Moving averages are technical trading tools that can help identify trends on different time frames. They can replace opinions and predictions for making trading decisions by being used as signals. Moving averages can identify trends and swings in price action in real time also signal range bound markets when they go flat with no directional curve.

Moving Average Filter

Moving averages are technical trading tools for capturing trends in the stock market.

Moving averages are price action filters that can identify a trend by which side of a moving average price is trading on.

A vertical moving average can show that a chart is in a trend while a horizontal moving average can show that price action is going sideways in a trading range.

The slope of a moving average can visually show the magnitude of a trend direction.

Moving averages can act as key support or resistance levels in both trading ranges and trends.

Moving Average Indicator

A moving average is a line on a chart that represents the average of prices over a specific timeframe, it changes as the price changes in the timeframe it represents.

Moving averages are technical tools that traders use to identify trends on charts.

A simple moving average is just the average of prices in the timeframe, an exponential moving average gives more weight to recent prices and changes faster when reacting to new prices.

Moving averages can smooth out price action for trading trends.

Moving average crossover systems can further smooth out volatility for holding positions during a trend.

Moving averages are for trading trends and are not as useful during sideways markets.

Billionaire Paul Tudor Jones and multi-millionaire Ed Seykota’s both incorporated moving averages into their successful trading systems.

Moving averages are quantified signals unlike trend lines that can be discretionary and based on opinions.

Moving averages can be backtested for their viability as profitable signals.

Moving averages can be used as entry signals, stop losses, profit targets, trailing stops, and discretionary trading tools.

Moving Average Crossover Strategy

A moving average crossover signal is when you use both a short term moving average and a long term moving average on the same chart. A crossover signal is generated when the moving averages break above or break below each other. A trader buys when the shorter term moving average crosses over the longer term moving average and sells when the shorter term moving average crosses back under the longer term one Instead of price crossing over or under a single moving average as a signal the shorter term moving average itself becomes the signal line as it crosses over the longer moving average. The best thing about moving average crossover signals is that they can capture trends and swings in price action while filtering out much of the volatility.

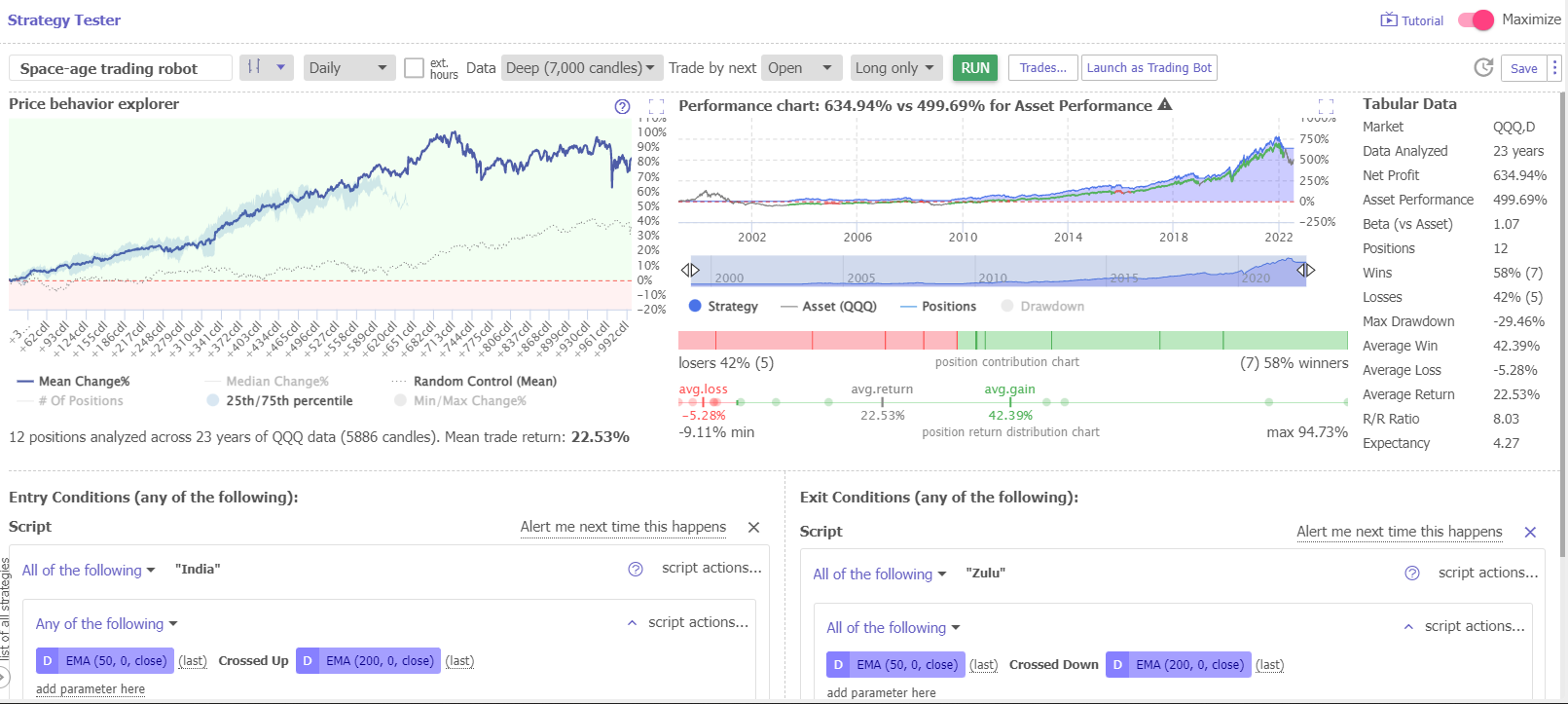

Using backtesting software you can set up an entry signal for when a shorter-term moving average closes over a longer-term moving average. Then you can set up an exit signal for when the shorter-term moving average closes back under the longer-term moving average.

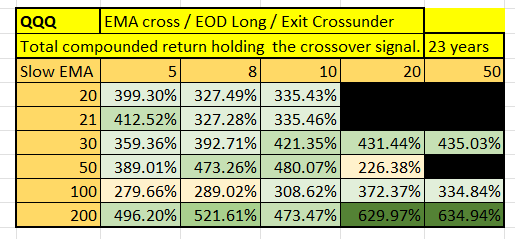

I have run backtests on the moving average crossovers I have found to be the most useful in trading. All these backtests were completed on the QQQ ETF as I have found it to be the best ETF for momentum and trend trading using moving average strategies.

Here are some of the most popular I looked at.

5 day / 20 day ema crossover: Flying Eagle crossover

5 day / 30 day ema crossover: Flying Falcon Crossover

8 day / 21 day ema crossover Scott Redler’s favorite

10 day / 30 day ema crossover: Flying Squirrel Crossover

10 day / 50 day ema crossover: Flying Dragon Crossover

50 day / 200 day ema Golden Crossover

50 day / 200 day ema Death Cross

Here are the results from April 1999 to July 2022 on QQQ historical data:

Backtesting data performed on TrendSpider.com

They work because they create good risk/reward ratios by letting winners run and cutting losers short. They also put a trader a position to be with the overall trend in their time frame. They give exit signals as trends come to an end and will also signal when it is time to get back into a chart on an upswing.

If you’re interested in trading price action using moving averages you can check out my best selling book about moving averages here or my other trading books on Amazon here. I have also created trading eCourses on my NewTraderUniversity.com website here. My educational resources can save you both time and money in your trading journey.