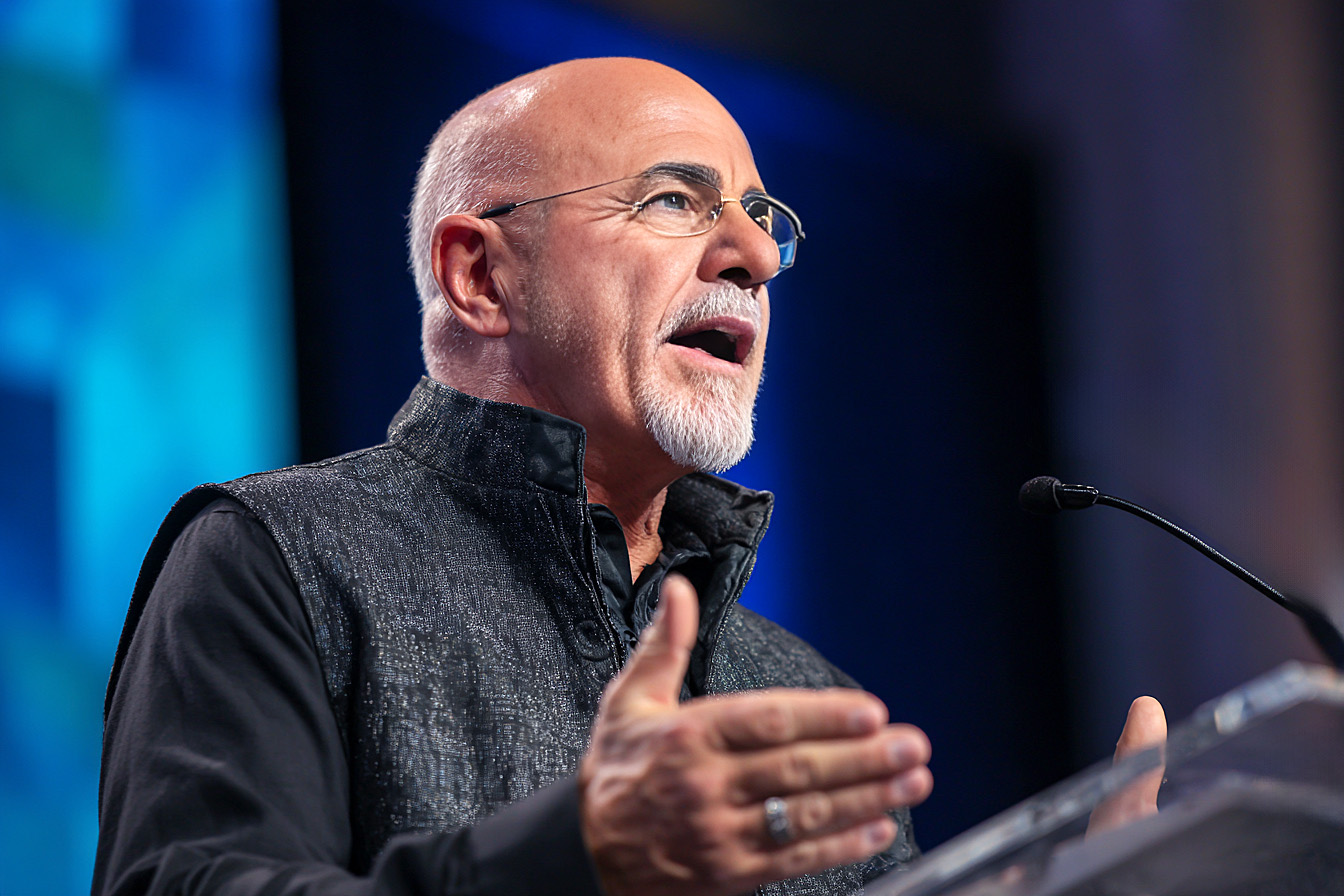

Financial stress affects millions of American families, with studies showing that a significant percentage of households live paycheck to paycheck regardless of income level. Dave Ramsey, who has helped millions of Americans achieve financial peace through his proven system, consistently identifies patterns in the financial mistakes that cost middle-class families decades of wealth building.

The ten lessons below represent the most common financial missteps middle-class people discover too late in their financial journey. Learning these principles early versus late can mean the difference between financial stress and true financial success.

1. Living Below Your Means is Non-Negotiable

The foundation of wealth building starts with spending less than you earn, yet this basic principle eludes many middle-class families. Dave Ramsey emphasizes that you must live on less than you make, not just break even each month. The difference between earning $70,000 annually and spending $72,000 versus spending $60,000 is the difference between financial survival and wealth accumulation.

Lifestyle inflation becomes the primary culprit as people increase spending to match their income growth. This means making conscious choices about purchases and avoiding the temptation to upgrade your lifestyle every time your paycheck increases. The families who master this principle create the margin necessary for building emergency funds, paying off debt, and investing for the future.

2. The Emergency Fund Comes First

Many middle-class families jump into investing or paying extra on their mortgages without building a proper emergency fund. Dave Ramsey’s Baby Steps system prioritizes building a $1,000 starter emergency fund first, followed by 3-6 months of expenses once debt is eliminated. This approach recognizes that life’s unexpected expenses are inevitable, and debt often results from being unprepared for these curveballs.

An emergency fund prevents families from sliding backward into debt when the car breaks down, medical bills arise, or job loss occurs. This step comes before all other financial goals, including investing, because it provides the stability needed to maintain progress on other financial objectives.

3. Debt is the Enemy of Wealth Building

While society normalizes car payments, credit card debt, and student loans, Dave Ramsey teaches that debt payments steal your most powerful wealth-building tool: income. Every dollar going to debt service represents a dollar that can’t work for your future through compounding investment gains.

The opportunity cost becomes staggering when you calculate how monthly debt payments could grow if invested instead. For example, $500 monthly in debt payments could become substantial retirement savings over decades when invested in growth stock mutual funds. Beyond the mathematical impact, debt creates psychological stress and limits your options during financial emergencies or career transitions.

4. The Debt Snowball Works Better Than Math

Dave Ramsey’s debt snowball method focuses on paying minimum payments on all debts except the smallest, which receives every extra dollar until eliminated. This approach prioritizes behavioral psychology over mathematical optimization, recognizing that personal finance is more about behavior than mathematics.

While the debt avalanche method (paying the highest interest rates first) might save money mathematically, the debt snowball creates psychological wins that maintain momentum. Small victories build confidence and create the emotional fuel to tackle larger debts. The method works because it acknowledges that most people need encouragement and quick wins to stick with their debt-elimination plan.

5. Your Car is Not an Investment

Middle-class people often justify expensive car payments by calling vehicle investments or making them necessary for work. Dave Ramsey advocates for reliable, paid-off used cars that get you from point A to point B without a monthly payment eating into your wealth-building potential.

New cars depreciate rapidly, losing significant value immediately upon purchase. The total cost of ownership, including payments, insurance, and maintenance, can consume a substantial portion of a family’s income. Instead of driving your wealth away through car payments, Ramsey suggests purchasing reliable used vehicles with cash and investing the difference. Transportation should serve your financial goals, not undermine them.

6. Insurance is About Protection, Not Investment

Mixing insurance with investing through whole-life insurance policies represents a costly mistake many middle-class families make. Dave Ramsey teaches the principle of “buy term life insurance and invest the difference” because the insurance industry’s investment products are expensive and typically underperform compared to simple mutual funds.

Whole life insurance policies combine insurance with a savings component, but the investment returns are generally poor compared to dedicated investment vehicles. Term life insurance provides the protection your family needs at a fraction of the cost, allowing you to invest the difference in better-performing options. Insurance should protect your family’s financial future, not be your primary investment strategy.

7. You Don’t Build Wealth with Credit Cards

Despite cashback rewards and points programs, credit cards encourage overspending and create financial risk. Dave Ramsey advocates for debit cards and cash because the psychological pain of parting with real money leads to more thoughtful spending decisions. Research shows that people spend more on credit cards than cash, which typically negates any rewards earned.

The average credit card interest rates can quickly compound, turning small purchases into expensive debt. Cash and debit cards create natural spending limits and eliminate the temptation to spend money you don’t have. Building wealth requires discipline in spending, not maximizing credit card rewards.

8. Investing Doesn’t Have to Be Complicated

Many middle-class investors get paralyzed by options or fall for complex investment schemes promising quick returns. Dave Ramsey promotes simple, diversified mutual funds with long track records, emphasizing consistency and the fact that time matters more than picking the perfect investment.

The stock market has historically provided solid returns over long periods, and trying to time the market or find the next hot investment often leads to poor results for the average retail investor. Analysis paralysis keeps many people from starting their investment journey, missing years of potential compound growth. Starting with simple, well-diversified mutual funds allows you to begin building wealth while learning about investing over time.

9. Your Income is Your Greatest Wealth-Building Tool

Too many people focus exclusively on cutting expenses while ignoring their earning potential. Dave Ramsey encourages investing in yourself through education, skills development, and career advancement because there’s a practical limit to how much you can cut from your budget. Still, there are fewer limitations on how much you can earn.

Developing new skills, pursuing certifications, or advancing your career can provide income increases that dwarf expense reductions. Side hustles and additional income streams can accelerate debt payoff and wealth building. Families focusing on increasing their income while controlling expenses create the most significant margin for financial success.

10. Retirement Planning Can’t Wait

Middle-class people often delay serious retirement investing until their 40s or 50s, missing decades of compound growth. Dave Ramsey emphasizes that starting early with consistent contributions, even small amounts, is far more powerful than trying to catch up later with larger contributions.

The power of compounding gains and dividend reinvesting works best with time, and every year of delay significantly increases the amount needed to reach retirement goals.

Someone who starts investing small amounts in their twenties can accumulate more wealth than someone who begins with larger amounts in their forties. Employer matching contributions represent free money that should never be ignored, and consistent investing over time typically outperforms attempts to time the market without a system or an edge.

Conclusion

These ten financial lessons represent behavioral changes rather than complex financial strategies. Middle-class families have the income necessary to build substantial wealth if they follow these proven principles consistently.

Dave Ramsey’s success stories demonstrate that millions of ordinary Americans have achieved financial peace by implementing these straightforward concepts. The key lies in starting with small steps, beginning with that first $1,000 emergency fund, and building momentum through consistent action.

While applying these lessons is never too late, starting sooner creates exponentially better results. Financial peace isn’t about having a high income; it’s about having the right behaviors and making intentional choices with your income.