Everyone understands the simple process of buying a stock. You type in the stock symbol and how many shares you want then click buy, then when you are ready to sell your stock you press sell and the quantity of shares you want to sell. This is simple and easy to understand.

Selling a stock short can confuse some new traders as you are reversing the steps in the process. To sell short you first have to have a margin account with your broker. You will need to open a margin account to sell stocks shorts because shorting is selling something you do not own. Margin requirements are a type of loan that is collateral that backs the short position and provides safety that the borrowed shares will be returned to the owner. FINRA requires brokerage accounts to always have a minimum of 25% of the shorted stock value in cash in the account. If a trader sold short a stock position valued at $10,000 they must have at least $2,500 in cash in the account.

Now once you have the margin and cash to cover the short position then you can type in the ticker symbol and click the ‘sell short’ button. Your broker will have to find shares to ‘borrow’ from another account and sell them in the open market, the proceeds from the sell will be your credit from the short sell but you have to ‘buy to cover’ the position later. When you ‘buy to cover’ the short position that will be your debit purchase price to buy back the shares you were short in the open market, then your broker can ‘return’ the shares to the account they were borrowed from. This is all done electronically today and is computerized. A short sell reverses the sequence of trading, you sell first and then buy. If you sell short for more than you buy it back you have made money. It is called a short sell because you are ‘short’ the stock that you sold and owe it to the seller you borrowed it from. While you are short a stock you also will have to pay margin interest on the position size. You will also have to pay any dividends on the stock that are due during the time period you are short.

Short selling and buying back at lower prices in the stock market can be more difficult than buying and selling at a higher price as the stock market tends to go up or sideways the majority of the time. Stock market sell offs are usually brief in time span and volatile in movement and also have some of the biggest rallies as they go down.

Most of the time the long side is the best side to trade in the stock market. Also the math for returns on the long side are more favorable as the upside of a stock is unlimited. A stock priced at $10 that you buy that then goes up to $110 is a 1,000% return on capital. A stock priced at $100 that you sell short that falls to $10 is a 90% return on your capital. The upside returns for long positions are uncapped while the most you can return on a short position is 100% if the stock goes to zero. Long side position losses are capped at 100% if your stock goes to $0 but the short side is uncapped as a stock can go up to any price in theory, that is why it is crucial to use a stop loss on short positions to cap your losses.

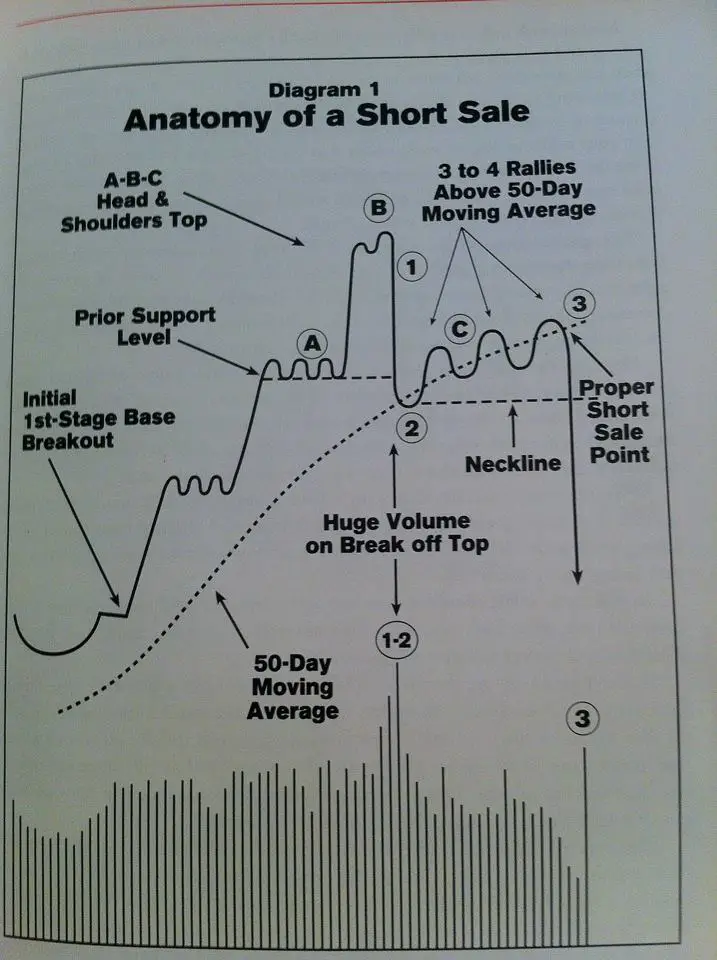

The best process I have seen and used for short selling in the past is in William J. O’Neil’s book: How to Make Money Selling Stocks Short. Finding individual stocks under distribution after a big run up gives traders the best probability of success on the short side in my opinion and experience. You want to see a stock with a bearish chart pattern like a head and shoulders or double top and in a confirmed downtrend under the 50 day moving average before you sell it short.

This is a page from William J. O’Neil’s book: How to Make Money Selling Stocks Short

This post is for informational and educational purposes only and is not investment advice.