Many Americans dream of escaping the 9-to-5 grind and retiring early. Having complete freedom with your time while you’re still young and healthy sounds amazing. But is early retirement possible or just a fantasy for the ultra-wealthy?

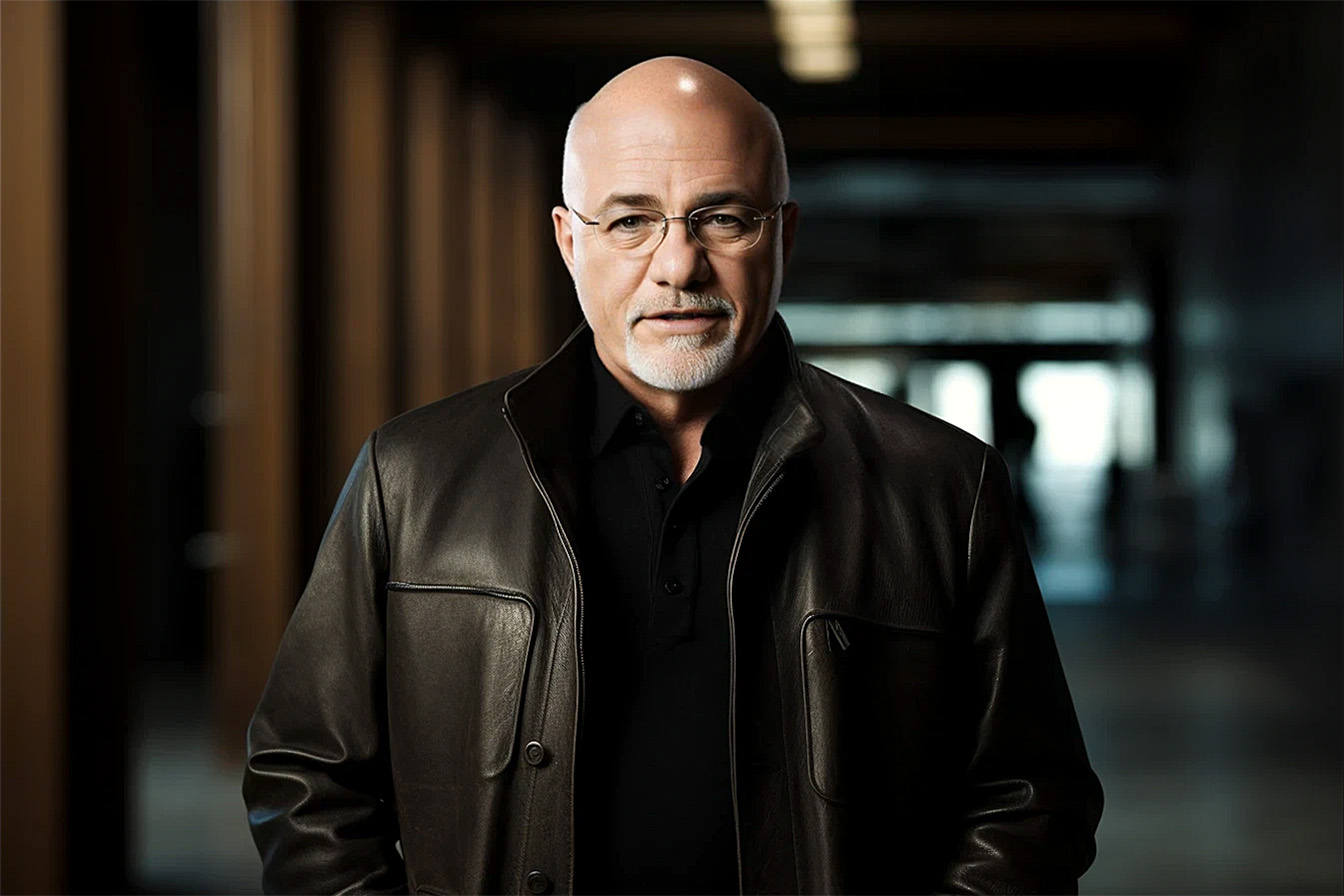

According to financial expert Dave Ramsey, early retirement is achievable for regular people. However, it requires severe discipline, thoughtful planning, and a willingness to make sacrifices that most people aren’t prepared to make. Ramsey has developed a proven system that has helped thousands of people achieve financial independence and retire years before the traditional age of 65.

1. Build Your Foundation with the Baby Steps

Before considering early retirement, you must get your basic finances in order. Dave Ramsey’s famous 7 Baby Steps provides the foundation for all wealth building, including early retirement. These steps include saving a $1,000 emergency fund, paying off all debt except your house, building a full emergency fund of 3-6 months of expenses, investing 15% for retirement, saving for kids’ college, paying off your home early, and finally building wealth and giving generously.

The key insight here is that early retirement isn’t just about saving more money faster. It’s about creating a stable financial foundation first. You can’t build lasting wealth if you constantly deal with debt payments, emergencies, or economic chaos. The Baby Steps ensure you have the discipline and systems to handle the aggressive savings required for early retirement.

2. Define Your Retirement Vision and Budget

Before you can determine how much money you’ll need, you must be clear about what your early retirement will look like. Are you planning to travel the world, or are you content with a simple lifestyle at home? Will you move to a lower-cost-of-living area or stay where you are? Do you want to pursue hobbies, volunteer work, or maybe start a small business?

Your retirement vision directly impacts your financial target. A globe-trotting retirement will require significantly more money than a quiet life of gardening and reading. Once you have a clear picture, create a detailed mock budget for your retirement years, including everything from housing and food to entertainment and healthcare. This budget becomes your roadmap for how much you need to save and invest.

3. Achieve Complete Debt Freedom

Here’s where Dave Ramsey’s approach differs dramatically from other retirement advice: you must be completely debt-free before you retire early. This means no credit card debt, no car payments, no student loans, and, most importantly, no mortgage payment. Many financial advisors suggest keeping a mortgage because of tax benefits or low interest rates, but Ramsey disagrees completely.

Debt will destroy your early retirement plans faster than almost anything else. When you have debt payments, you need more income to cover your expenses, which means you need a larger nest egg to generate that income. Plus, debt payments never go away and can’t be easily reduced if your investments perform poorly. By eliminating all debt, you dramatically reduce the money you need to maintain your lifestyle in retirement.

4. Navigate the Early Withdrawal Challenge

One of the biggest obstacles to early retirement is accessing your retirement accounts before age 59½. Most money in 401(k)s and traditional IRAs can’t be touched before this age without paying a hefty 10% penalty on top of regular income taxes. This creates a significant challenge for anyone wanting to retire in their 40s or 50s.

However, there are several strategies to work around this limitation. The Rule of 55 allows penalty-free withdrawals from your current employer’s 401(k) if you leave your job at age 55 or later. You can also set up substantially equal periodic payments under IRS Section 72(t), which allows penalty-free withdrawals in exchange for taking required distributions for at least five years. Additionally, Roth IRA contributions can be withdrawn penalty-free anytime, and taxable investment accounts have no age restrictions.

5. Follow Ramsey’s Real Estate Investment Rules

Real estate can provide excellent income during early retirement, but Dave Ramsey has particular rules about how to invest in property. First, you must have paid off your home completely before buying any investment property. Second, you must pay cash for all investment properties – no exceptions, no matter how good the deal seems.

These rules might seem overly conservative, but they protect you from the risks that destroy many real estate investors. When you own properties free and clear, you have maximum cash flow and no risk of foreclosure if the market turns bad. The cash-only approach also forces you to buy conservatively and avoid overleveraging yourself. While it takes longer to build a real estate portfolio this way, the income is much more reliable and stress-free.

6. Make Aggressive Lifestyle Changes

Early retirement requires saving rates that most people would consider extreme. While traditional retirement advice suggests saving 10-15% of your income, early retirement typically requires saving 50% or more. This means significantly cutting your spending in areas that most people consider normal expenses.

Everything becomes fair game for reduction: dining out, entertainment subscriptions, expensive vacations, new cars, designer clothes, and costly hobbies. The good news is that these lifestyle changes also prepare you for retirement spending. If you can live happily on half your income while working, you’ll need much less money to maintain that lifestyle in retirement. The key is finding a balance between enjoying life today and still making progress toward your early retirement goal.

7. Get Professional Guidance

Early retirement planning is complex, and the stakes are high if you make mistakes. Dave Ramsey strongly recommends working with a trusted financial advisor throughout your planning and retirement phases. A good advisor helps you stay on track, avoid costly mistakes, and adjust your plan as circumstances change.

Look for an advisor who understands early retirement strategies and can help you navigate the various account types, withdrawal strategies, and tax implications. They should also be able to explain complex concepts in simple terms and be patient enough to answer all your questions. Remember, you’re making decisions that will impact the rest of your life, so professional guidance is worth the investment.

8. Assess Your Readiness Honestly

Before leaping into early retirement, you must evaluate whether you’re truly ready. This means more than just having enough money saved – you also need to consider the emotional and practical realities of not having a regular paycheck. Do you have multiple income sources? Can your budget handle unexpected expenses or market downturns?

Ask yourself tough questions: Does your budget align with the lifestyle you want in retirement? Have you considered healthcare costs? What will you do with your time? Do you have a plan for staying mentally and socially engaged? Early retirement should enhance your life, not create new sources of stress or boredom.

Case Study: Lindsay’s Early Retirement Journey

Lindsay started following Dave Ramsey’s plan when she realized she was tired of living paycheck to paycheck despite earning a good salary as a marketing manager. She began with Baby Step 1, saving her first $1,000 emergency fund, which took her three months of cutting back on dining out and entertainment. This small success motivated her to use the debt snowball method to tackle her $45,000 in student loans and credit card debt.

After two years of intense focus, Lindsay was completely debt-free except for her mortgage. She then built her full emergency fund and invested 15% of her income in retirement. But Lindsay wanted more—she dreamed of early retirement to travel and write a novel. She increased her savings rate to 60% by moving to a smaller apartment, cooking all her meals at home, and finding free entertainment options. She also started a side business doing freelance marketing work.

By age 35, Lindsay had paid her mortgage and accumulated enough in retirement accounts and taxable investments to support her modest lifestyle. She had also purchased a small rental property with cash, which provided additional monthly income. Lindsay could retire from her corporate job and pursue her dreams while still in her thirties. Her success came from consistently following Ramsey’s principles and being willing to make short-term sacrifices for long-term freedom.

Key Takeaways

- Early retirement is possible for regular people but requires extreme discipline and sacrifice that most people aren’t willing to make.

- Before pursuing early retirement, you must complete Dave Ramsey’s 7 Baby Steps to build a solid financial foundation.

- Being completely debt-free, including paying off your mortgage, is essential for early retirement success.

- To determine how much money you’ll need to save, you need a clear vision of your retirement lifestyle and a detailed budget.

- The 59½ rule creates challenges for accessing retirement accounts early, but legal strategies exist to work around this limitation.

- Real estate can provide retirement income, but only if you follow Ramsey’s strict rules of paying cash and owning properties free and clear.

- Early retirement typically requires saving 50% or more of your income, which means making significant lifestyle changes.

- Professional financial guidance is crucial for navigating complex strategies and avoiding costly mistakes.

- You must assess your financial and emotional readiness before leaping into early retirement.

- The short-term sacrifices for early retirement can lead to decades of freedom and financial peace.

Conclusion

Dave Ramsey’s approach to early retirement isn’t about get-rich-quick schemes or risky investments. Instead, it’s built on debt freedom, disciplined saving, and conservative investing. While his methods may seem slow or overly cautious compared to other strategies, they provide a reliable path to financial independence that doesn’t depend on market timing or perfect execution.

Early retirement isn’t for everyone. It requires sacrifices that many people aren’t willing to make, as well as maintaining discipline over many years. However, for those who are committed to the process, Ramsey’s system provides a proven roadmap to financial freedom. The key is starting with the Baby Steps, getting completely out of debt, and then aggressively saving while living below your means. With patience and persistence, early retirement can become a reality rather than just a dream.