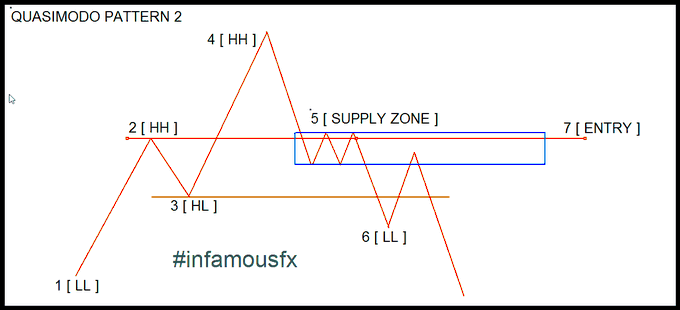

The Quasimodo chart pattern is a lesser known bearish chart formation in technical analysis. It has also been called the Over and Under chart pattern. This pattern can identify a high probability confluence area on a chart at a resistance zone that can lead to a reversal in an upswing. It is a signaling pattern that can confirm a trader’s bearish bias.

Quasimodo Pattern | Advanced Price Action Trading Concept 2020 | HoneyPips #forex #forexsignals #forextrading #forexstrategy #forextrader #ForexMarket #forexmentor https://t.co/kNVcVSZPQG

— Md. Alamgir Hossin (@techlover1952) July 21, 2020

The Quasimodo chart pattern is similar to the head and shoulders chart pattern but does not hold the support on the second test after the maximum peak or ‘head’ is formed. It is a type of malformed head and shoulders patterns which is where its name comes from the hunchback character Quasimodo. It is a bearish reversal pattern signaling the end of a failed uptrend when the last rally fails at the same resistance zone as the first left ‘shoulder’. Shorting at this level present the best risk/reward ratio with a tight stop loss on a break and close above that previous resistance.

How are the Head and Shoulders, broken base and Quasimodo patterns different?”

The Quasimodo pattern has a broken base and the lower drawdown entries.

The Quasimodo pattern has a higher probability of success when other reversal signals have a confluence to the return to the first resistance level price or left shoulder aligns with an overbought reading or there is a bearish divergence between technical oscillators and a higher high in price action. For example, if the return to resistance aligns with a 70 RSI or price is higher but the RSI is lower that can be a confirmation of this pattern.

Swing traders can identify supply and demand zones using this pattern for buying dips near previous support areas and selling into previous resistance zones. This pattern can be used to identify good risk/reward ratios near previous areas of support and resistance.

The Quasimodo pattern is rare but can be a powerful way to identify important areas where buyers and sellers are located when it appears on a chart.

Like all chart patterns, the Quasimodo pattern is best used to create good risk/reward ratios and not predicting the future. A stop loss and trailing stop are good tools for managing the risk of being wrong. This pattern just creates probabilities, not certainties and trade management is what creates profitability over the long term.

never gets any easier we stay learning to master the craft #QML #QuasimodoPattern pic.twitter.com/itVnfIuuDr

— Sbo Dhlamini (@Sbo_Dhlamini) November 19, 2019