Trend following is the process of using reactive technical analysis to take trades in the direction of the primary chart trend and let them run as far as they will go with a trailing stop. Traditional trend following was developed and used for the futures markets like commodities, currencies, index futures, and others but it can also be used by stock traders. Futures contracts supercharge trend following systems with leverage, but a stock trend trader can use high beta growth stocks, speculative names, and IPOs to capture the trends in the highest alpha stocks with the strongest sustained moves.

Time frame: The time frame for trend traders in stocks can be as little as a few days if they are stopped out but they can also let winners run for many months in some cases. The time frames for trend traders can be in increments of 10 days, 20 days, 30 days, 50 days, or more.

As an example, a trend trader can use pure price action to buy a new 10-day breakout of a price range and then use a trailing stop as a breakdown below a new 10-day low in price. This formula will maximize any trend in the 10-day range of prices.

Trend Trading Strategies

Here is an example of using a 10-day high breakout entry strategy with a 10-day breakdown exit strategy on the ARES chart. It uses a rolling 10-day range that resets the high and low of the range with each new day. This is a profitable strategy on a chart that holds ranges and trends higher.

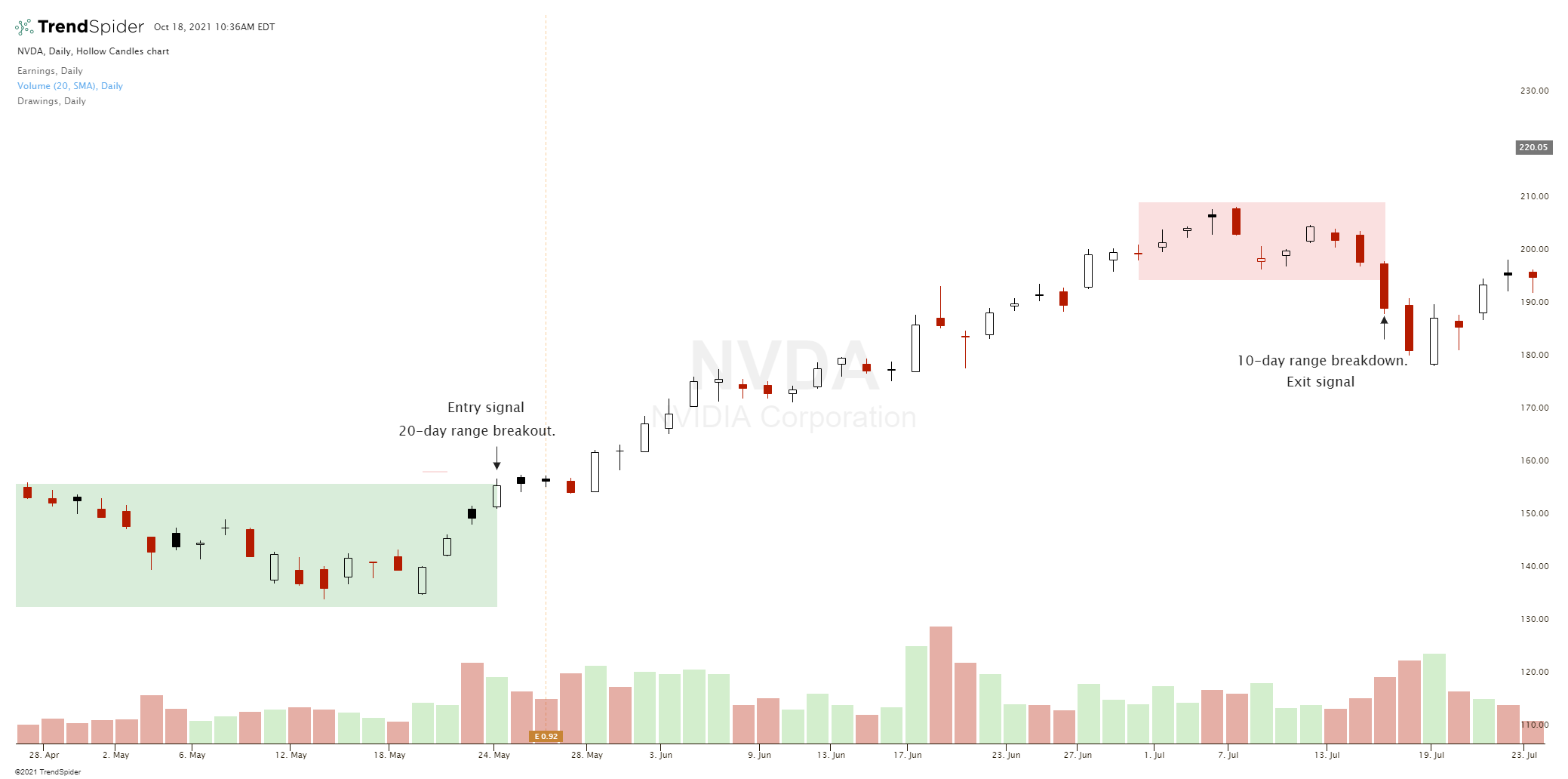

Another example would be to buy a breakout of a 20-day range of prices and then exit when a new 10-day low is made after a breakdown in price.

Here is an example of a trend trade on the NVDA chart using the 20-day range breakout higher as an entry signal and the 10-day breakdown out of a range as an exit signal.

These types of trend trades can last for months creating big wins during larger trends and smaller losses when a trend does not evolve trend trader does nothing during price bases and ranges if their trailing top loss is not triggered.

The above are some examples of trend following trading strategies but you can design your own system that caters to how the charts on your own watchlist move and set your signals for your own time frame, risk tolerance, and available screen time.

This is a sample from by book The Ultimate Guide to Stock Trading you can buy here on Amazon.