Navigating the real estate market to find out how much home you can afford based on your salary can be daunting. It’s not just about finding a property you love; it’s about ensuring that the financial commitment won’t derail your other life goals or put you in a precarious financial situation. This comprehensive guide aims to demystify the various factors determining your home-buying budget, from widely accepted financial rules to the impact of mortgage rates and credit scores. Whether you’re a first-time homebuyer or looking to upgrade, understanding these principles can help you make an informed decision that aligns with your financial health.

The Importance of Knowing What You Can Afford

Buying a home is not just a milestone; it’s a long-term financial commitment that requires careful planning. Understanding how much home you can afford is the cornerstone of this planning. It’s not just about avoiding the stress of living paycheck to paycheck; it’s about ensuring you can maintain your lifestyle while saving for the future. There are many factors determining your home affordability based on your salary.

The 28/36% Rule Explained

The 28/36% rule is a financial benchmark many lenders and financial advisors use. According to this rule, up to 28% of your gross monthly income should go towards housing expenses, which include mortgage payments, property taxes, and insurance. Your total debt payments, including car loans, student loans, and credit card payments, should be at most 36% of your gross income. This rule ensures you have enough income for other essential expenses and savings.

The 25% Rule Explained.

While the 28/36% rule is widely accepted, some financial experts like Dave Ramsey advocate for a more conservative approach known as the 25% rule. According to this guideline, your housing costs should not exceed 25% of your net (take-home) pay. This allows for greater financial flexibility, enabling you to allocate funds for emergencies, retirement, and other financial goals.

Calculating Your Monthly Earnings and Expenses

Before applying any affordability rules, you need a clear understanding of your monthly earnings and expenses. Your earnings should include all income streams, such as salary, bonuses, and side gigs. On the expense side, list all your fixed and variable costs, including utilities, groceries, transportation, and entertainment. Subtracting your total expenses from your total income will give you a clearer picture of how much you can allocate toward housing.

How Mortgage Rates Affect Your Buying Power

Mortgage rates are a critical factor in determining your monthly payments. Even a tiny fluctuation in rates can significantly impact your buying power. For instance, a 1% increase in the mortgage rate could lead to a several hundred dollar increase in your monthly payment, depending on the loan amount. It’s crucial to shop around for the best mortgage rates and consider the impact of potential rate increases in the future.

The Role of Credit Scores in Home Affordability

Your credit score is a numerical representation of your creditworthiness and plays a pivotal role in determining the mortgage rate you’ll be offered. A higher credit score can get you a lower rate, increasing your buying power. It’s best to check your credit score well before house hunting. If your score is less than ideal, in most situations, you should delay your home purchase to give yourself time to improve it.

Understanding Debt-to-Income Ratios

Your Debt-to-Income (DTI) ratio is another metric lenders use to assess your ability to manage monthly payments. The DTI ratio is calculated by dividing your total monthly debts by your gross monthly income. Lenders view A lower DTI ratio favorably, as it indicates a lower risk of default. Most lenders prefer a DTI ratio under 36%, although some may allow higher ratios under certain conditions.

Why Down Payments Matter

The down payment is the initial lump sum you pay when purchasing a home, and it directly impacts the size of your mortgage. A larger down payment reduces your monthly payment and can help you secure a better mortgage rate. Moreover, putting down 20% or more can help you avoid paying Private Mortgage Insurance (PMI), a costly premium that protects the lender if you default on the loan.

Closing Costs: The Hidden Expense

Closing costs are the fees you pay to finalize your mortgage, and they can significantly impact your home’s affordability. These costs can range from 2% to 5% of the home’s purchase price and include various fees such as loan origination, appraisal, and legal fees. Many people overlook closing costs, but they are crucial in determining how much home you can afford.

Types of Loans: What Are Your Options?

There are several types of mortgage loans, each with its requirements and benefits. Conventional loans often have stricter credit requirements but lower mortgage insurance costs. FHA loans are more lenient but come with higher insurance premiums. VA loans are available to veterans with no down payment or PMI requirements. There are also Adjustable Rate Mortgages to consider. An adjustable-rate mortgage (ARM) is often presented as an attractive, lower-cost alternative to fixed-rate mortgages, especially when interest rates are high. Understanding the pros and cons of each can help you choose the best option for your financial situation.

Geographical Factors and Home Affordability

The cost of living varies dramatically from one location to another. In some cities, you might find that your income barely covers a small apartment, while in others, the same income could afford you a spacious home. Researching the average home prices and living costs in your desired area can help you set a realistic budget.

How to Improve Your Home Affordability

If the homes in your desired area are out of your budget, several strategies exist to improve your affordability. These include improving your credit score, increasing your down payment, or considering a less expensive location. You could also look into various first-time homebuyer programs that offer financial assistance.

Salary Requirements for Different Price Ranges

To give you a practical idea, here’s a rough salary guide based on different home price ranges:

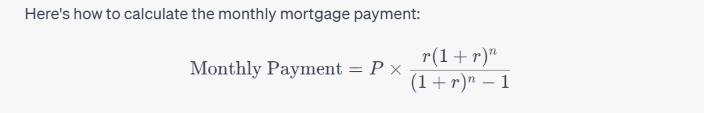

To calculate the salary requirements based on the 25% rule, we’ll use an 8% mortgage rate, a 10% down payment, and a 30-year mortgage term. The 25% rule suggests that your monthly mortgage payment should not exceed 25% of your monthly take-home pay.

Where:

- is the principal loan amount

- is the monthly interest rate (annual interest rate divided by 12)

- is the number of monthly payments (loan term in months)

Let’s assume that the down payment is 10% of the home price, so the loan amount would be 90% of the home price.

Here’s a rough salary guide:

| Income | Affordable Home Price | Monthly Payment |

|---|---|---|

| $50,000 | ~$125,000 | ~$823 |

| $60,000 | ~$150,000 | ~$988 |

| $70,000 | ~$175,000 | ~$1,152 |

| $80,000 | ~$200,000 | ~$1,317 |

| $90,000 | ~$225,000 | ~$1,481 |

| $100,000 | ~$250,000 | ~$1,646 |

| $110,000 | ~$275,000 | ~$1,810 |

| $120,000 | ~$300,000 | ~$1,975 |

| $130,000 | ~$325,000 | ~$2,139 |

| $140,000 | ~$350,000 | ~$2,304 |

| $150,000 | ~$375,000 | ~$2,468 |

| $160,000 | ~$400,000 | ~$2,633 |

| $170,000 | ~$425,000 | ~$2,797 |

| $180,000 | ~$450,000 | ~$2,962 |

| $190,000 | ~$475,000 | ~$3,126 |

| $200,000 | ~$500,000 | ~$3,291 |

Salary Requirements for Different Home Price Ranges

First-Time Homebuyers: Special Considerations

If you’re a first-time homebuyer, you may be eligible for special programs or grants to make a home more affordable. These programs can offer down payment assistance, reduced mortgage rates, or tax credits. It’s worth researching these options and consulting with a financial advisor to see if you qualify.

Making Informed Decisions in Home Buying

The process of buying a home is complex and filled with variables. However, understanding these key factors will equip you to make informed decisions. You can always consult with financial advisors, mortgage brokers, and real estate agents to tailor this advice to your unique situation.

Key Takeaways

- Financial Benchmarks: Utilize guidelines like the 28/36% and 25% rules to set a budget for housing expenses.

- Income Assessment: Evaluate all revenue streams and outflows to determine your housing budget capacity.

- Interest Rate Influence: Be aware of how fluctuations in mortgage interest rates can alter your purchasing ability.

- Creditworthiness: Your credit rating directly impacts the mortgage terms you’ll be offered.

- Debt Metrics: Keep an eye on your Debt-to-Income (DTI) ratio as lenders use it to gauge your repayment capability.

- Initial Payment: The upfront down payment can significantly influence your monthly payments and loan terms.

- Unseen Expenditures: Account for closing costs, often an overlooked aspect that can affect overall affordability.

- Loan Varieties: Familiarize yourself with different mortgage options to select the most advantageous one.

- Regional Variables: Consider the cost of living in your desired location as it will affect how much home you can afford.

- Enhancing Affordability: Employ strategies like credit improvement and down payment increases to make homes more accessible.

- Income Guidelines: Know the approximate annual income needed for homes in various price brackets.

- First-Timer Advantages: Look into special programs that offer first-time homebuyers financial relief.

Conclusion

Navigating the complexities of home buying requires a multifaceted approach, encompassing everything from financial rules of thumb to geographical considerations. By diligently assessing your earnings, understanding the nuances of mortgage rates, and being mindful of additional costs, you can make a well-informed decision that aligns with your lifestyle and financial aspirations.