This is a Guest Post by Jayce Bryson, he spent the first 10 years of his career as a credit analyst and then portfolio manager for a super-regional bank where he managed a half billion dollar senior loan portfolio. He started Signalee to show new traders how to take advantage of volatility to consistently grind out profits in the stock market.

The Truth About Selling Covered Calls

Generate EXTRA INCOME EVERY MONTH by selling COVERED CALL OPTIONS on your blue chip dividend stocks!

The above is the usual teaser to try to get people who generally don’t know much about trading, let alone options, to try their hand at writing covered calls. It’s often touted as low-risk and an easy way to boost income. It’s less risky than many options strategies but it violates the basic risk:reward rules that a trader lives or dies by.

Actual Performance vs Hype

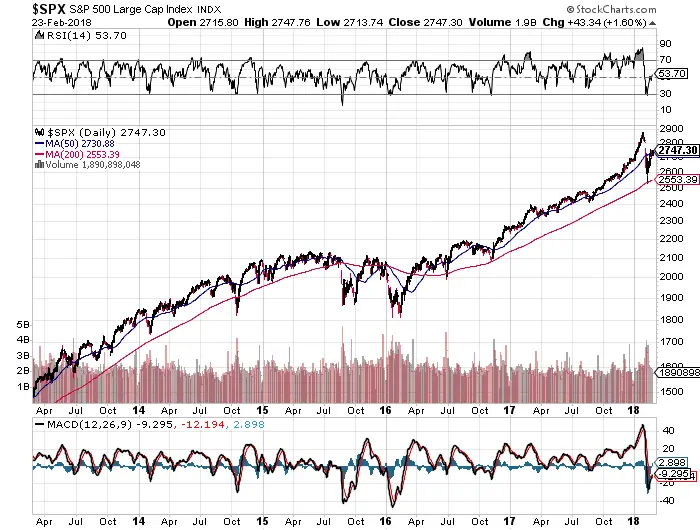

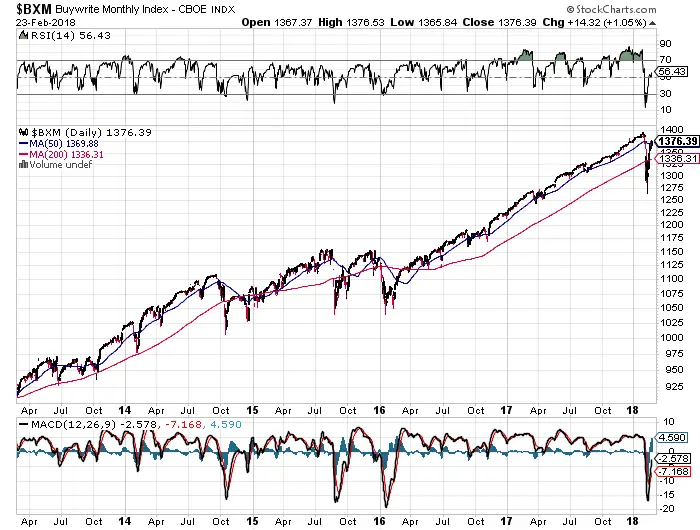

The performance of a covered call strategy on the S&P 500 is tracked via the CBOE’s Buy-Write Index. The index is a passive total return index based on buying an S&P 500 stock index portfolio and writing a near-term option each month.

During the past 5 years the S&P 500 covered call strategy as tracked by the CBOE’s Buy-Write Index has generated a 49% total return. The S&P 500 returned 81% during the same time period. The reason: the S&P 500 experienced a strong bull market during the past 5 years and bull markets are when covered call strategies fall behind when call options are written blindly.

When to Sell a Covered Call

Selling a covered call blindly like the CBOE’s Buy-Write Index locks an investor out of bull markets. If the price of the ETF has dropped it makes no sense to sell a covered call because it effectively forces the investor to sell low.

A successful covered call strategy will mimic https://signalee.com core position trading: it will systematically lighten up the position at peaks and repurchase shares on pullbacks. The key is to understand the behavior of a trending market:

- Trending bull markets grind upwards slowly but drop quickly.

- During the slow grind upwards the bull market will stretch a little too far from a long-term moving average, which will lead to a temporary pullback that allows price to consolidate.

A successful covered call strategy waits until the market has stretched, sells a covered call, and then buys back the call when the market inevitably pulls back.

$EEM chart is an example. Settings: 50-day Bollinger Bands, SMA200 and SMA20:

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

There are a lot of ways to measure when a market has stretched from a long-term moving average. An investor can use Bollinger bands, RSI, or can simply eyeball a chart.

If you want specific trade rules for a high-probability covered call trade entry: wait until price touches the upper 50-day Bollinger Band. On the first day that the daily price range doesn’t touch the upper Bollinger Band, but is still above the 20-day simple moving average, sell an at-the-money call with an expiration date of one month or less. Repurchase the covered call when price tags the 20-day simple moving average. If price hasn’t tagged the 20SMA by expiration, let yourself be assigned and then repurchase the shares (if it’s a long-term holding) when price reverts to the 20SMA.

Technical analysis may be voodoo to a buy & hold investor but it provides a useful guidepost for a covered call strategy. While this approach isn’t guaranteed to overcome the returns of a simple buy and hold strategy over the long-term (people are buying the premium for a reason after all), it will at least boost current income in the short-term.

There are many ways to make money in the market and just as many ways to lose it all. If you’re interested in how to grind out profitable trades using https://signalee.com core position trading, then you may be interested in following along as https://signalee.com takes a $1,000 account up to $1 million.