This is a guest post by Mike Semlitsch @ForexFalcon_com on Twitter.

During the years I learned that the price moves in the financial markets are 90% random and only 10% of the time they are not random. Therefore, a trader should only trade during that 10% of the time when he can predict the direction of the next price move with high certainty.

In this article you will learn how to detect one of the most profitable patterns that I know! With those patterns you can predict the next price move with very high probability.

I call these chart patterns “Mini Bubbles” and “Mini Crashes”. These chart patterns usually develop every month on different pairs. And because they develop relatively often, it can be very worthwhile for you to learn how to detect them.

But before we go into the details about these patterns, I want to emphasize why you should aim for the highest quality (highest probability) in your trading.

Behave Like A Professional Gold Hunter

As a trader you have limited resources (money, time, nerves…) similar to a professional gold hunter. Maybe you have watched the netflix series “Aussie Gold Hunter”. Then you know what I mean.

Gold hunters have fixed costs and only limited time to earn enough money to cover the costs. If they want to stay in the business then they need to have a professional approach that guarantees that they find enough gold within their limited time.

Therefore, a professional gold hunter would NOT search for gold at a random place. The following illustration shows this fruitless approach where you would maybe find some gold by chance from time to time:

But most traders, especially the novice traders, do exactly this error. They use a trading system (a set of rules that defines trade entries and exits) and they follow the rules blindly.

Such a trading system tells you e.g. if indicator A does X and indicator B does Y then go long.

But these traders are completely ignoring the bigger picture of the chart situation. Many signals of their system are doomed to fail because the bigger picture is acting against your signal. For example if a major support/resistance is in the way of the trade and therefore has little to no chance to succeed!

A simple filtering of the worst signals (avoiding those with the lowest chance to succeed) would already help a lot to improve their trading results.

Therefore, as a trader you should avoid this trading error and never trade blindly:

Experienced traders have learned what makes the difference between a losing trader and a winning trader.

An experienced trader trades less often. Similar to a professional gold hunter who does NOT dig for gold at a random spot, an experienced trader does NOT trade anywhere on the chart.

On the contrary, an experienced trader uses a professional approach to detect the best chart area and only trades when the situation is promising:

Most probably even a simple moving average crossover trading system would be profitable, if it is only executed within the best chart situations.

Therefore, the most important part in trading is to find the most promising chart situations!

I call these chart situations SETUPS. Within these setups you will get SIGNALS from your trading system.

Every trade should have the following components:

1. A good setup

2. A good signal

Only if the setup AND the signal are good then you have a very promising trade with a high probability of success! In my opinion, this is the key to join the constantly winning traders!

The annotations within the following illustration are showing what I mean exactly:

One Of The Best Setups: Bubbles And Crashes

The following explanations are based on examples of mini bubbles. But these explanations are also valid for mini crashes into the opposite direction, because mini crashes are inverted mini bubbles.

As a trader you most have already heard of the term “bubble”. There was a tulip bubble, bitcoin bubbles and stock market bubbles.

The mini bubbles which occur in the forex market are smaller and can be detected on the H1 timeframe. They only need some days to weeks to develop.

And those mini bubbles produce one of the most reliable subsequent price moves that I know!

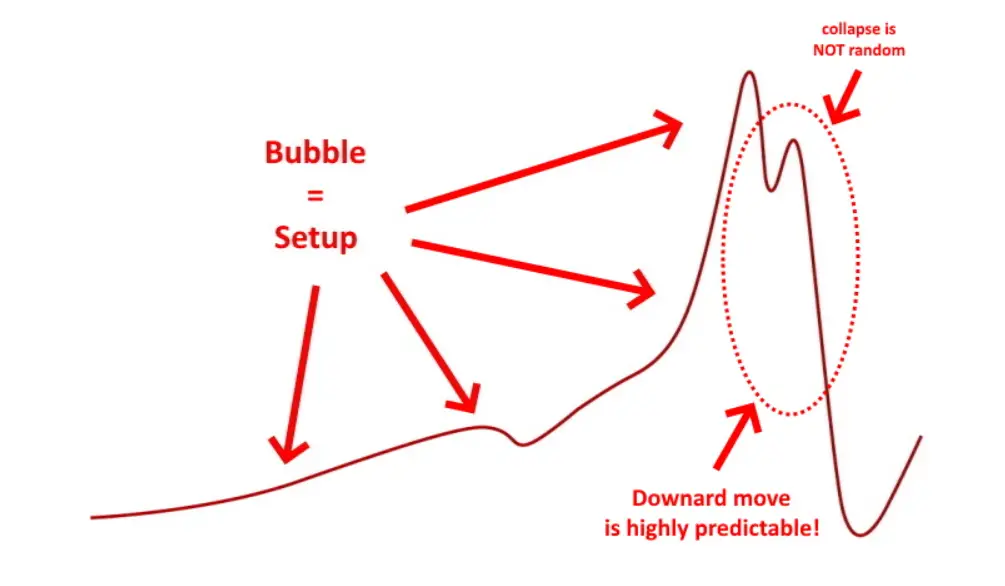

Knowing beforehand if a bubble will develop is NOT possible. But AFTER a bubble has developed then the direction of the next big move is highly predictable.

Schematically a mini bubble looks as shown in the following illustration:

The collapse of the bubble is the profit move for your sell trade. Usually the drop of the price is very strong and long lasting.

I have created trading tools which can enter at the top of bubbles fully automatically (V-Power EA, DTB EA) and other trading tools which give entry alerts in real-time (DTB Alerter). If you download and test the free versions of these tools then you will automatically receive my daily chart analysis where I detect mini bubbles and mini crashes for you.

The visual detection of the best chart situations is crucial to stay constantly profitable.

The more edges you get from the bigger picture (the high probability chart situation) which help your signal to succeed, the higher the winning percentage of the entry signal will be.

The very best mini bubbles and mini crashes have 4 edges which help the signal to succeed! I will explain everything in detail in the remaining part of the article.

In the following illustration you can see how the 4 edges help your entry signal to succeed:

Real Chart Examples Of Bubbles

We will now examine how mini bubbles look like and how you can detect them.

Besides other approaches, trend channels are imho the best way to detect mini bubbles and mini crashes.

First you need to find a trend which starts relatively strong and has a duration of 2+ days. I call this part the “initial trend”. The trend needs then to show a “substantial pullback” which is followed by an even steeper trend than the initial trend. For a complete bubble the steeper trend will get even steeper at the end and forms a so called “blow off top”.

In the following screenshot you can see the initial trend within the right green ellipse. In this example the duration of the initial trend was 8 days (the vertical dotted lines separate the different trading days).

The substantial pullback is labeled with the red dotted ellipse. In terms of trading bubbles this pullback is called “a bear trap” where the bearish traders are caught on the wrong side.

The subsequent extremely strong upward trend, labeled with the right green ellipse, defines the beginning of the mini bubble. After the bubble started you can draw the base trend line which connects the low at the beginning of the initial trend and the lowest low of the substantial pullback (the bear trap):

In Mt4 you can now copy this trend line and move the copied line upwards until the line touches the highest high of the initial trend, as shown in the following screenshot.

With the help of the channel you can exactly see where the channel overshoot occurred and which also defines the beginning of the mini bubble.

Above of the trend channel the price is in an overbought condition.

The free space below of the price until the base trend line is the area for a high probability downward move (where you can make profits with high probability).

Within this free space you can expect little to no support which could stop the downward move. Therefore, the price will most probably drop through with only little interruption:

But until now the highest probability chart situation has still not completely developed. One key part for the bubble is missing!

As I already mentioned above, a bubble ends with a so called “blow off top” which means that the already steep trend gets even steeper.

To detect the blow off top you can draw a second (smaller) trend channel.

This smaller trend channel is drawn according to the price action after the overshoot of the first channel occurred.

Now you need to wait until the price also overshoots this second trend channel. If that happens, then the price is within a crazily strong overbought condition and the bubble has most probably reached the final stage before it will collapse!

As you can see in the next screenshot, the free space below of the price has grown even more. This means that you can expect an even bigger profit move and an even faster downward move especially at the beginning of the collapse of the bubble:

As I already mentioned above, there are trading tools (V-Power EA, DTB EA) which can be activated to make automatic entries. The most logical time to activate them is when the price overshoots the second trend channel.

At that moment, the visual quality checks of the setups are completed. You are now sure that a highest probability setup has developed. Now an EA can do the boring/time consuming part and wait for the entry signal to open the position for you.

If you have time to watch the chart yourself and if you have time to do manual trading then I’m sure that a simple moving average crossover sell signal will be profitable after the bubble collapses:

The best mini bubbles and the strongest reversal/collapse moves develop if the blow off top of the bubble reaches a major resistance level. In one of my next articles I will explain in detail why this is an additional “quality booster” of the setup:

Mini bubbles and mini crashes can develop in different sizes and during longer or shorter time spans. In the example above the bubble needed 15 days until the blow off top rang the final bell before the collapse happened.

Some days ago, the forex pair USDCAD produced a bubble that took only 6 days until the collapse occurred:

As a rule of thumb, you can say: Usually the size of the bubble defines the size of the anticipated profit move (the collapse of the bubble).

With my next 2 articles I will explain the underlying dynamics why these mini bubbles and mini crashes develop and why the subsequent collapse is one of the most reliable occurrences in the seemingly “most of the time random price moves of the financial markets”. So, stay tuned 🙂

This is a guest post by Mike Semlitsch who is a trader and software developer with a proven track record of helping novice and intermediate traders succeed in trading the financial markets. Driven by a passion to help others, he takes pride in creating and providing the best trading systems and indicators possible. As the owner of the website www.PerfectTrendSystem.com, he specializes in developing trading systems and tools that allow users to trade in harmony with the actions of the smart money.