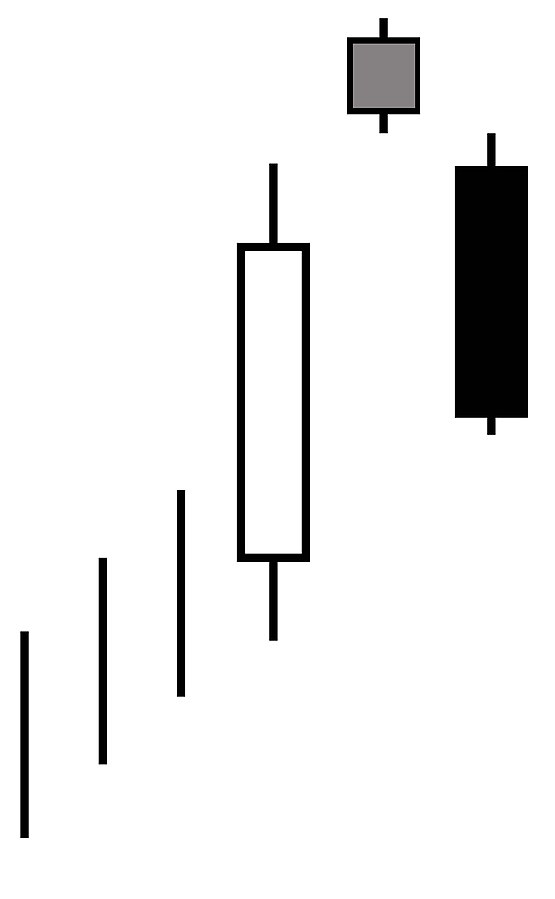

An Evening Star is a group of candlesticks that create a chart pattern used in technical analysis to signal a high probability that a current uptrend in price could reverse. This is a bearish candlestick pattern created by three candles in a row consisting of a large white/green candlestick, a small candle that is usually black/red, and then a red/black candlestick.

The Evening Star candlestick chart pattern is a valid technical indicator that a future decline in price is a high probability. It takes three full days of opens and closes through three days to fully form.

- Day one: Large bullish candlestick.

- Day two: Small candlestick that can be bullish or bearish and higher than the previous day.

- Day three: Large bearish candle that opens at a price lower than the previous day’s candle and then closes near the middle of the first day’s candle price range.

- The Evening Star pattern has the most meaning after a strong uptrend and can signal the market is topping out.

- An Evening Star candlestick chart pattern is used by technical analysts to signal the timing for a short selling position entry or warning it is time to lock in long position profits.

- The Evening Star is not a common pattern but can be a meaningful signal showing a failure to find buyers at higher price levels.

To increase the odds of success of this pattern, traders can use other indicators like overbought/oversold price oscillators, moving averages, and trendlines to confirm a confluence for more meaning in the full chart context. An Evening Star pattern formed at an overbought RSI level, a key long-term moving average overhead, or at a upper channel trendline has a higher probability of marking a chart top.

Vistula / CC0

The inverse chart pattern of the Evening Star is the Morning Star, that is viewed as a bullish reversal near a chart bottom.