-

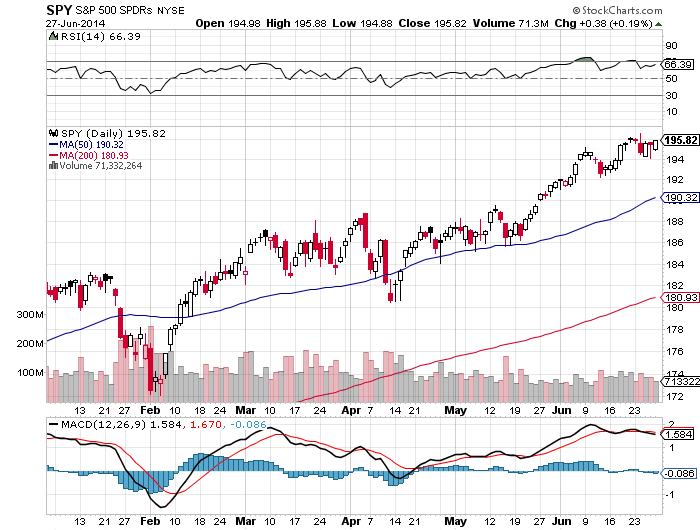

So far the stock market in 2014 does not care about anything but the central bank IV drip.

-

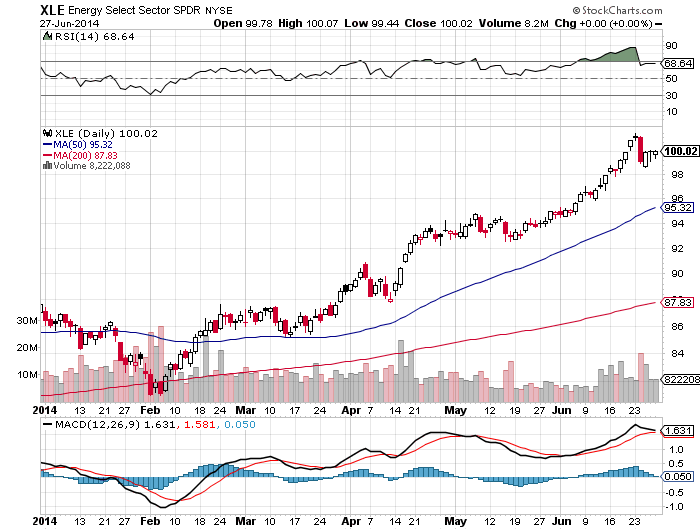

The bulls continue to run wild in the energy sector $XLE as they wait for some clarity in Iraq. $XLE did finally fall back to reality under the 70 RSI.

-

2104 has been the year of VERY low volatility and a very slow grinding up trend with all dips bought quickly.

-

The stock market has shrugged off all headline risk an continued to go higher this is very bullish.

-

The market rallied back quickly from the surprisingly bad GDP report last week, if unexpected bad news can’t get even a pull back, what can?

-

The year to date chart is incredibly bullish from a pure price standpoint.

-

The MACD bearish crossover does point toward a possible divergence and pullback in the short term. Or what is likely in 2014 called “A rare buying opportunity.”

-

A return to the 50 day would be a a normal occurrence inside a bull market and a high probability entry opportunity. This year it has bounced there intra-day and spent almost no time under that key level.

-

The market is currently in a $196 resistance $194 support range. The longer we stay in this range and build a base it could set us up for higher prices.

-

I will be looking to trade the long side dips next week with $SPY in the money call options. I will be watching for bounces at the $194 level and if possible the 50 day, if some risk off does come into play with Iraq or Ukraine next week I would be an aggressive buyer at the 30 RSI level intra-day. I am looking to play my long side swing signals. I will have to trade the signals I am given, and I am no hurry.

// ]]>