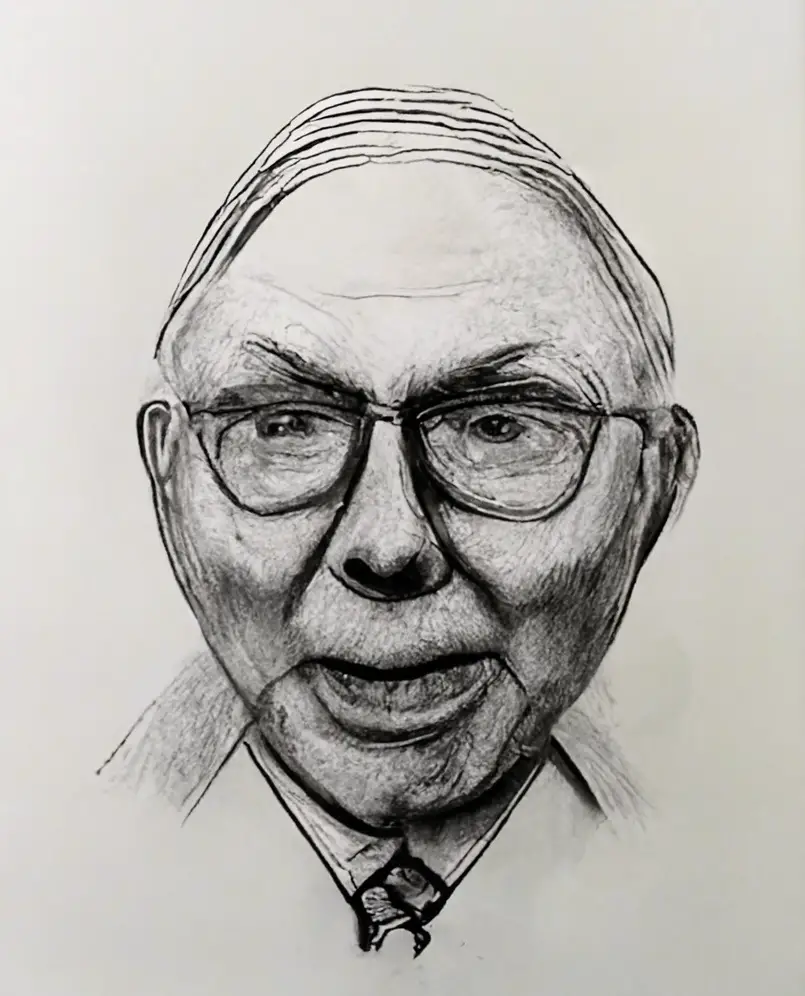

“The first $100,000 is a bitch, but you gotta do it. I don’t care what you have to do – if it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000. After that, you can ease off the gas a little bit.” – Charlie Munger

Is the first $100k the hardest?

Yes, in both personal finance and investing building the first $100,000 account is the most difficult as it usually come from working a job, selling your time and labor for a paycheck. Working a job can’t be leveraged as you sell your time and labor directly to an employer for a 1:1 ratio. You work once and you get paid once. There is no residual income from working nor any dividends or compounding of gains.

Once you do get to $100,000 you can begin to diversify your income streams to investments, cash flowing assets, real estate, and trading systems. When your money gets put to work and starts to make you money then the hardest part of personal finance is over and you can start enjoying the effects of capital gains, compounding returns on capital, dividends, and cash flow from assets. You make money in more ways than just selling your time for money.

How do I save my first 100k?

When starting at $0 there a few first steps to getting your savings and investment accounts growing.

The most obvious is to get a job but that is the step most stop at as they spend their whole paycheck. The key step one is to pay yourself first. Save a minimum of 10% of each paycheck into a savings account before you do anything else with your money, even pay bills second.

The next step is work a second job if possible or work all the overtime allowed at your first job which is preferrable. Save all of that additional income to supercharge your savings effort.

If your job offers a matching 401k have enough capital withdrawn from your account to get the full match. This can be part of your 10% in savings. This is one way to double your effort for accumulating capital quicker and also defer taxes until you withdraw the money later. I explain this process here.

Dollar cost average into an investing account using an S&P 500 index fund or ETF on a consistent basis. This averages your cost basis and can lead to an average 10% return on your capital over time. This helps get your capital growing and benefitting from each bull market. I explain that process here.

Of course none of this works unless you make enough money to live off of and also live within your means. Large car payments, going out every weekend and spending a lot of money on entertainment, and large rent or mortgage payments will make this process impossible as all your money will go to your monthly bills. Start small go big later when you can afford it.

The bigger your income and the more frugal your spending behavior the faster you get to $100,000. Not easy but well worth it as once you get there the next $100,000 is so much easier. My second $100,000 took less than half the time as my first one did.

Is 100k net worth good at 30?

According to a Bank of America survey in 2018, 16% of millennials now have $100,000 or more in savings. — (Which they defined as people between the ages of 23 and 37). By age 30, you should aim to have the equivalent of your annual salary saved. 1 in 6 millennials have $100,000 saved. [1]

By age 30 you should have the equivalent of your annual salary saved. If you earn $50,000 a year, aim to have $50,000 in savings when you hit 30. This counts all savings, IRAs, 401Ks and taxable trading or investing accounts.

By age 35 you should have twice your annual salary saved.

By age 40 you should have three times your annual salary saved.

By age 45 you should have four times your annual salary saved.

A six figure net worth is not only a great personal financial milestone but also a great psychological barrier to breakthrough that builds confidence in your saving and investing skills and discipline. The good news is growing this capital over time should be easier than getting to this first milestone as you benefit from putting your capital to work.

If you have a desire to get to your first $100,000 read my books The Working Dead or Investing Habits on Amazon to learn how to start investing, achieve financial peace, become financially independent, and eventually reach financial freedom.

If you’re interested in learning how to trade the price action in the stock market you can check out my books on Amazon here or my eCourses on my NewTraderUniversity.com website here.