When implied volatility for options pricing is high it is usually the best risk/reward ratio to look at selling option premium with strategies like iron condors, credit spreads and short strangles. When implied volatility falls the price of options can drop quickly creating profits for short volatility option plays.

Should I buy options when volatility is high?

Long option plays are more difficult to profit from during high IV environments as their price is high and must move to a greater degree than the Vega pricing. During high implied volatility markets a long option buyer must have the price of the underlier move with enough magnitude and speed to overcome both the Vega and Theta priced into the contract by going deep enough in-the-money in intrinsic value before IV drops.

How do you make money from high implied volatility?

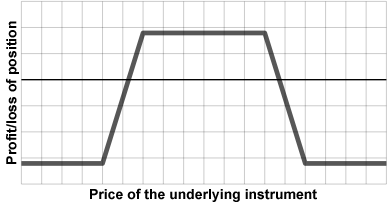

Iron Condor Strategy

An iron condor is an option play that is created with two vertical spreads. An Iron Condor is a combination of both a put option spread and a call option spread that have the same expiration date and four different strike prices.

A short iron condor is opened when an option trader sells both sides of the underlying stock or commodity by shorting the same number of calls and puts at the same time, then buying another option contract further out of the money of each position to hedge with the purchase of calls and puts.

This option play is named for the shape of the potential for profit and loss graph, which looks similar to a large bird with a body and extended wings like a condor. With this analogy option traders often call the closer options the body and the farther out options the wings. It is called iron to denote its strength in being profitable inside a set price range.

One edge of an iron condor play over a single vertical spread is the initial and maintenance margin needed for the open iron condor is often the same as the margin for one vertical spread as the risk can only go against one side at a time. However the iron condor offers the chance to profit from two net credit premiums of options instead of just one. This can create a larger return on capital at risk when the market is in a trading range.

An edge an iron condor has with commissions happens when the price of the underlier is trading inside the price range of the options inner strikes at expiration and a trader can let most or all of the options expire worthless with no need for further trading costs.

An option trader can also close a leg of the trade if price moves within range of going in-the-money on a short side of an option.

The danger for long iron condors is during market trends in one direction during the time of the option play causing a loss on the short options or if the options in the play become illiquid and difficult to exit without losing a large amount in the bid/ask spread. The parameters set when you open the trade can set your risk based on the worse case scenario of price reaching your hedges for the maximum loss. This play is most profitable when implied volatility is high but the market does not move consistently in one direction and just ends up back inside the original range when the option play was open.

The iron condor is a nondirectional option play because the maximum profits occur when there is no trend in price during the time that it is open.

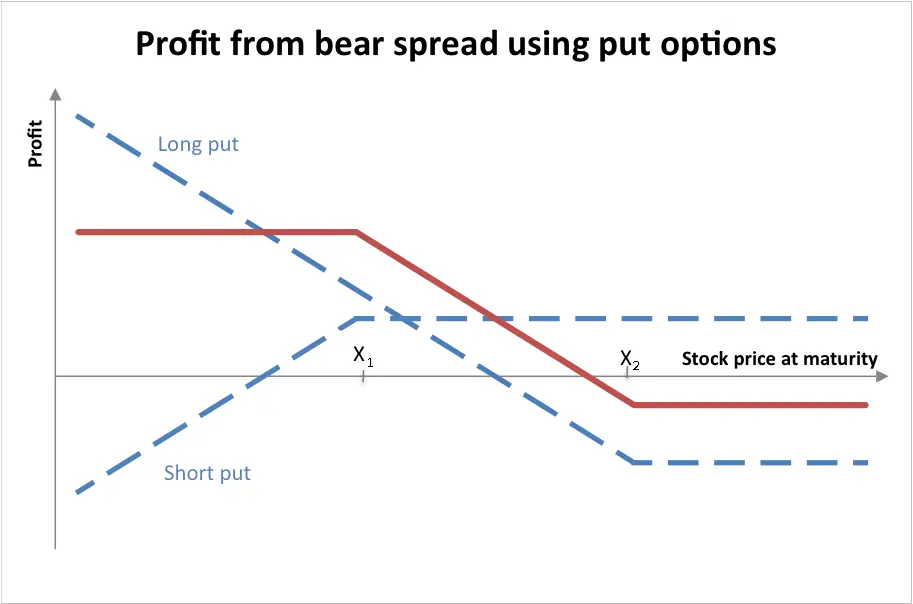

Credit Spread Strategy

In options trading a credit spread is an options play where a trader buys one option and sales another option contract of the same stock and expiration but at different strike price levels. This type of option play construction attempts to make a net profit when the price spread between the two different options gets closer together leading to a net profit from the difference in the short and long options.

Option traders get paid a net credit when they open this option play with the difference between the prices when both selling one option and buying another, they want to see the price spreads get smaller, converge, or simply both expire to keep the net profit in premium. While an option trader would need to pay a premium to open a debit spread they get paid to open a credit spread. A spread getting closer together or converging means that the short option in the play could even be close to being in-the-money at the expiration date but still at a less amount than the net premium paid when opened and the trade is profitable. This would be a smaller amount than the most that could be gained if both options in the credit spread expired worth nothing, as both expiring worthless would lock in the maximum credit for this option play.

Option brokers margin requirements for option credit spreads are much less than they are for uncovered short options with unlimited risk. A credit spread is an option play with the long option acting as a hedge for the short option. It is not possible for the account to lose more money than the margin that is required at the time the play is opened because the loss is capped.

A bullish credit spread refers to an option play where the premium value of the spread play decreases as the price of the underlying stock rises. A bullish credit spread is constructed with puts options.

A bearish credit spread refers to an option play where the premium value of the spread play decreases as the price of the underlying stock falls. A bearish credit spread is constructed with call options.

This option play is best suited for range bound markets and the profit from this option play comes from the variance in premium between the option contract bought and the option contract short. A credit spread becomes more profitable as the premium value of the option play declines in the option traders favor.

The maximum gain is equal to the net credit occurs if both options expire out-of-the-money.

The maximum loss is difference in strike prices minus the net credit that occurs if both the options expire in-the-money.

A credit spread has much less risk than a naked put or uncovered call in a volatile market because it has a hedge than limits the losses.

Short Straddle

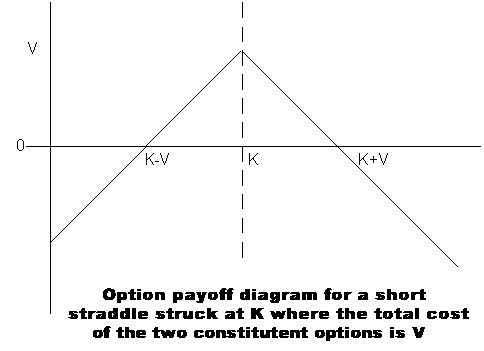

A short straddle is a non-directional option play when the trader sells a put option and a call option on the same underlier with the same strike price and expiration date. The potential profit is capped at the total option premium the option writer receives from the sale to open the transaction from the put and call price at the sale.

The risk of a short straddle play is theoretically unlimited as a large trend in the underlier price whether up or down will create a large loss. It loses if a price move causes one side of the short straddle play to go in-the-money and cost more to buy back than the total premium received when it was opened it will become unprofitable.

The most profit possible for a short straddle happens at expiration if the underlying asset trades at the same price as the strike of the straddle. If both the put and call sides of the straddle expire out-of-the-money and worthless the straddle achieves the maximum profit and the option trader profits from all the premium received when the play was opened.

The short straddle option play is nondirectional because the short straddle profits when there is no trend in price during the time the play is open. The short straddle can be considered as a credit spread because it is sold to open and results in a credit from the option premiums of both the put option and call option. A short straddle combines an at-the-money naked put and uncovered call to hedge each other with the premium received.

The risk for the option trader of a short straddle play is potentially unlimited due to having no hedges in place while being short both sides of the market with both a call and a put, of course a stop can be used to buy to close and stop losses if the market goes against one of your positions. While the win rate with the short straddle play can be high the risk/reward ratio is not good as the maximum profit is limited to the premium of the options received but a loss can be any size if the play is held during a strong trend. This is one of the best option plays for maximum two sided IV crush profits.

What is options IV crush?

Implied volatility or IV crush describe when an options Vega premium dropped dramatically out of its pricing. This usually happens after a major event has passed for the underlying stock or market for the option contract. The most common time to see IV crush in a stock option is after an earnings announcement for the underlying company. It can also happen in the market as a bear market suddenly reverts to an upswing in price action.

An IV crush happens because the Vega in the options pricing model tries to project the potential move after earnings or the risk of a large move into an option price. Option sellers have to be compensated for the uncertain risk of the potential future price action of a stock after earnings.

The at-the-money options in an option price chain reflects the implied move in a stock. If a stock is trading at $100 a share and the $100 strike call option and $100 strike put option (front month) are trading at $110 ($1100 for a 100 share contract) the day before the earnings announcement then a approximate $10 move in the stock is priced into Vega (excluding Theta). Implied volatility is directionally neutral so both calls and puts price in the Vega premium. The magnitude of a move is priced in but not the direction.

In the above example, if after earnings the stock opens up at $110 then the $100 strike call option will be priced at approximately $110 ($1100 for a 100 share contract excluding any Theta). In this example the Vega premium is priced out and has been replaced by intrinsic value as the at-the-money call option has gone $10 in-the-money after earnings.

It is difficult to make money buying options and holding through earnings as the implied volatility is priced in. To be profitable on a long options play the intrinsic value gained after earnings has to be enough to replace the lost Vega and you must get the direction correct. Many option traders prefer to sale option premium before earnings like short option straddles or short option strangles to profit from IV crush. With that type of short option play it is crucial to hedge the risk with long farther out-of-the-money options in case there is an outsized parabolic move beyond the parameters of the Vega pricing.

After an earnings announcement the implied volatility pricing curve for the Vega value of an options chain is crushed. These principles also apply to high implied volatility in the general stock market that is crushed when sentiment turns back to bullish and price moves back up quickly and fear subsides.

I created my Options 101 eCourse to give a new option trader a shortcut to a quick and easy way to learn how stock options work.

I also wrote a quick and easy book Options 101 for those interested.