What exactly makes a million dollars so noteworthy? Why does this particular seven-figure sum sway the collective consciousness when measuring financial success?

Having a million-dollar net worth is a milestone that captures the imagination of many as an elite level of financial success. But what truly makes this seven-figure savings mark so significant? Is a million dollars actually enough to guarantee carefree wealth?

As it turns out, accumulating your first million is intensely challenging yet attainable for regular Americans with decades of dedication. And while the dollar amount confers bragging rights, true wealth encompasses more than just a number.

Clearing the million net worth mark awards membership into an esteemed echelon, denoting praiseworthy fiscal discipline. Only 8% of American families ever amass such fortunes over a working life. While some dismiss a mere million as pocket change for the ultra-wealthy, arriving at this milestone through diligent savings, investing, or business building confers bragging rights for ordinary people. It’s still the dream of many in the middle class to become millionaires.

Yet, as alluring as that seven-figure number appears on account statements, authentic wealth encompasses much more. True riches flow from living intentionally, generosity of spirit, and finding a higher purpose. Paradoxically, these are characteristics that make being a millionaire possible in the first place.

With prudent habits established early and sustained patiently over decades, millionaire status lies within reach of dedicated middle-income earners. The real prize becomes not a dollar amount but who you become in the quest to get there.

What makes $1 million a noteworthy milestone in personal finance and investing?

- Being a millionaire puts you in a prestigious group – only about 8% of Americans have a net worth of over $1 million. The title of “Millionaire” carries weight.

- $1 million is often seen as a benchmark for having “enough” to retire. However, 80% of millionaires still work full-time, so it’s not necessarily an automatic retirement fund.

- Reaching $1 million is attainable through long-term saving and investing, thanks to compound interest. Saving just $200 monthly from age 20 to 65 can make most people millionaires. However, it requires discipline, which many lack.

- What constitutes “wealthy” is personal and based on lifestyle costs. Many millionaires don’t feel wealthy or live lavish lifestyles. Wealth is a mindset as much as a dollar amount.

- $1 million isn’t necessarily needed for a comfortable retirement, especially with Social Security, a pension, and a paid-off house. But it provides security.

- The first $1 million is the hardest in investing. After that, it gets easier to accumulate additional millions due to compounding.

While $1 million is a noteworthy milestone, what makes it unique is more symbolic than practical for most people. It represents hitting a rare target through long-term financial discipline.[1]

Keep reading for a deeper dive into why your first million-dollar net worth can be extraordinary.

$1 Million Puts You in Rare Company

According to the latest data from the Federal Reserve, only around 8% of American families have accumulated a net worth of $1 million or more. Reaching this target means joining a prestigious club accessible to just a tiny slice of the population. The sense of achievement from this milestone stems from the problematic road required to reach such rarefied financial air. With diligence and intentional effort channeled over a working lifetime, arriving at millionaire status bestows recognition and perceived prestige.

Clearing the $1 million hurdle also provides entrance into an exclusive community of peers who have demonstrated similar financial discipline. While critics may downplay the significance of a mere million in the face of more considerable billionaire fortunes, hitting the mark still symbolizes crossing into elite territory. It’s like running a marathon – sure, some may complete it faster, but simply finishing that 26.2-mile distance remains hallowed ground for most.

It’s a Flashy, Feel-Good Round Number

The specific dollar amount of one million resonates strongly in our culture. Unlike a $875,392 net worth, being worth one million dollars has a much more significant impact when said. A seven-figure salary also leaves a big psychological impression. The messaging implies that being a “millionaire” evokes images of luxury and success across popular media, business, and celebrity circles. There’s no denying the flashy appeal inched up by seven figures.

A million conveys social signals like business savvy, high intelligence, and influence. Right or wrong, being a millionaire garners attention, respect, and assumptions of competency. While income and assets don’t automatically correlate with financial freedom, that won’t stop perceptions.

The utility of anything can be measured more in feelings than function. Clearing the million-dollar threshold feels good as a symbol of achievement. There’s no rule some digits arranged in a particular order should mean more than other figures. But just like a .300 batting average conveys skill more than a .275 average in baseball, achieving millionaire status creates pride.

It Can Fund a Comfortable Retirement

Conventional wisdom states that accumulating $1 million by retirement provides financial freedom. No longer chained to the treadmill of work, this nest egg yields the income needed to fund costs for the balance of one’s golden years. The reality, not surprisingly, is more nuanced.

While any responsible retirement plan should underscore the variability of individual situations, a few assumptions can provide guidelines. Most financial planners recommend limiting annual withdrawals to 4% to 5% of total portfolio value during retirement to mitigate the risk of depleting assets. By this rule, a $1 million balance could generate $40,000 – $50,000 yearly.

For Americans focusing on funding essential living expenses in low-cost areas, this retirement vehicle could adequately support their needs into advanced ages. But funding an extravagant globetrotting lifestyle would quickly chew through a single million in a few years.

In today’s era of longevity, expanding into the 80s and 90s, there are no guarantees that even a seven-figure balance will remain sufficient over decades. And with healthcare costs continuing to outstrip overall inflation, medical needs could torpedo projections. Still, having $1 million beats not having it by a long shot for retirement readiness.

Earning the First Million Is the Real Challenge

While having a million-dollar net worth is scarcely enough for lavish lifetime spending, the heavy lifting comes in accumulating that initial seven-figure amount. Reaching this feat requires relentless discipline and focused effort over a working career spanning decades. But mathematics illustrates how, after conquering this first investing mountain, millions pile up easier later through compounding.

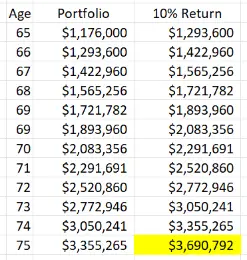

The initial million is notoriously tricky because starting capital remains comparatively low. For example, a 25-year-old beginning at $0 and investing over 40 years by adding $100 monthly at a 10% – 12% average annual return crosses the millionaire line at age 65 with approximately $1,176,000. But by age 75, that savings stream has ballooned to over $3.69 million with an average 10% annual return.

With each million milestone cleared, the next feels more straightforward to attain since investment gains snowball quicker on more significant balances. This explains why the leap from $1 million to $2 million may be around 7-8 years, while vaulting from $3 million to $10 million could take less than a decade.

Patience and persistence pay compounded dividends over long time horizons. Every dollar matters in fueling liftoff.

Wealth Is About More Than Just Dollars

For all its glory as the gold standard of financial achievement, having a $1 million net worth and entering the millionaire club reveals little about happiness or satisfaction. Correlating money directly with wealth in a fulfilled life proves short-sighted.

Surveys show a surprisingly high percentage of millionaires don’t feel wealthy based solely on their asset accumulation. Likewise, for every flashy millionaire flashing luxury brands and exotic vacations on social media, there are ten more living like the millionaire next door, driving modest cars, and clipping grocery coupons.

True wealth encompasses broader components than simple account balances on a bank statement. Financial education, financial literacy, intentional goal-setting skills, and establishing enough to give back generously can all constitute forms of wealth as much as dollar figures.

Ultimately, $1 million remains alluring due to its statement about success and the recognition it gives. But long after the seven-digit thrill fades, pursuing other less visible forms of personal fulfillment pays dividends that compound forever.

It’s an Attainable Goal for Regular People

Building net worth to reach millionaire status no longer remains an impossible pipe dream only magnates like Rockefeller or Vanderbilt could achieve generations ago. With the right financial GPS programmed early enough and mile markers celebrated along the journey, practically anyone in America can traverse the million-dollar mark in time.

History shows that stock market returns have averaged around 10% annually across decades despite short-term turbulence. Even factoring in inflation, consistent investing over 30-40 years can reliably turn modest monthly contributions into seven figures.

For example, saving just $416 monthly from age 22 to 67 ($5,000 annually) at a conservative 8% average yearly return reaches $1.5 million by retirement. Boost contributions to $833 monthly ($10,000 annually) while maintaining that rate of return and $1.25 million nets by age 55, permitting early retirement flexibility.

Replicating this deliberate savings pattern along proven mathematical principles allows everyday Americans to hit this prized target. The key remains understanding that delayed gratification pays exponential rewards over long horizons. Skimping on small lifestyle luxuries like a daily Starbucks coffee or restaurant meal can redirect fortunes into brewing millions.

Key Takeaways

- Reaching the $1 million net worth mark grants admission into an exceptional group, denoting praiseworthy financial discipline

- The specific round dollar value captivates awareness, conferring elite status and perceptions of competence.

- A seven-figure savings balance furnishes retirement security but not necessarily extravagance without continual replenishment.

- Vaulting over the first million summits poses the steepest hurdle, as compounding escalates asset accumulation.

- Authentic wealth stems from enriched wisdom, generosity, relationships, and purpose as much as dollars.

- The average American can grasp this prized target with steadfast habits and patience over decades and realize more meaningful riches.

Conclusion

The lauded million-dollar milestone symbolizes far more than an arithmetic amount. This apex has evolved into a representation of realizing ambitions once restricted only to the privileged few. Transcending societal barriers, any everyday American willing to sacrifice and defer instant delight in service of delayed reward can summon sufficient means to reach this peak. But the journey itself forges underappreciated fortunes in knowledge, empathy, and higher purpose that ultimately enrich life’s trajectory well beyond any monetary measure. The million-dollar path will unfold for you in your financial journey by finding inspiration in pursuing small, intentional steps today.

While the first million takes tremendous patience and commitment, staying the course unlocks membership into an elite financial league. More importantly, the wisdom and character developed in the process proves priceless.