A short squeeze is when a big rally to the upside happens during a downtrend in a market due to a lack of sellers at lower prices combined with the pressure on current short sellers to be forced to buy to cover due to the reversal in the market trend creating upside price pressure.

Short squeezes gain momentum as more and more short sellers are forced to buy to cover their positions at higher and higher prices resulting in increased trading volume on the reversal out of the downtrend. The pressure on the short sellers to buy back their positions can be amplified by margin calls, trailing stops, and stop losses being triggered. The short sellers create buying pressure because they have to buy back the shares or contracts they are short to cover at some point.

A short squeeze is more likely to happen and can be more powerful in stocks with small market capitalization and small floats and also in thinly traded futures markets with low volume. Short squeezes have a higher probability to happen when a large amount of a stock’s float is short, a market has an extremely high percentage of bearish sentiment, or sellers simply are exhausted after a long downtrend and find prices with no sellers left. When a market reaches maximum bearish sentiment at a price level where people prefer to hold their positions instead of sell then a short squeeze is set up to get underway.

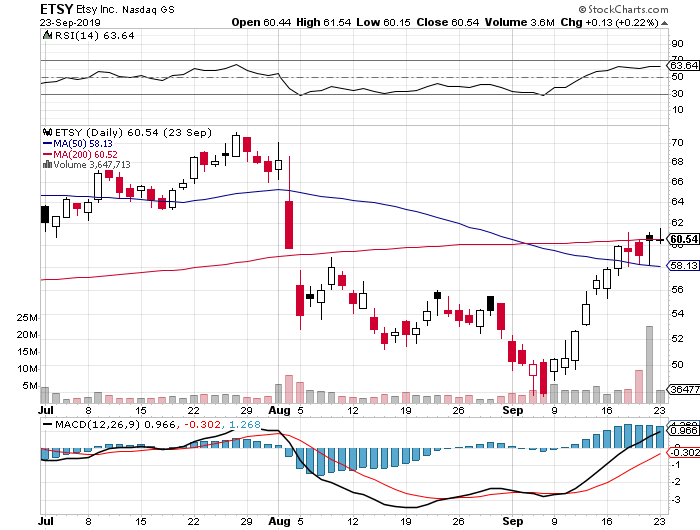

Chart courtesy of StockCharts.com