“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” – Warren Buffett

Warren Buffett only buys stocks when he believes he’s getting a great company for a good price. He is able to get the best companies at great prices during bear markets. This is when he believes the biggest investing opportunities of your life happen.

He focuses on investing based on two things:

Finding great companies trading below their true intrinsic business value and that have huge discounts versus their future discounted cash flow.

Buffett deploys his large cash positions he holds on the Berkshire Hathaway balance sheet into stocks during deep bear markets. This is where he finds the value in price.

Warren Buffett doesn’t just buy stocks all of the time. He only buys individual stocks when their price is in his perceived value zone. He will not buy any stock during overpriced market bubbles but will start buying huge positions during bear market drops of -20% to 50% for the stock indexes and more for individual stocks.

He wants to enter a position with a big margin of safety based on the price versus the company’s fundamental value and cash flow. He wants his risk to the downside limited but wants to maximize his upside profit potential. He buys in at a great discount on price at the right time then will hold a stock for at least a decade a more if the fundamentals stay consistent.

“If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.” – Warren Buffett

Buffett is a value investor and his favorite time frame is forever. He can only execute his investment strategy if he gets into a great company stock at a good price. He has evolved into a value investor in search of quality and growth along with the right price.

What are investment opportunities?

Investment opportunities happen when you have a chance to buy an asset for much less than it’s intrinsic value. The best opportunities come when there is deep fear in the market and sellers want out of an asset at a low price or better yet, any price you will pay them.

There is an old saying capturing when to buy low at extremes.

“The time to buy is when there’s blood in the streets.” – Baron Rothchild

Panics, wars, recessions, and depressions can create once in a lifetime investing opportunities in high quality assets.

Great investment opportunities have intrinsic value at a low price based on historical valuations. For the stock market it would be a low price to earnings ratio, for real estate it would be a discounted price in a growing area, for bonds it would be a high yield with a safe issuer.

There are two primary types of investment opportunities:

One type of great investment opportunity has a great risk/reward ratio. The risk if you’re wrong is limited but your upside potential profit is three to five times more than the risk of loss. This is the kind of investment that can create big capital gains through price appreciation from the entry price. Great investments pay you to own them and hold them over the long-term.

The other type of investment opportunity proved great cash flow from owing it. This can be a high dividend yield stock, a safe bond paying a high interest yield, or a property with high rental income. Great investments pay you while you own them.

The way you know something is a good investment is that you are making money and the way you know something is a bad investment is that you are losing money.

What are 3 examples of investment opportunities?

What should I invest in early in life?

The best assets to invest in early in life are stocks and a personal home. The stock market averages 12% a year historically and home prices tend to hedge against the inflation risk of rent increases while also accruing capital gains.

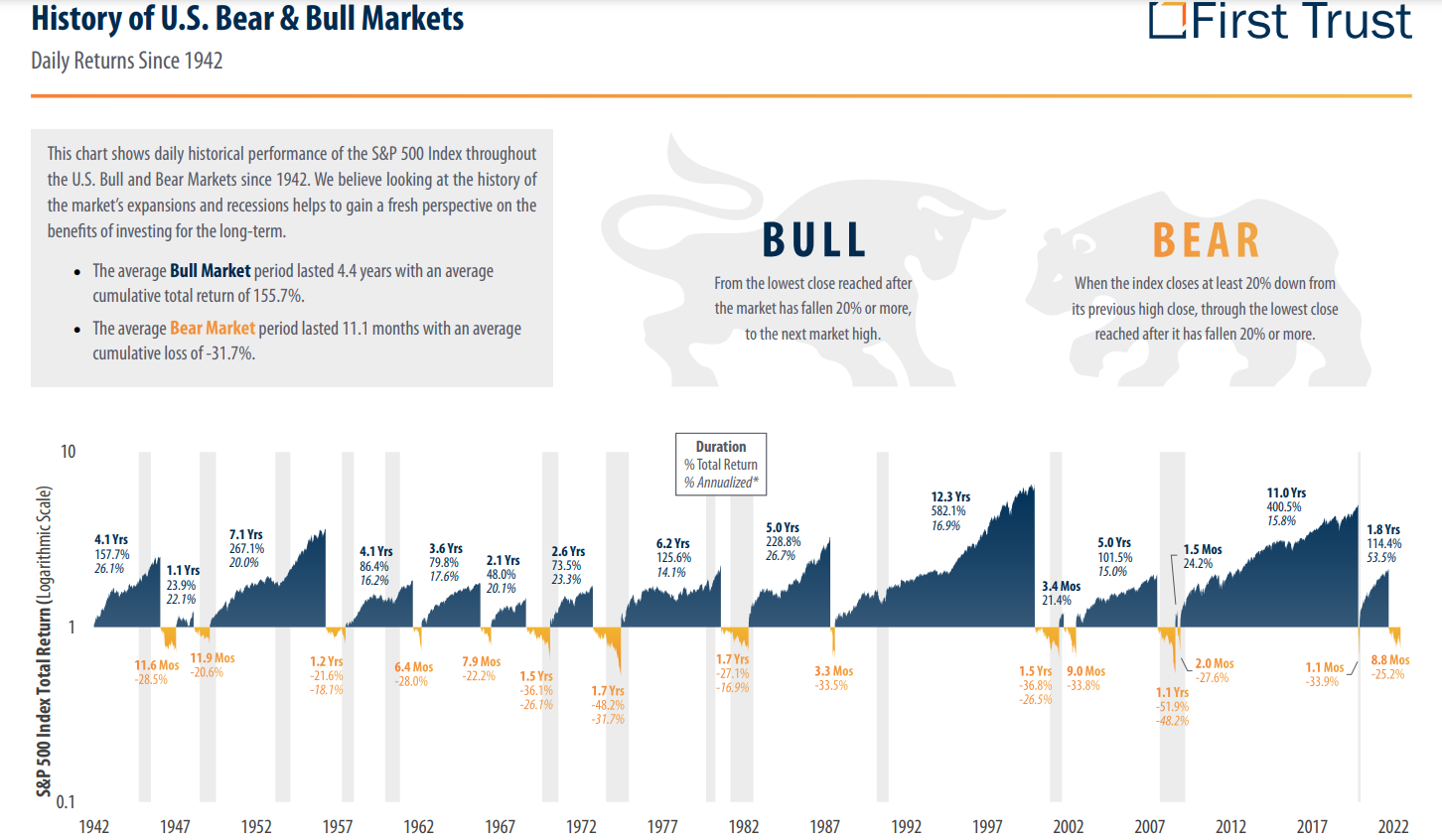

Historically, the best time to start investing in the stock market is after a 20% to 50% drop in the indexes. Buying after the drop gives you a much higher probability of returns over the next 12 months and larger compounded returns over coming years.

Dollar cost averaging for long-term investors tends to work over 10-year periods and longer because the system has the investor buying on the way down for lower and lower prices and when prices eventually return to all-time-highs like they have always done in the U.S. indexes. Averaging into positions by buy and hold investors during bear markets can be rewarded with profits during market recoveries.

Since 1926, bear markets have lasted through 14.7 years while bull markets have lasted 75.4 years in total.[1]

The biggest opportunity to profit from buy and hold investing is best during bear markets. The biggest risk in buying and holding investments occurs during the end of bull markets as prices quit making new highs and eventually crash.

Buying after a 50% bear market drop has happened in an index is the biggest investment opportunity of a buy and hold investor’s life. In the 21st century the greatest buying opportunities happened in late 2003 and early 2009. If you are a buy and hold investor or value investor the stock market is near this type of opportunity once again for those with the courage to look at history and not be overwhelmed with fear.