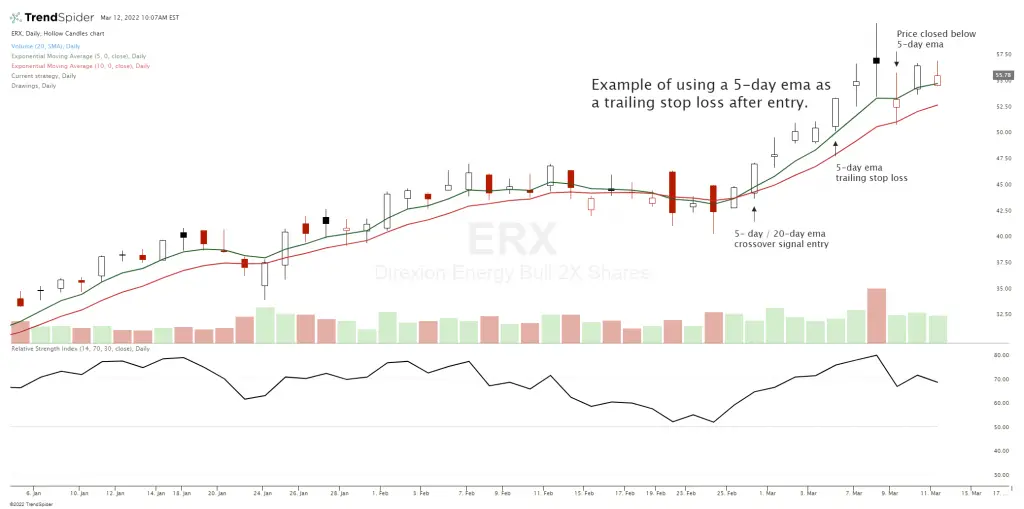

Position Sizing: Lessons for Risk Management

Understanding the nuances of position sizing and its implications for risk management is critical for success in trading. This often-overlooked aspect of a trading strategy holds the key to safeguarding your capital and maximizing your potential for long-term profitability. As traders navigate the complex world of the financial markets and their trade execution, managing risk […]

Position Sizing: Lessons for Risk Management Read More »