The Art of Selling a Losing Position

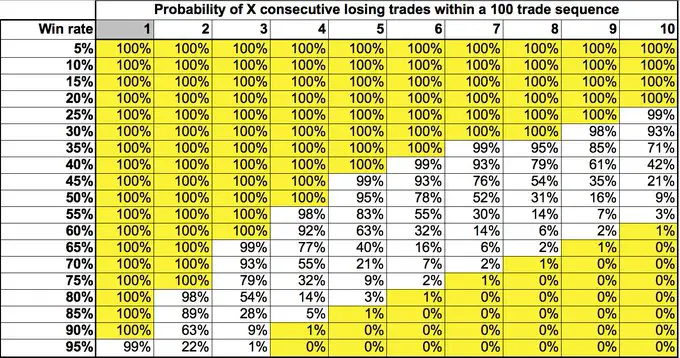

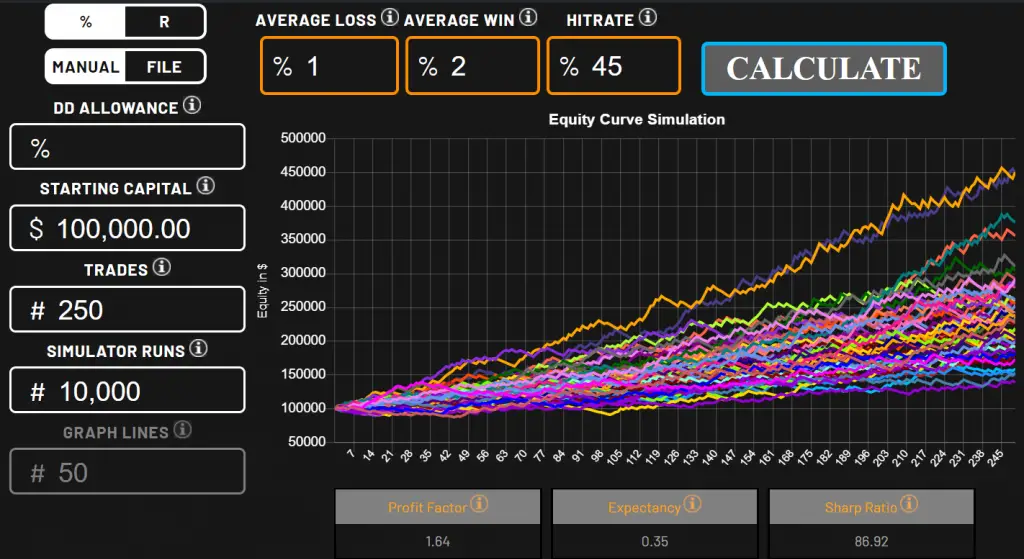

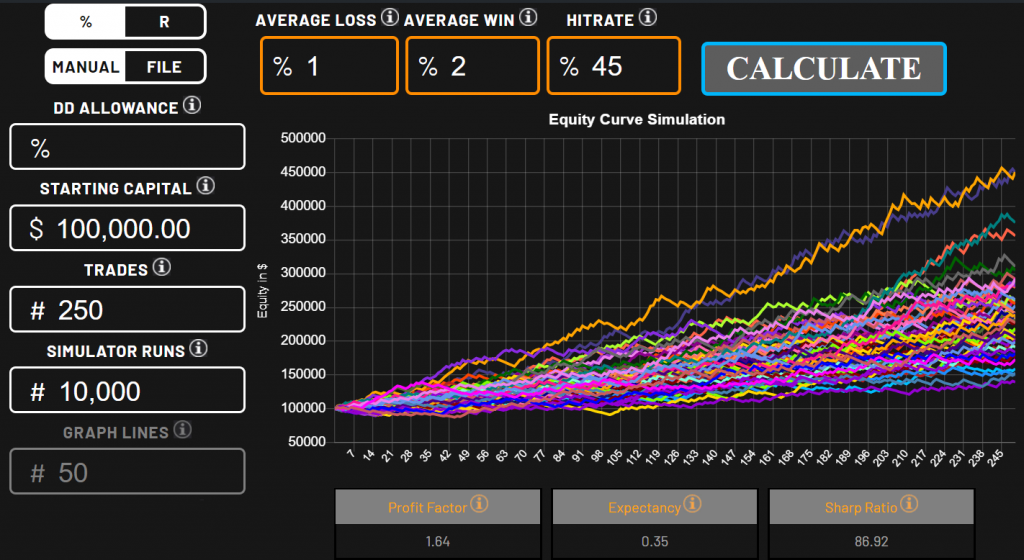

The art of selling a losing position is a key skill in the science of risk management. When you are in a trade that is losing money you have to know when it is time to exit and accept the loss. In theory stop losses and keeping your losses small are simple in concept but […]

The Art of Selling a Losing Position Read More »