The morning star candlestick pattern is created by three candlesticks that show a bullish reversal from the lows in price. Morning star patterns generally form in price during a downtrend on a chart. It is a signal for a high probability that a low is in and that price is likely to begin to swing higher. It is a reversal pattern that indicates that a chart could be going from a downswing to an upswing in price.

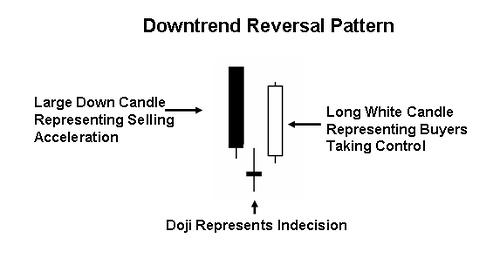

It’s three candle formation consists of a bearish down candle, a small reversal candle off the lows, and finally a bullish candle that opens higher than the middle low candle and closes near its highs of the day.

Morning star patterns have more meaning when they happen near previous key price support levels, important moving averages, or oversold technical readings on a chart.

The morning doji star candlestick pattern refers to a morning star pattern that has a doji as its middle candle in the three-candle pattern. However a morning star can have either a small candle or a doji as its middle candle.

The opposite of a bullish morning star is a bearish evening star that signals the reversal of an uptrend in price.