What is Risk Management?

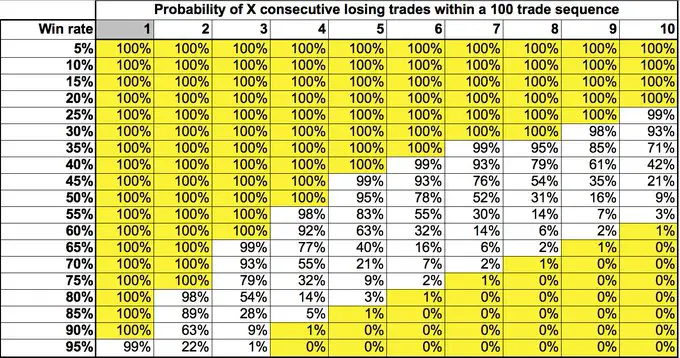

Risk management is used in all industries to mitigate the probabilities of the loss of assets. Risk management identifies, evaluatates, and prioritizes the frequency and magnitude of the potential probabilities of risk events. Risk management implements cost effective processes to use available resources to measure, minimize, and limit the impact and damage of both common […]

What is Risk Management? Read More »