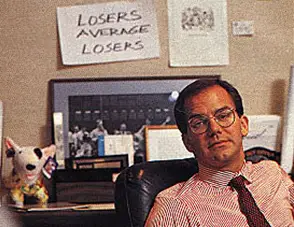

The legendary Paul Tudor Jones is one of the best traders and money managers of his generation. He had no losing years in his primary fund over multiple decades. PTJ more than doubled his assets under management during the Black Monday Crash of 1987 on the same day other traders, investors, and money managers faced huge drawdowns. He is ranked at 432nd richest person on the Forbes billionaires list of wealth. His net worth is around $5.8 billion and continues to grow. Here is a look at his current stock portfolio to see how he manages his position sizing and diversification when putting billions of dollars to work.

Tudor Investment Holdings has $2.25 billion under management in this portfolio with 1,222 different stock holdings and 24.18% allocated to the top 20 holdings in its stock hedge fund portfolio.

Below is the current top 50 publicly traded holdings in the Current Paul Tudor Jones Portfolio in 2020 after his Q3 update. This is a breakdown of his top 50 trading and investing portfolio positions from his fund’s 13F filings as of the 3nd quarter of 2020.

Ticker Symbol/Company/Portfolio distribution percentage

ADSW Advanced Disp Svcs Inc Del Com 5.25%

GLIBA Gci Liberty Inc Com Class A 3.16%

GRUB Grubhub Inc 2.15%

IMMU Immunomedics Inc 2.00%

AIMT Aimmune Therapeutics Inc 1.51%

NGHC National Gen Hldgs Corp 1.41%

AAPL Apple Inc 1.02%

KC Kingsoft Cloud Hldgs Ltd Ads 0.90%

KDP Keurig Dr Pepper Inc Com 0.87%

PCG Pg&e Corp 0.72%

LSXMK Liberty Siriusxm Group Cl C 0.72%

Goodrx Hldgs Inc Com Cl A 0.55%

DIS Disney Walt Co 0.54%

TEAM Atlassian Corp Plc 0.52%

AMT American Tower Corp 0.51%

MSFT Microsoft Corp 0.49%

OTIS Otis Worldwide Corp Com 0.48%

VICI Vici Properties 0.48%

CME Cme Group Inc. 0.45%

AMZN Amazon Com Inc 0.45%

GOOGL Alphabet Inc 0.45%

PJT Pjt Partners Inc 0.45%

ADBE Adobe Sys Inc 0.44%

HEC Hudson Executive Invt Corp Com Cl A 0.43%

FSLR First Solar Inc 0.43%

CVX Chevron Corp 0.42%

LIN Linde Plc Com 0.41%

AMD Advanced Micro Devices Inc 0.41%

BDX Becton Dickinson And Co. Dep Shares Mand Conv Preferred Stock Series A 0.40%

RILY B Riley Finl Inc 0.39%

Rackspace Technology Inc Com 0.39%

KMB Kimberly Clark Corp 0.37%

ALXN Alexion Pharmaceuticals Inc 0.36%

BLK Blackrock Inc – Cl A 0.36%

ATVI Activision Blizzard Inc 0.35%

DLR Digital Realty Trust Inc 0.35%

V Visa Inc 0.34%

LSI Life Storage Inc 0.34%

RPAY Repay Hldgs Corp Com Cl A 0.33%

NOW Servicenow Inc 0.33%

TCO Taubman Centers Inc 0.32%

GIS General Mls Inc 0.32%

ADT Adt Inc Com 0.32%

XOM Exxon Mobil Corp 0.32%

ZM Zoom Video Communications In Cl A 0.31%

HD Home Depot Inc 0.30%

WMT Wal-mart Stores Inc 0.30%

TJX Tjx Companies Inc 0.29%

STND Standard Avb Finl Corp Com 0.29%

ADI Analog Devices Inc 0.29%

PYPL Paypal Holdings Inco 0.28%

TXG 10x Genomics Inc Cl A Com 0.28%

NSA National Storage Affiliates 0.28%