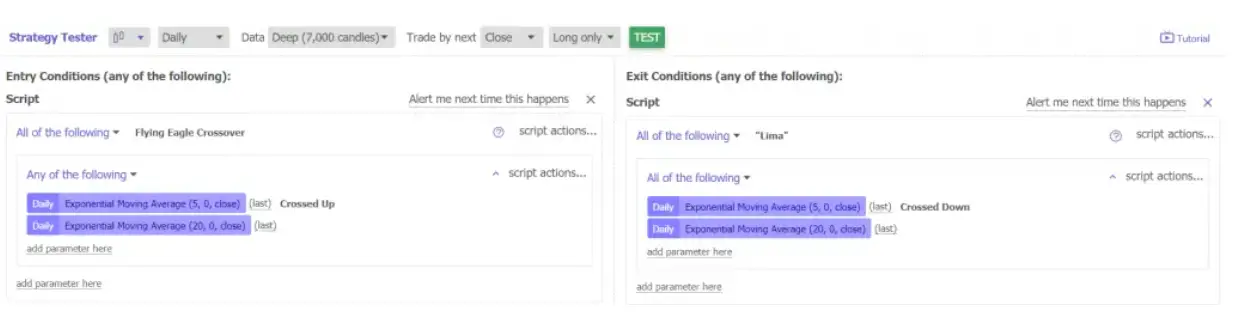

Exponential moving average crossover signals are one way to capture trends on a chart by entering a long trade when a shorter term moving average crosses over a longer term one, then exiting as the shorter term moving average crosses back under the longer term one. The inverse of this are moving average cross under systems as a way to capture downtrends by selling a position short when a shorter term moving average crosses under a longer term one, then buying to cover the short position as the shorter term moving average crosses back over the longer term one.

Exponential moving averages adjust faster to changing price action than simple moving averages as an EMA will give more weight to newer prices than older prices and adjust faster than an SMA.

Moving average crossover signals are a way to trade based on price trends instead of personal opinions or fundamentals. These types of reactive technical signals can keep you in a trade longer than a single moving average alone by filtering for much of the volatility. A moving average crossover signal will give less signals than one moving average signal alone.

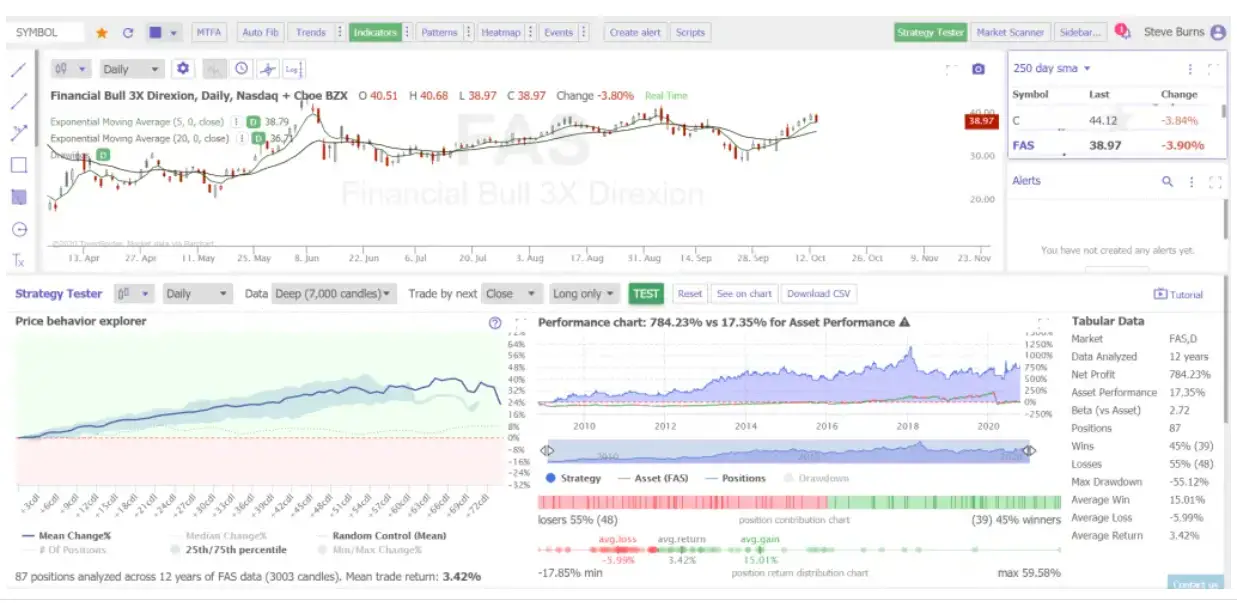

Moving average crossover signals can be back tested for results in different types of market environments using web-based software.

Many times in trading literature you will hear a the short and long term moving averages used in a crossover referred to as fast and slow moving averages. ‘Slow’ refers to long term moving average and ‘fast’ refers to the short term moving average.

Here are some of the moving average crossovers that have backtested the best as profitable mechanical trading signals. Each trader can choose the ones to test that are right for your time frame and market. It is important to backtest crossover signals on your own watchlist of stocks before trading them live in real time.

5-day EMA / 20-day EMA

5-day EMA / 30-day EMA

10-day EMA / 30-day EMA

10-day EMA / 50-day EMA

10-day EMA/ 100-day EMA

10-day EMA / 200-day EMA

20-day EMA / 200-day EMA

50-day SMA / 200-day SMA

These are great signals to start with for backtesting on your own watchlist of stocks and choice of time frame for swing trading or trend trading. There is no magic or predictive ability in backtesting exponential moving average crossover signals they simply make money by capturing trends, risking open profits for bigger wins, and keeping losses small.

If you want to learn more about using moving averages in your trading here are my educational resources:

Here are my three moving average books:

Moving Averages 101: Incredible Signals That Can Make you Money https://amzn.to/3jYuC2A

Here are my three moving average eCourses: