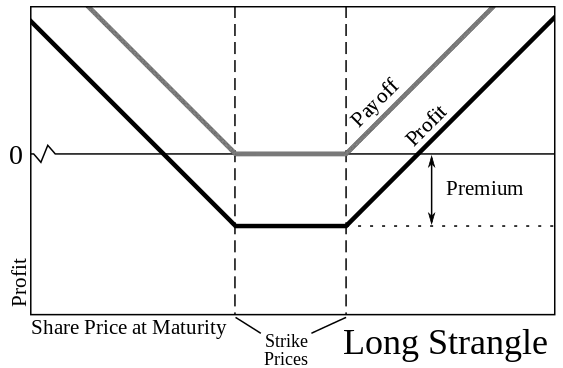

Traders who strongly believe the price of an underlying asset will change significantly in the near future but are unsure about the direction of the move can trade combinations of options that have different directional bias and strike prices. A long strangle is an option play designed to bet on a big move in either direction for an underlying stock . These are option trading strategies that combine both puts and calls to create positions that do not depend on the direction of the market movement for their profitability just the magnitude of the move. Long strangles make money if the stock price moves up or down significantly before the expiration of the options and create more profits than the cost of the option premium for both sides of the play.

A long strangle is long call options at a higher strike price and long put options at a lower strike price at the same expiration and on the same stock. Such a position makes money if the stock price moves up or down well past the strike prices of the strangle. Both long call and put options are out-of-the-money strikes. A strangle tries to buy the extrinsic value of two options and profit from one side having more intrinsic value by expiration than the cost of both options. There are higher costs and risks with these strategies than standard one sided option plays.

- Long strangles can be low risk plays during big price moves as one side of the options will go up in value when the other side goes down in value the majority of the time.

- If one side of the option play become worthless it generally means the other side is worth more.

- You can make money on strangles even when you do not know which way the chart will move.

- It is less stressful to hold an option position when there is a hedge in place if one of the options move against you.

- The big risks are transferred from the option buyer of the long strangle to the option sellers of the calls and puts in this play.

- Strangles lose small with small movements but win big when there is a big move. They are asymmetrical bets in their construction. The maximum loss is both the options premiums if price ends between both strike prices but the upside profit is uncapped until the options are sold.

- If one side of the option sellers have an outsized move against them you will be on the other side of their position and be the trader their capital flows to.

- Long strangles can be played on any time frame.

- With the long strangles the winning side has a growing delta and the losing side has a shrinking delta.

- Long strangles can be used to capture trends, volatility, and reversals.

Where is the risk?

- Time is against the strangle play, theta value is being lost as you wait for the move to take place.

- You have bigger liquidity risk with options than with stocks, only play options with tight bid ask spreads. It costs money to get in and out of these trades buying the ask and selling the bid. Focus on front month and close to the money options for maximum liquidity.

- Long strangles can go down in value if implied volatility decreases and is priced out.

- When they become profitable they transform into directional bets with high delta risk and you must exit properly to lock in those profits.

- Commission costs are generally more expensive with options than stocks. Be aware of how much it costs with different numbers of contracts and how that will effect your P&L.

The long option strangle is a bet on the magnitude of a move or trend within a certain time frame and is directionally neutral.

Gxti, CC BY 3.0 <https://creativecommons.org/licenses/by/3.0>, via Wikimedia Commons

I created my Options 101 eCourse to give a new option traders a shortcut to a quick and easy way to learn how stock options work.