Trading Lesson: Candlestick Formations

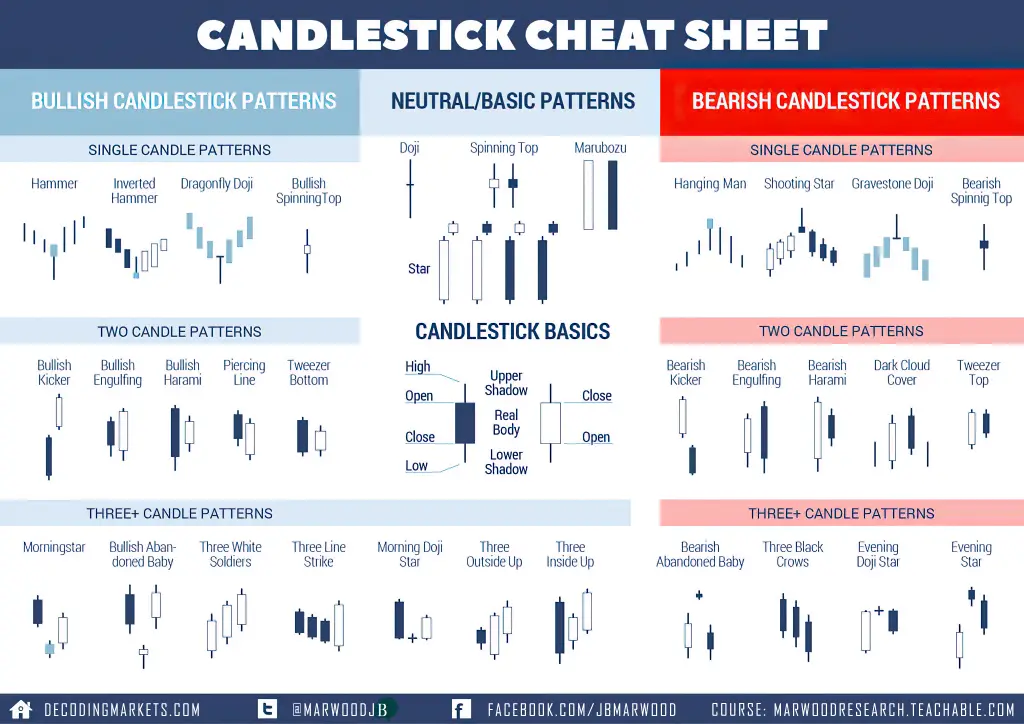

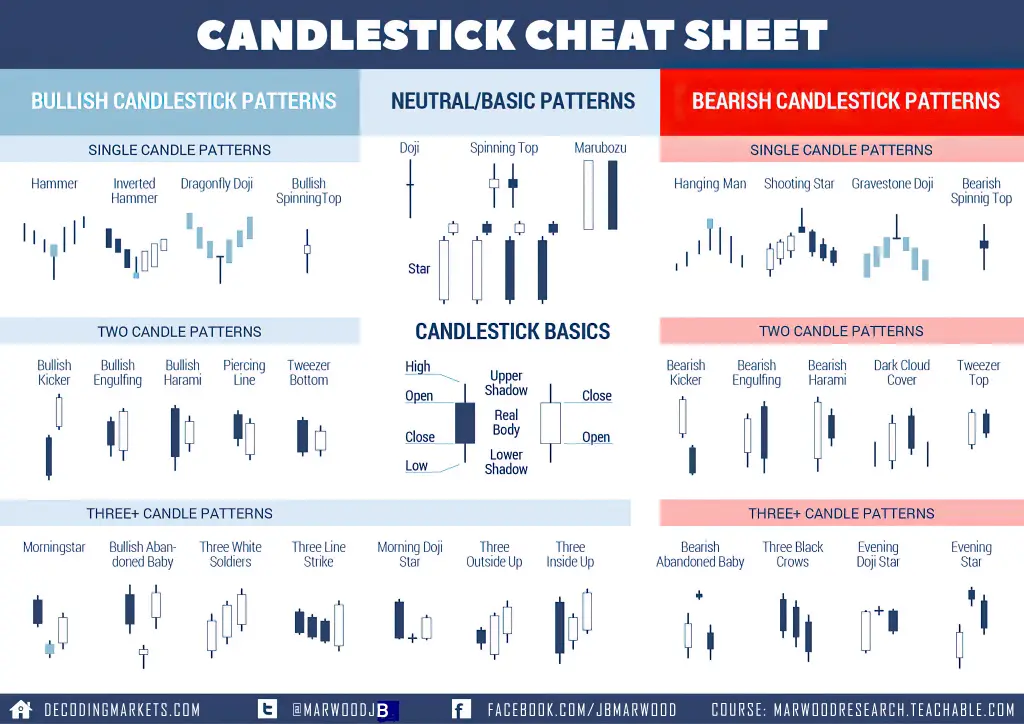

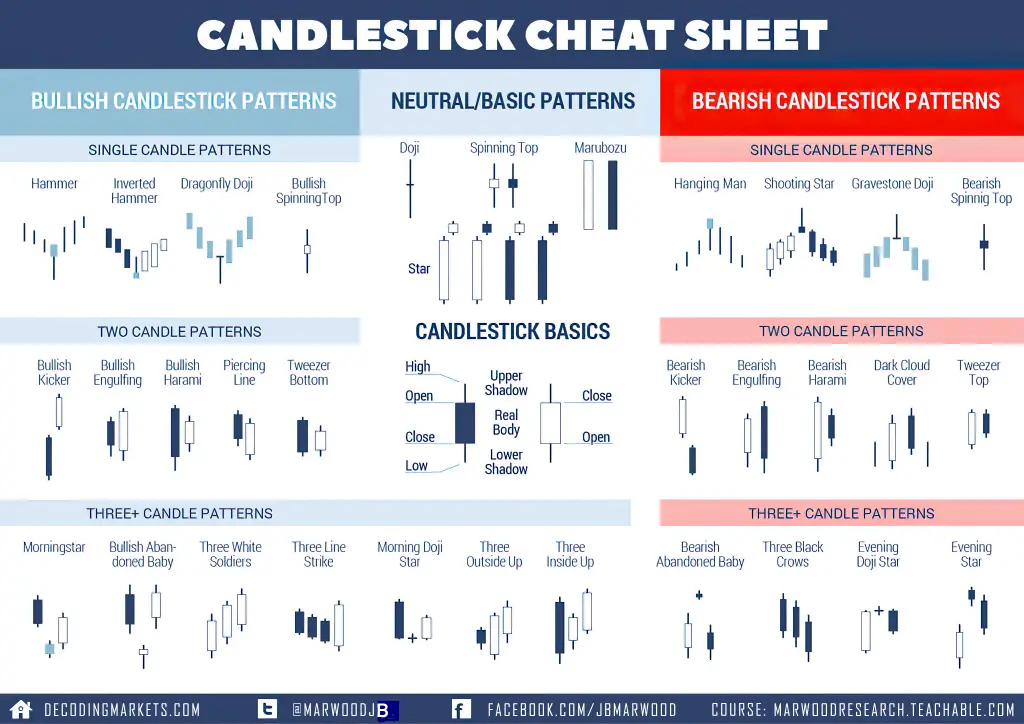

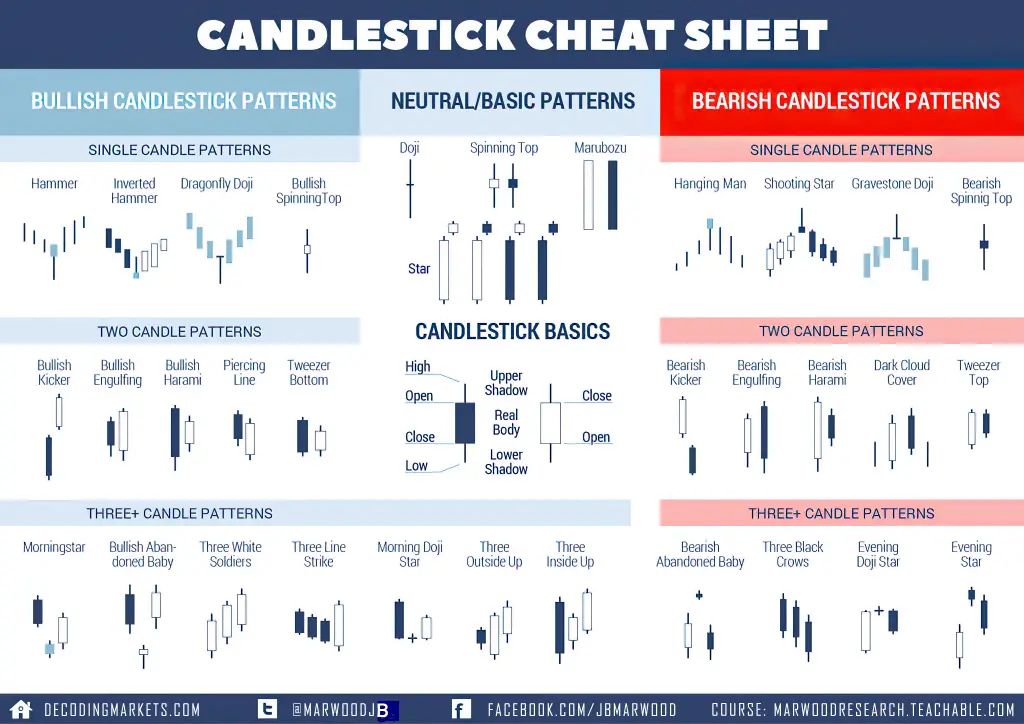

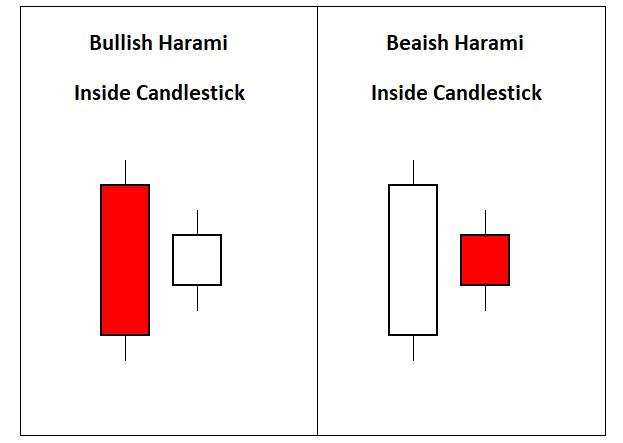

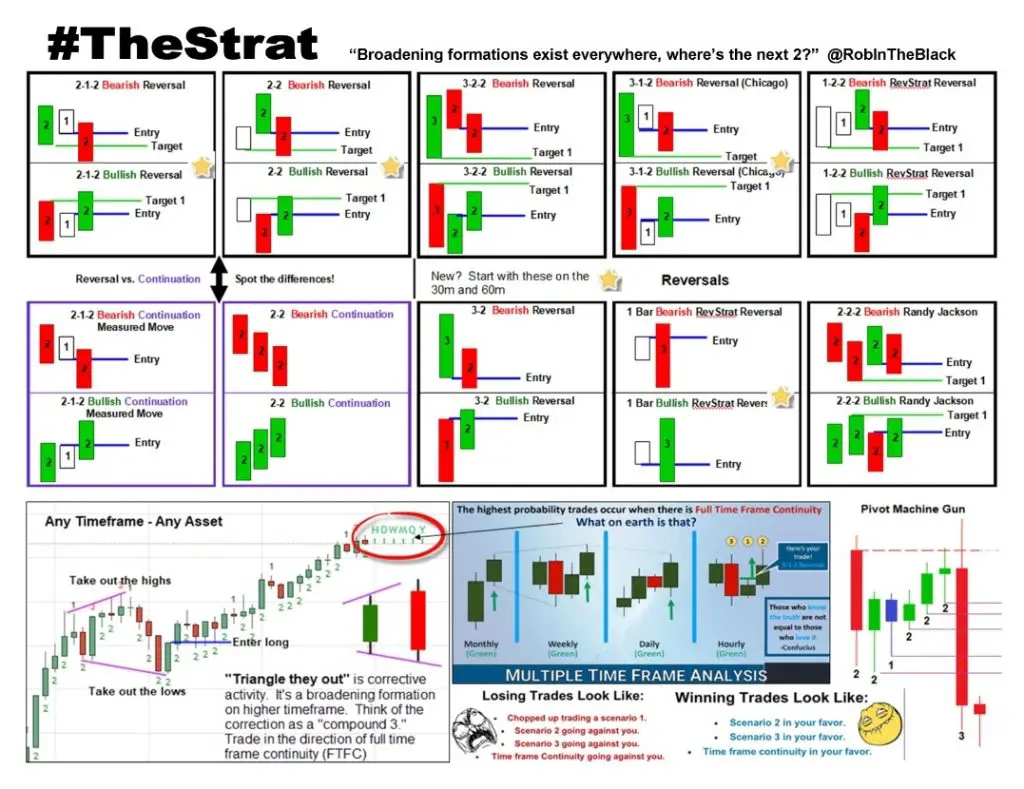

Candlestick charts are the most visual types of charts as they show the open, close, and intra-candle price action visually and with the full candle sentiment. All of the elements of the candlesticks have a technical meaning. The color of a candlestick reflects the sentiment on the chart for the candle period. Different Types of […]

Trading Lesson: Candlestick Formations Read More »