’s the version of the formula that works best for trading:

So for example, if a trade has a 1:1 reward to risk ratio, with a 60% chance of winning, you would bet:

((1)(.6)-(.4))/1 = .2 or 20% of your account

The one issue with Kelly sizing is that we’ll never know our true win rate or reward to risk ratio in markets. The best we can do is estimate.

Also, the effectiveness of a trading edge changes over time. Because markets evolve, the same edge won’t work forever.

This is why Thorp only uses the Kelly number as a reference. In practice it’s better to bet around half-Kelly because you get about three-quarters of the return with half the volatility.

If you’re less certain of your edge, you should bet an even smaller amount. When Thorp was working on his trend following model in the mid 2000s, he was simulating 1/10 of the Kelly number.

Thorp also has advice on drawdowns. He suggests lowering your position size during rough patches and then ramping up again as you come out of them.

If we lost 5 percent, we would shrink our positions. If we lost another few percent, we would shrink our positions more. The program would therefore gradually shut itself down, as we got deeper in the hole, and then it had to earn its way out. We would wait for a threshold point between a 5 percent and 10 percent drawdown before beginning to reduce our positions, and then we would incrementally reduce our position with each additional 1 percent drawdown.

For more posts and information about Alex you can follow him on twitter at @MacroOps and you can check out his website Macro-Ops.com.