Dave Ramsey has a different perspective on frugality and financial independence than the majority of people. In today’s world, where consumerism is rampant, it’s easy to fall into the trap of unnecessary spending. People often squander their hard-earned money on things that don’t offer long-term value or improve their quality of life. Financial guru Dave Ramsey’s mission is to help people avoid these common financial pitfalls and guide them toward a more financially secure and independent future. His philosophy focuses on frugality, savings, and wise investments. This article delves into 25 everyday expenditures that often lead to financial drain, offering insights into better money management and a more sustainable lifestyle. Let’s see what they are.

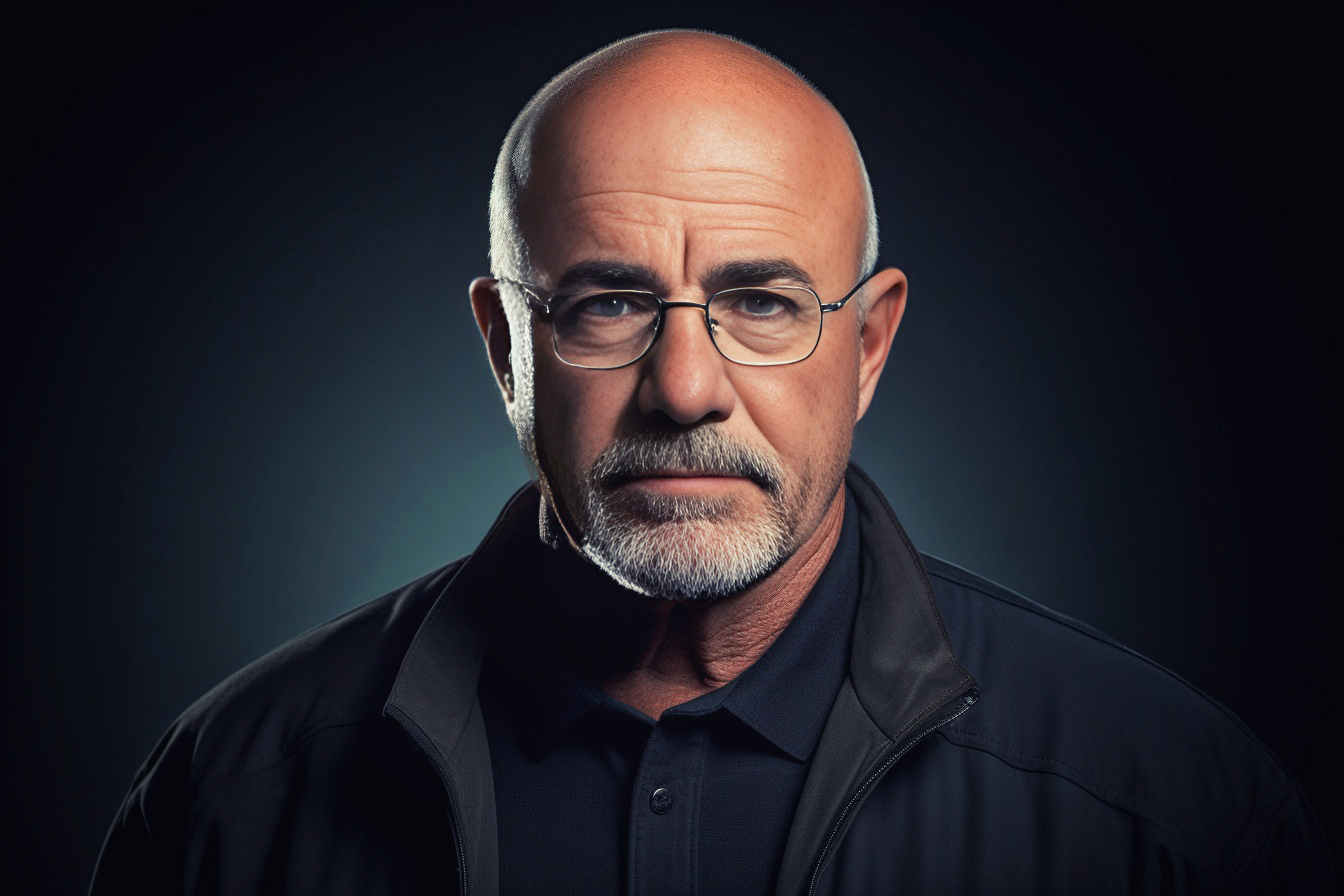

Dave Ramsey and His Financial Philosophy

Dave Ramsey is a renowned figure in the world of personal finance. A best-selling author and popular radio host, Ramsey’s financial philosophy revolves around eliminating debt, creating and sticking to a budget, and investing wisely. His financial strategies, known as “The Baby Steps,” are designed to help individuals and families move from financial distress to financial peace.

Understanding the Concept of Wasting Money

Wasting money goes beyond squandering funds on unnecessary items. It encompasses spending on items and services that do not contribute value to our lives, whether short-term pleasures or items that depreciate quickly. Identifying these habits and eliminating them is an essential step toward financial independence.

Top 25 Things Poor People Waste Money On: Dave Ramsey’s List

Here are 25 things that Dave Ramsey has said that people waste money on in his books, teachings, speeches, and public events.[1]

- Designer Baby Clothes: Infants quickly outgrow their clothes. Investing in expensive designer wear for babies can be an unnecessary expense.

- Expensive Coffees: Regularly buying pricey coffee from cafes adds up. Consider brewing coffee at home instead.

- Trendy Clothes: Fashion trends come and go. Instead of buying into every trend, consider investing in timeless, quality pieces.

- New Cars: Cars depreciate rapidly. Opting for a reliable used car can save you thousands.

- Luxury Apartments: While everyone wants a comfortable living space, renting luxury apartments beyond your means can cripple your finances.

- High-End Makeup: Expensive makeup brands can be a luxury. More affordable brands often offer similar quality at a fraction of the cost.

- Premade Meals: Buying premade meals can be convenient but more expensive than cooking at home.

- High-Cost Mobile Service Plans: Many people pay for more data and features than they need. Consider opting for a more affordable plan.

- Unnecessary Tech Upgrades: Upgrading to the latest tech gadget is often unnecessary and costly.

- Expensive Vacations: Vacations are essential for relaxation and enjoyment but should fit your budget.

- Furniture on Credit: Buying furniture on credit can lead to paying more than the item’s worth due to interest.

- Expensive Cable Packages: With the advent of affordable streaming services, expensive cable packages can often be cut down.

- Impulsive Purchases: Unplanned purchases can lead to financial strain.

- High-Interest Credit Cards: These cards can increase your debt faster than you anticipate.

- Unused Gym Memberships: If you aren’t regularly using your gym membership, it’s likely a waste of money.

- Dining Out Frequently: Eating out at restaurants is much more expensive than preparing meals at home.

- Alcohol and Cigarettes: Not only do these harm your health, but they also drain your wallet over time.

- Lottery Tickets: Your chances of winning are almost zero. This money could be saved or invested instead.

- Brand Name Groceries: Often, store brands offer similar quality at a lower cost.

- Paying for Convenience: These conveniences add up, whether it’s a Door Dash order when you can go get your food or a delivery fee for groceries.

- Neglecting Preventative Care: Regular health and dental check-ups can help prevent more severe and costly problems down the line.

- Fast Fashion: These clothes are often lower quality and must be replaced more often than durable items.

- Subscriptions You Don’t Use: Whether it’s a magazine or a streaming service, it’s a waste if you’re not using it.

- Excessive Gifting: While it’s nice to give gifts, doing so excessively with expensive gifts can strain your finances.

- Expensive Beauty Treatments: While everyone wants to feel pampered, high-end beauty treatments can add up quickly. Opting for more affordable options or DIY treatments can save you money.

Exploring Dave Ramsey’s Principles of Frugal Living

According to Ramsey, frugality isn’t about living stingily but wisely. It’s about making careful financial decisions, delaying gratification, and living within your means. His principles advocate cutting unnecessary spending, purchasing quality items that last longer, and always planning before purchasing.

How Overspending Impacts Your Path to Financial Independence

Overspending often results in accumulating debt, significantly delaying your journey toward financial independence. Every dollar you spend on non-essential things is something you could have saved, invested, or used to reduce debt. Over time, this can result in significant financial stress and an inability to meet your financial goals.

Ways to Avoid Money-Wasting Pitfalls

Avoiding these pitfalls involves conscious decision-making and financial discipline. Here are a few tips:

- Stick to a budget

- Cut or limit non-essential expenses

- Save before you spend

- Prioritize paying off high-interest debts

Frugal Alternatives to Common Money-Wasting Habits

Implementing frugal alternatives can save you money without compromising your quality of life. Here are some alternatives:

- Choose home workouts instead of gym memberships

- Use cash instead of credit cards to limit spending

- Replace high-end beauty treatments with natural, DIY treatments

The Role of Budgeting in Achieving Financial Independence

A well-planned budget is critical to achieving financial independence. It helps you understand your income, control your expenses, prioritize your spending, and save for the future. Dave Ramsey promotes the “Zero-Based Budget,” where every dollar has a purpose before the month begins.

Dave Ramsey’s Take on Investments for Financial Freedom

Ramsey encourages regular, disciplined investing as a path to wealth and financial independence. His recommendations generally focus on investing 15% of household income into tax-advantaged retirement accounts and spreading investments across mutual funds for diversification.

The road to financial independence isn’t always smooth, but with the right strategies, determination, and discipline, you can navigate your way to financial peace, as Dave Ramsey advises. Embrace frugality, avoid unnecessary spending, and remember: every dollar counts.

Key Takeaways

- High-End Baby Items: The magnitude of expenses on limited-use baby items can be vast and immediate, causing unnecessary financial burdens.

- Expensive Daily Coffees: Over time, the seemingly small costs for luxury café coffees accumulate into a significant sum.

- Trendy Seasonal Clothing: The frequent need to update your wardrobe to stay on trend can lead to sustained and continuous overspending.

- New Vehicles: The substantial upfront cost and rapid depreciation of new vehicles make them a significant wasteful expenditure.

- Oversized Houses: Large properties require a considerable initial investment and generate ongoing, often underestimated, maintenance costs.

- High-Priced Beauty Products: Regular purchases of premium beauty treatments and cosmetics can quickly drain your finances.

- Pre-Packaged Meals: The convenience of ready-made meals comes with a high cost when adopted daily, causing a continuous drain on the budget.

- Extravagant Phone Plans: Over a contract period, the monthly charges for expensive phone contracts accumulate into a significant amount of money.

- Frequent Gadget Upgrades: The recurrent nature of tech updates makes this a persistent expense, both in magnitude and frequency.

- Luxury Vacation: While it seems like a once-a-year extravagance, the sheer magnitude of the expense of luxury vacations can have a long-lasting impact on your finances.

Conclusion

The essence of frugality is the art of discerning needs from wants, cultivating an awareness of where your money is going, and making conscious decisions. Dave Ramsey’s principles for financial independence revolve around avoiding unnecessary expenditure, emphasizing the importance of living within one’s means, and investing wisely. Smart spending and careful budgeting form the backbone of these principles, turning the path to financial freedom from an uphill battle to a manageable journey. By avoiding the money-wasting pitfalls listed above, you’re not just saving money but reclaiming control over your financial future, paving the way toward an economically stable life.