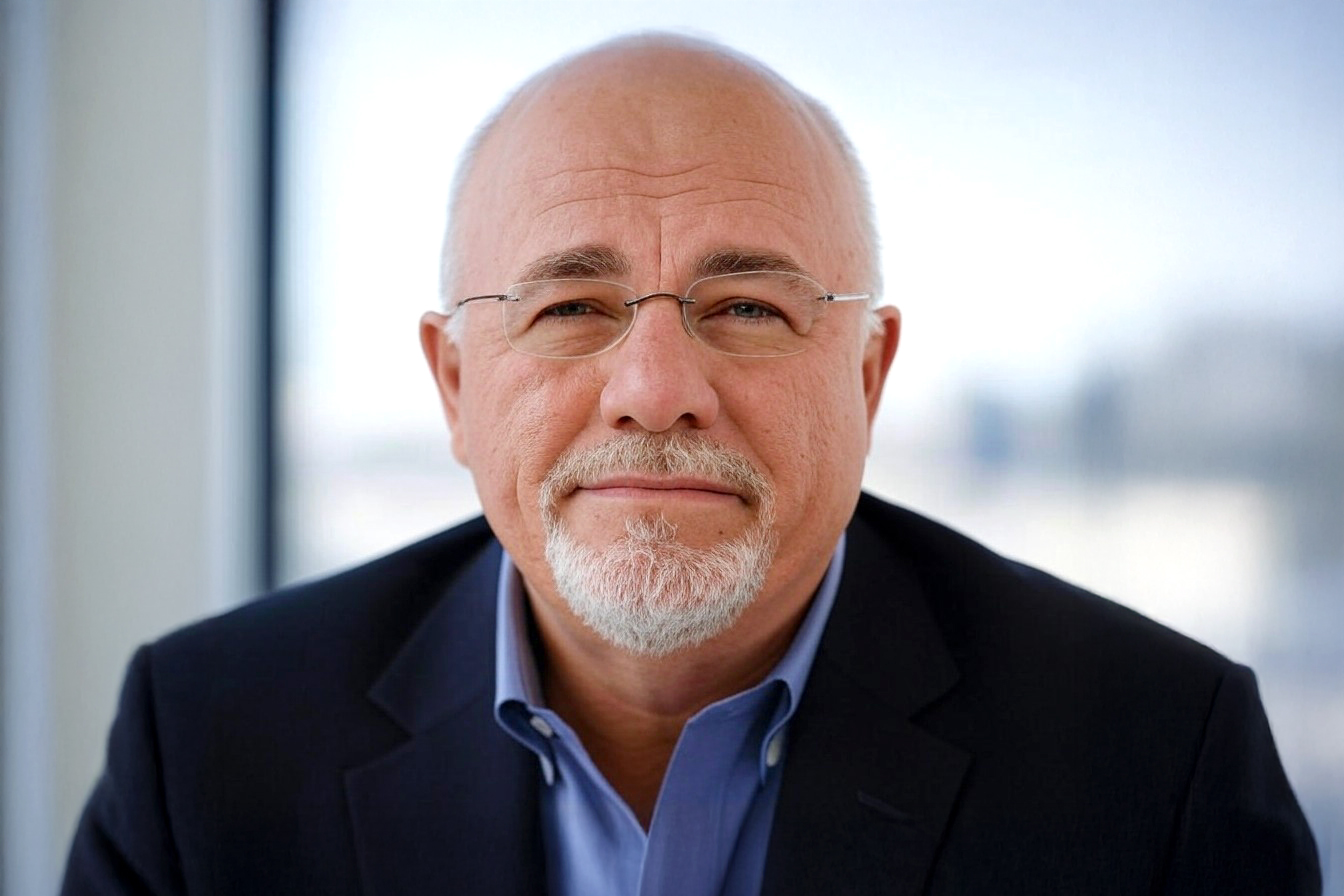

Dave Ramsey, America’s trusted financial guru, has spent decades helping middle-class families break free from financial mediocrity. His straightforward approach to financial success centers on a simple principle: stop buying things that keep you broke.

Through his radio show, books, and financial coaching, Ramsey consistently identifies spending patterns that trap middle-class families and prevent them from building real wealth. His philosophy challenges conventional thinking about what constitutes “normal” spending, arguing that many purchases considered standard by middle-class families destroy their finances.

Eliminating the following five bad spending habits can allow families to redirect thousands of dollars annually toward investments, emergency funds, and wealth-building activities that create lasting financial security. Let’s explore each one.

1. New Cars with Loan Payments

Ramsey’s stance on new car purchases is unwavering: they represent one of middle-class families’ most significant wealth-destroying decisions. His core principle states that a car is not an investment but a depreciating asset that loses value when you drive it off the lot. New vehicles typically lose significant value in their first year, making them poor financial choices for families trying to build wealth.

The financial mathematics is stark. Two monthly new car payments of $600 to $700 drain family budgets by $1,200 to $1,400. This represents money that could be invested in appreciating assets instead of depreciating ones. This doesn’t even count insurance and maintenance fees. Ramsey frequently points out that expensive car payments indicate that someone will remain in the middle class, as these payments consume income that should be directed toward wealth building.

His alternative approach emphasizes purchasing reliable used vehicles with cash. This strategy eliminates monthly payments, freeing up substantial income for savings and investments. Ramsey advocates buying two to three-year-old cars, allowing someone else to absorb the initial depreciation while still obtaining a reliable vehicle. The money saved from avoiding car payments can be invested in mutual funds or other wealth-building vehicles that increase in value over time.

2. Luxury Goods and Status Symbols

Ramsey draws a sharp distinction between looking wealthy and being wealthy, criticizing the middle-class tendency to purchase luxury items for appearance rather than utility. His observations about actual millionaires reveal that self-made millionaires often shop at practical stores and avoid expensive brand names, prioritizing value over status symbols.

The temptation to purchase designer clothing, luxury handbags, premium electronics, and high-end accessories represents a fundamental misunderstanding of wealth building. These purchases drain resources that could be invested in appreciating assets, creating a cycle where families appear successful while remaining financially vulnerable. Ramsey emphasizes that true wealth comes from accumulating assets, not accumulating expensive possessions.

His advice centers on building wealth first, then purchasing luxury items with cash after achieving financial security. This approach ensures that luxury purchases don’t compromise long-term financial goals. He advocates for practical shopping habits, suggesting that middle-class families focus on meeting needs efficiently rather than trying to impress others with expensive purchases.

The opportunity cost of luxury spending is significant, as money spent on status symbols could be generating returns through investments instead.

3. Timeshares

Ramsey’s position on timeshares is clear, consistently describing them as financial traps providing poor value to middle-class families. The timeshare industry creates an illusion of vacation investment, but the reality involves high upfront costs, ongoing maintenance fees, and minimal resale value.

The financial burden of timeshares extends far beyond the initial purchase price. Annual maintenance fees typically increase yearly, creating a perpetual expense that families can’t easily escape. Special assessments for property improvements add unexpected costs, while the difficulty of selling timeshares means families often remain locked into these obligations for decades.

Ramsey’s alternative approach emphasizes cash-paid vacations that provide greater flexibility and better value. Families can enjoy diverse vacation experiences without the long-term financial commitment of timeshare ownership.

By saving money specifically for vacation expenses, families maintain control over their travel choices and avoid the economic burden of ongoing maintenance fees. This approach aligns with his broader philosophy of avoiding long-term debt obligations that don’t build wealth.

4. Frequent Restaurant Meals

The rising cost of dining out has made restaurant meals a significant budget drain for middle-class families. Ramsey points out that regular restaurant visits can consume hundreds of dollars monthly, representing money that could be directed toward wealth-building activities instead.

Home-cooked meals typically cost a fraction of restaurant prices, making meal preparation at home one of the most effective ways to reduce monthly expenses. The cumulative impact of frequent dining out often surprises families when they calculate their annual restaurant spending. This money could be invested in emergency funds, retirement accounts, or other wealth-building vehicles that create long-term financial security.

Ramsey’s approach doesn’t eliminate dining out entirely but emphasizes budgeting for occasional restaurant meals as entertainment rather than making them a regular expense. He advocates meal planning and preparation as practical skills that support financial health and family well-being. The discipline required for home cooking often translates to better financial habits in other areas, creating a positive cycle of money management.

5. Extended Warranties

Ramsey’s analysis of extended warranties reveals them as overpriced insurance products that rarely provide value to consumers. Most extended warranties are never used, making them profitable for retailers but poor investments for consumers. The markup on these products is substantial, representing pure profit for companies while providing minimal benefit to buyers.

His alternative philosophy centers on self-insurance through emergency fund savings. Rather than paying for extended warranties on multiple purchases, families can build emergency funds that protect unexpected repair costs while serving other financial needs. This approach gives families more flexibility and control over their money.

The sales pressure surrounding extended warranties often catches consumers off guard, leading to impulse purchases that don’t align with sound financial planning. Ramsey’s advice emphasizes making deliberate financial decisions rather than responding to sales tactics. Building an emergency fund creates genuine financial security beyond protecting individual purchases to providing overall economic stability.

Conclusion

Dave Ramsey’s overarching principle emphasizes avoiding purchases that require financing. He argues that if you can’t afford to pay for something outright, you can’t truly afford it. His approach challenges middle-class families to reconsider spending patterns and redirect money toward wealth-building activities rather than consumption that keeps them financially stuck.

By eliminating these five spending categories, families can free up substantial monthly income for savings, investments, and debt elimination. The cumulative impact of these changes often surprises families who discover they have more money available for wealth building than they realized.

Ramsey’s philosophy aims to help middle-class families overcome financial mediocrity and build lasting wealth through disciplined spending and strategic investing.