In his 1962 partnership letter, Warren Buffett gave his investing clients an overview of his value investing strategy he calls The Generals.[1]

“We usually have fairly large portions (5% to 10% of our total assets) in each of five or six generals, with smaller positions in another ten or fifteen.” – Warren Buffett

This example of his early portfolio math worked out so that five or six stocks made up approximately 50% of his early investment portfolio and another 30% of his portfolio was in ten to fifteen stocks. Buffett was investing approximately 80% of his millions in capital under management in his portfolio during the 1960s in around twenty individual stocks.

This also shows an early example of his position sizing parameters for top stocks in his portfolio being 5% to 10% of total capital used for positions in his top picks.

He bought for two reasons:

- They were available for very cheap prices relative to business value.

- They were diversified by industry so they provided less correlated portfolio risk.

This was Warren Buffett’s value investing filter he learned from Benjamin Graham and used in his earliest days to filter for stocks.

“Combining this individual margin of safety, coupled with a diversity of commitments creates a most attractive package of safety and appreciation potential.” – Warren Buffett

It appears he also liked to buy stocks in different uncorrelated industries in sectors adding to the safety of them all not moving down together at the same time to provide some additional risk management in addition to his already large margin of safety based on fundamental value of the company’s price versus fundamental value.

Buffett’s earliest diversification was a value investment portfolio with 50% of his total capital in 5 stocks and the other 30% in usually 15 stocks with some remaining cash for any other opportunities that arose. This is an example of how Warren Buffett invested when he was a small investor managing millions compared to the billions he manages today. This is an amazing example of how he ran a portfolio when he did not have to worry about liquidity and scaling like he does today.

How many stocks does Warren Buffett invest in?

Berkshire Hathaway’s last reported 13F filing for Q2 2022 included $300 billion in managed 13F securities with a top 10 holdings concentration of 87.51%. Berkshire Hathaway’s largest holding is Apple Inc with shares held of 894,802,319. [2]

Here are the current Warren Buffett top stock holdings in his Berkshire Hathaway portfolio in 2022.

Rank/Ticker/Sector/Portfolio percentage allocation

- AAPL INFORMATION TECHNOLOGY 39.43%

- BAC FINANCE 10.13%

- KO CONSUMER STAPLES 8.11%

- CVX ENERGY 7.53%

- AXP FINANCE 6.77%

- OXY ENERGY 6.23%

- KHC CONSUMER STAPLES 4.00%

- MCO FINANCE 2.16%

- USB FINANCE 1.78%

- ATVI INFORMATION TECHNOLOGY 1.72%

We can see a heavier weighting toward Apple as a company and in finance as an industry but overall he is still diversified in his top ten holdings even though his portfolio is concentrated in some areas.

Buffett to this day continues to hold huge allocations in his top 10 stocks for the Berkshire Hathaway portfolio he manages as they make up 87.51% of his portfolio with the remaining 39 stocks allocated to only 12.49% of the total investment capital.

How many stocks should the average person own?

“Very few people have gotten rich on their seventh best idea. But a lot of people have gotten rich with their best idea. So I would say for anyone working with normal capital who really knows the businesses they have gone into, six is plenty.” – Warren Buffett

For normal investors with small amounts of capital in their brokerage accounts a maximum of six stocks can be all the diversification you need if they are in different industries and you have researched their fundamentals, price action, and historical trends.

“It’s absolute insanity to think owning 100 stocks instead of five makes you a better investor.” – Charlie Munger:

Is owning 40 stocks too much?

40 individual stocks is far too many for a small investor based on Buffett’s quotes and teachings. What he does recommend for an investor instead of owning 40 stocks is to just buy an S&P 500 index fund and hold it for the long term. This index alone would provide the wide diversification that an investor is looking for and making the process of holding over 40 positions much easier. This index holds over 500 stocks across all stock sectors.

Is 20 stocks too much?

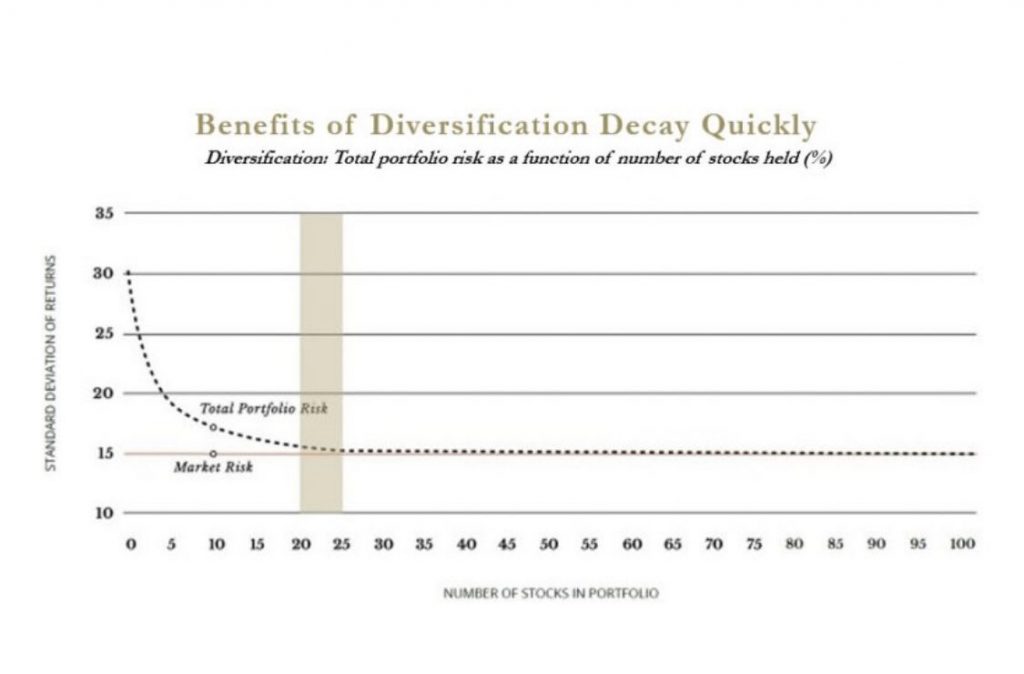

As the number of stocks in a portfolio reach 20-25, the volatility reducing benefits of diversification reach near zero. This is the sweet spot for portfolio size for an investor seeking to beat the market. At 20-25 stocks, you’ve captured all the potential benefits of diversification with even the right stocks. Few people need this many positions but it’s the maximum needed positions that will still be of any benefit to the stock investor.

What is Warren Buffett’s 90 10 rule?

Warren Buffett’s #1 money tip for retirees is a method that allocates 90% of investment capital into stock-based index funds while the remaining 10% of money is put into lower-risk investments. Buffett’s favorite exchange traded index fund is one that tracks the S&P 500 like the SPDR SPY ETF or Vanguard’s VOO. An S&P 500 index fund also works to capture diversified stock market returns with no need to invest in individual stocks is that is all that you’re after. He has seen that the S&P 500 beats the majority of all mutual fund managers and that the ETFs also save investors a lot of money with much lower management fees that add up over time versus managing an individual stock portfolio.[3]

In a letter to Berkshire Hathaway shareholders, Warren Buffett outlined his investing plan to use the 90/10 rule regarding his wife’s inheritance, which will be invested 90% in an S&P 500 index fund and 10% in government bonds. [4]

The lack of portfolio diversification was the key reason Warren Buffett was a billionaire by 50 years old and remained one of the richest people in the world for decades. His personal investment portfolio has remained almost 100% in Berkshire Hathaway for most of his adult life.

“Diversification is protection against ignorance. It makes little sense if you know what you are doing.” – Warren Buffett

He believes in diversification if you don’t know what you are doing but concentrating your portfolio into only the best stocks if you know how to identify them.