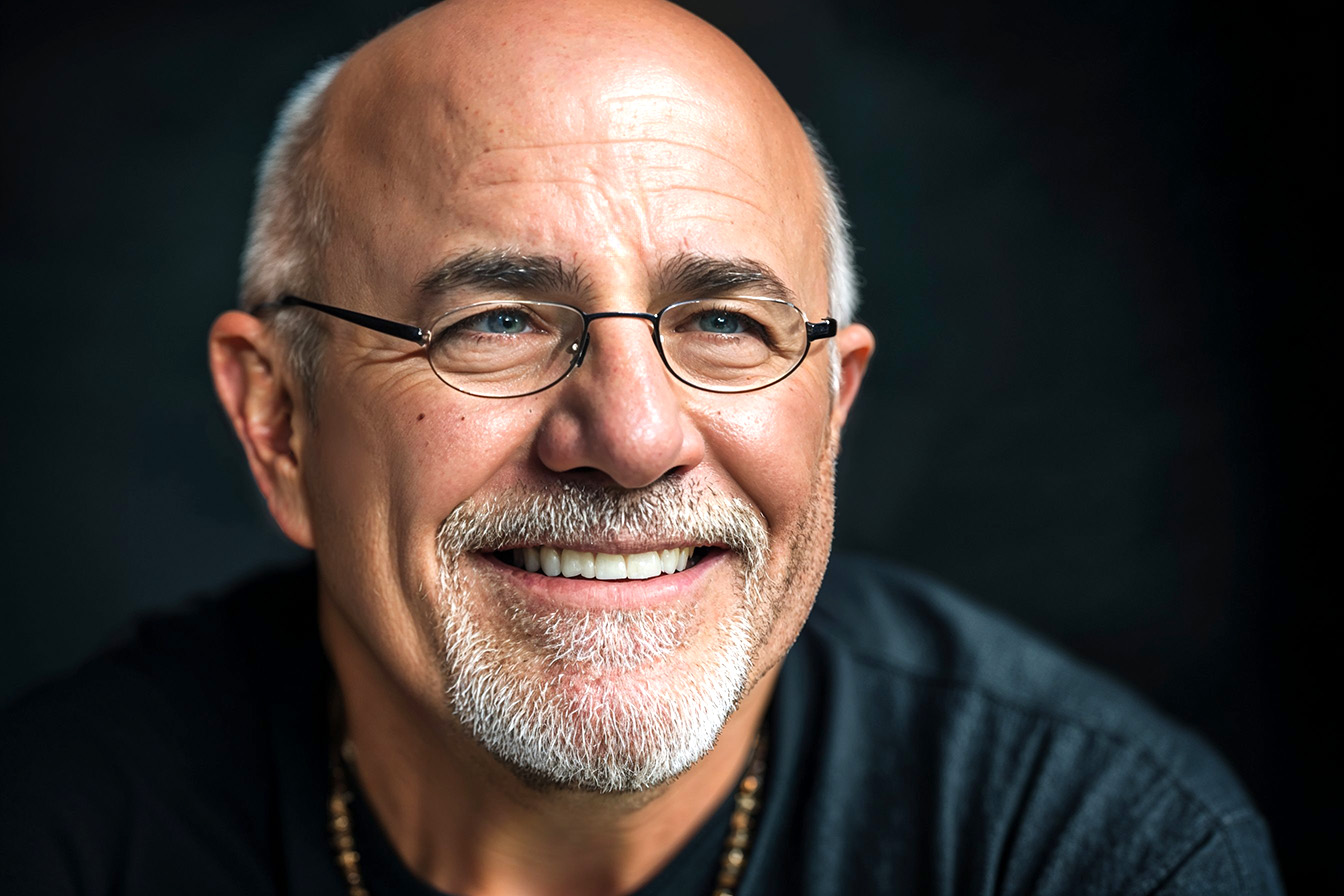

“Personal finance is only 20% head knowledge. The other 80% — the bulk of the issue — is behavior.” These words from financial guru Dave Ramsey reveal an uncomfortable truth: most of our money problems aren’t about math or income levels. They’re about the small, seemingly harmless habits we repeat daily.

You might think your financial struggles come from not earning enough money. But Ramsey, who built his empire after going bankrupt, says the real culprit is much closer to home. Those daily behaviors quietly drain your bank account while you’re not paying attention. The good news? Once you identify these habits, you can break free from the money rut holding you back.

1. Not Paying Attention to Where Your Money Goes

The most significant money mistake people make isn’t dramatic or noticeable. It’s simply not paying attention to where their cash disappears each month. Ramsey bluntly says, “I tried to out-earn my stupidity for years and couldn’t do it. I had to start paying attention and make the money I have.” Most people have no idea where their money went last month, let alone last week.

Think about those quick stops at convenience stores, the daily $5 coffee, or the random items you throw in your cart while grocery shopping. These small purchases feel harmless but add up to hundreds or even thousands of dollars over time. You’re driving blindfolded down a financial highway while not tracking your spending. Ramsey’s solution is simple: make a list before you shop and only take enough cash to buy what you need.

2. Impulse Buying to Impress Others

One of Ramsey’s most famous observations is, “We buy things we don’t need with money. We don’t have to impress people we don’t like.” This statement hits hard because it’s so true. How often have you bought something not because you needed it but because of how it would look to others? Ramsey calls this “financial pride, one of the fastest ways to stay broke.”

This habit shows up in everyday purchases more than you might realize. Maybe you buy designer clothes to fit in at work, upgrade your phone every year to keep up with friends, or lease a fancy car to make the right impression. But here’s what Ramsey discovered through his research: the typical millionaire lives in a middle-class home, drives a two-year-old paid-for car, and shops at regular stores. The people who have money aren’t trying to impress anyone. Before making any purchase, ask yourself: “Would I buy this if no one ever saw it?”

3. Making Emotional Money Decisions Driven by Fear

Fear might be the most dangerous emotion when it comes to money decisions. Ramsey explains the cycle perfectly: “When you get desperate, just about twenty seconds after I get desperate, I get stupid. And right after I get stupid, I get broke.” When we’re scared about money, we make terrible choices that worsen our situation.

This shows up in different ways for different people. Some folks turn to payday loans or title loans when they’re desperate, not realizing these trap them in even worse debt cycles. Others panic and sell their investments when the market drops, locking in losses instead of riding out the storm. Some people even play the lottery regularly, hoping for a miracle rescue from their financial problems. The key is building an emergency fund so you never have to make money decisions from a place of fear or desperation.

4. Lifestyle Inflation Without a Plan

One of the sneakiest money habits is lifestyle inflation. This happens when your income increases, but instead of saving the extra money, you immediately find new ways to spend it. You get a raise and suddenly “need” a bigger apartment, fancier meals, or more subscriptions. Before you know it, you’re spending even more than you make, despite earning more money.

Ramsey notices this pattern everywhere: “People are anxiety-ridden by the economy, and they’re boxed in. Yet they spend like they’re in a prosperous economy, buying superfluous stuff instead of necessities.” The problem is that we adapt quickly to new spending levels. After just a few weeks, that premium cable package or meal delivery service feels necessary. The solution is to live below your means consciously, no matter how much you earn, and automatically save or invest any income increases.

5. Not Having a Written Budget

The final habit that keeps people stuck is flying blind financially. Without a written budget, you hope it works out each month instead of making it work. Ramsey says, “You must gain control over your money, or the lack of it will forever control you.” A budget isn’t about restricting yourself; it’s about taking control.

When you don’t have a plan for your money, every spending decision becomes a separate choice with no context. You might buy lunch out because you feel like it, not realizing that money was supposed to go toward your credit card payment. Or you might skip saving because some other expense came up without considering your long-term goals. Ramsey advocates for zero-based budgeting, where every dollar has a specific job before the month begins. This way, you’re telling your money where to go instead of wondering where it went.

Case Study: Karen’s Money Transformation

Karen was stuck in a cycle she couldn’t break. Despite earning a decent salary as a marketing coordinator, she never seemed to have any money left at the end of the month. She was frustrated because she felt like she should be doing better financially, but somehow, she always found herself stressed about money. Karen’s biggest problem was that she had no idea where her money was going each month.

Like many people, Karen fell into several of these daily habits without realizing it. She grabbed coffee and a pastry on her way to work most mornings, ordered lunch when busy, and frequently shopped online in the evenings to unwind. When her friends got the latest gadgets or clothes, she felt pressure to keep up. She also tended to avoid looking at her bank account when money felt tight, making her more anxious about her finances.

Everything changed when Karen decided to track every penny for one month. She was shocked to discover she was spending over $300 monthly on food and coffee outside her grocery budget, plus another $200 on random online purchases. Armed with this information, she created her first real budget and started making conscious choices about her spending. Within six months, Karen had paid off her credit card debt and began building an emergency fund. The same income that used to disappear now provided her with financial security and peace of mind.

Key Takeaways

- Track every dollar you spend for at least one month to understand your spending patterns.

- Make a written budget before each month begins and assign every dollar a specific purpose.

- Question whether purchases are driven by genuine need or the desire to impress others.

- Build an emergency fund to avoid making desperate financial decisions during tough times.

- Resist lifestyle inflation by automatically saving any income increases instead of spending them.

- Use cash for discretionary spending categories to create natural spending limits.

- Wait 24 hours before making any non-essential purchase to avoid impulse buying.

- Focus on building wealth quietly rather than looking wealthy through expensive purchases.

- Remember that financial success is 80% behavior and only 20% knowledge.

- Take control of your money before it controls you by creating and following a plan.

Conclusion

Breaking free from these five daily habits isn’t about depriving yourself or living like a monk. It’s about becoming intentional with your money instead of letting it slip away through unconscious choices. The beautiful thing about focusing on behavior instead of income is that you can start making changes immediately, regardless of how much you currently earn.

Remember Dave Ramsey’s encouraging words: “Making mistakes with money means just one thing. It means you’re human. But the good news is that I can change it tomorrow. I can decide. I’m not spending money I don’t have anymore.” Your past mistakes or income level don’t determine your financial future. It’s defined by the daily choices you make starting today. Pick one of these habits to work on this week, and you’ll be surprised how quickly small changes can significantly improve your financial life.