Candlesticks are a type of chart that clearly represents the behavior of buyers and sellers through visual price action patterns. They are a very helpful type of chart that can be used for seeing patterns form on a chart and establish signals.

Here are three ways that candlestick charts can be used to quantify patterns that signal the path of least resistance.

Confirm the direction of your technical trading signal.

There are only two types of candlesticks, trending candle or non-trending candle. Candlesticks can be used to confirm another type of technical indicator signal like moving averages, RSI, or Bollinger Bands. If a technical indicator gives a bearish signal and the chart also has a bearish candle it can be a confirmation of the original signal and increase the odds of trading success.

In the below Alcoa (AA) chart a bearish candlestick confirms the 5 -day EMA / 20-day EMA cross under on the chart. There is also another bearish confirmation candle after the initial bearish candle.

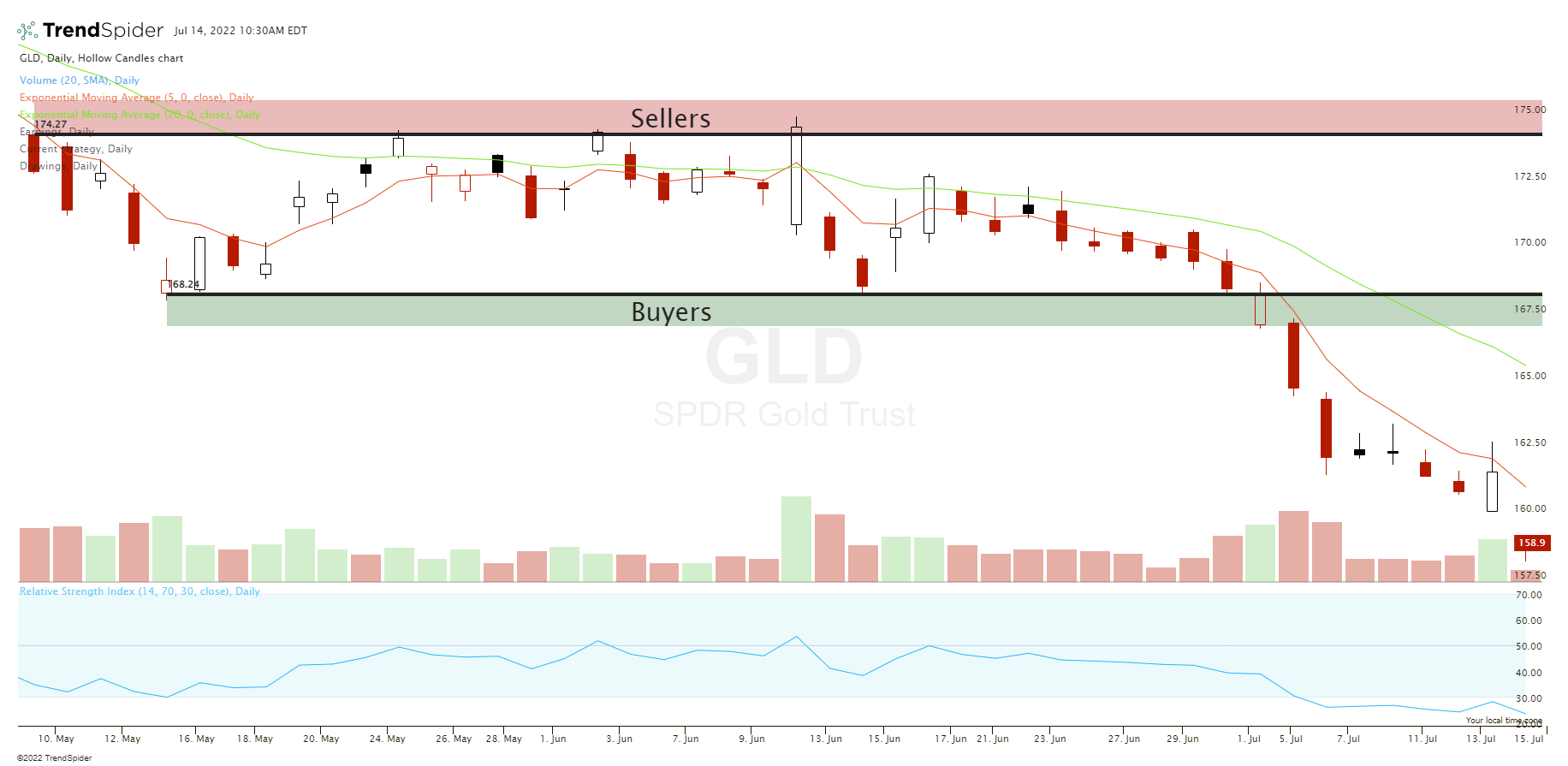

Quantify a trading range.

Candlestick charts can be used by connecting candlestick wicks and/or candle bodies to define support and resistance on a chart and quantify the current trading range. These will be the high probability zones for selling into overhead resistance or buying lower support. It is defined by two horizontal trend lines an upper and lower one.

Here is an example of connecting candlesticks to see the trading range on a chart.

Confirm the direction of the breakout of a range.

A candlestick can confirm the breakout of a trading range and signal a new direction for the chart to swing or trend in. This can also be a candle with the same sentiment like a bullish candle breaking out over resistance or a bearish candle breaking down below support. This breakout can occur with the body of the candle or just a wick.

In the below AGQ chart example the bearish candlestick wick breaks below long term support before the chart rolls over lower.

Candlesticks can be the most visually helpful type of charts to use in trading price action.

If you’re interested in trading the price action in the markets using candlesticks you can check out my best selling Ultimate Guide to Candlestick Patterns book here or my other trading books on Amazon here. I have also created trading eCourses on my NewTraderUniversity.com website here. My educational resources can save you both time and money in your trading journey.