Michael Burry began warning about the stock market being in a passive investing bubble. The primary area of passive investing in 2022 is putting money into the SPY ETF and low cost S&P 500 index mutual funds. According to Bloomberg approximately 21.2% of all the S&P 500 companies shares are now held inside passive funds contrasting to only 3.3% in 2003. This generation has gotten very comfortable dollar cost averaging into the stock market using these funds with the belief they will always go higher over time. The S&P 500 has averaged approximately 12% annual returns over its history along with 50% drawdowns. Even Warren Buffett has recommended the buy and hold S&P 500 as the best strategy for most passive investors. The long S&P 500 investment may have become a crowded at this point and it takes continuous buying power to keep it up at current price levels.

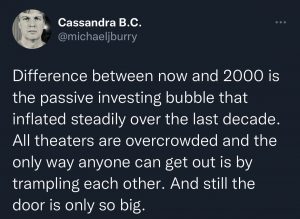

Achieving profits in the stock market and realizing those gains on the exit are very different things. The bulls of the early 2000s discovered this the hard way. Burry points out in the year 2000 the stock market had the dotcom and tech bubble while in 2022 we are seeing a passive investing bubble.

The majority have become too comfortable dollar cost averaging capital into index funds and buying at any valuation and price. Buying every dip in price has also been rewarded with new all time highs since 2009. As people start to retire and sell their investments, there is profit taking by investors, or as the flows into funds slow the stock market could plunge. This market has all the signs of an index bubble in the short-term. Easy monetary policy has also been a major driver of the recent stock market bubble and that dynamic has ended until inflation is under control.

Michael Burry believes that passive and blind investing into index funds is destroying the proper functioning of a market based on valuations, earnings, and future cash flow. True value is no longer priced in based on fundamentals. Another signal of a bubble.

“Passive investing has removed price discovery from the equity markets. The simple theses and the models that get people into sectors, factors, indexes, or ETFs and mutual funds mimicking those strategies — these do not require the security-level analysis that is required for true price discovery.” – Michael Burry (Bloomberg)

Burry sees the next bull market being more focused on value stocks. The discipline of paying for real fundamental value returning to the stock market is what he believes will make sense.

21.2% of investors holding shares in specific S&P 500 companies are no longer doing it because they see it as a great investment but just because it’s in the index they buy and hold consistently. When price begins to move higher detached from any fundamental intrinsic value that’s a bubble.

What is Michael Burry predicting?

The S&P 500 index bubble could burst if holders all began to exit on a loss of faith in their system. The index can also stop going up or crash if people simply stopped contributing consistently to hold up prices. In bear markets the price to earnings ratio can seem lower but the market is pricing in decreased earnings in coming months and years. With 78.8% of the S&P 500 companies in the hands of other types of investors and traders it will not be difficult for the index to go much lower.

All stock prices move based on supply and demand not theories and strategies. It’s the volume around buying and selling at different levels that will drive the price action even in the S&P 500 index. Both selling and buying of the S&P 500 index does affect the individual stock prices of the companies in the index to a degree. They will go up and down together with a lot correlation to the index movement.

A large percentage of the trading in the S&P 500 companies now happens indirectly through the S&P 500 index ETFs and mutual funds. SPY is a secondary market for these companies shares. The SPY exchange traded fund holds the shares and the SPY ticker is traded based on these holdings. This removes a large percent of the company shares from direct action on the stock exchange. According to Vanguard 94% of SPY trading creates no activity on the underlying shares it holds.[1]

“The dirty secret of passive index funds — whether open-end, closed-end, or ETF — is the distribution of daily dollar value traded among the securities within the indexes they mimic. In the Russell 2000 Index, for instance, the vast majority of stocks are lower volume, lower value-traded stocks. Today I counted 1,049 stocks that traded less than $5 million in value during the day. That is over half, and almost half of those — 456 stocks — traded less than $1 million during the day. Yet through indexation and passive investing, hundreds of billions are linked to stocks like this. The S&P 500 is no different — the index contains the world’s largest stocks, but still, 266 stocks — over half — traded under $150 million today. That sounds like a lot, but trillions of dollars in assets globally are indexed to these stocks. The theater keeps getting more crowded, but the exit door is the same as it always was. All this gets worse as you get into even less liquid equity and bond markets globally.” – Michael Burry [2]

What does Michael Burry say about the economy?

Michael Burry was warning about a recession in June 2022, he has been correct so far. Stock markets tend to crash during recessions as consumer spending drops and economic growth ends and the economy begins to shrink. Recessions are a part of the business cycle caused primarily by monetary policy having to raise rates to cool off an overheated economy. Bubbles have usually formed and inflation has taken hold before the Federal Reserve begins to raise rates. Other times financial bubbles popping can cause crashes and the unwinding of asset classes like equities or real estate causing a flood of supply on the market bringing down prices.

While unemployment is one indicator used to quantify if a recession has started, employment tends to peak later after the economic decline has begun. Jobless claims and high unemployment tend to continue deep into an economic recovery as it is a lagging indicator. The end of the recession marks the bottom of the economic decline and the start of an economic rebound rather than a quick reversal and improvement in conditions. It takes time for growth to return after a recessionary cycle.[3]