Covered Calls for Beginners (Options Trading Strategy Guide)

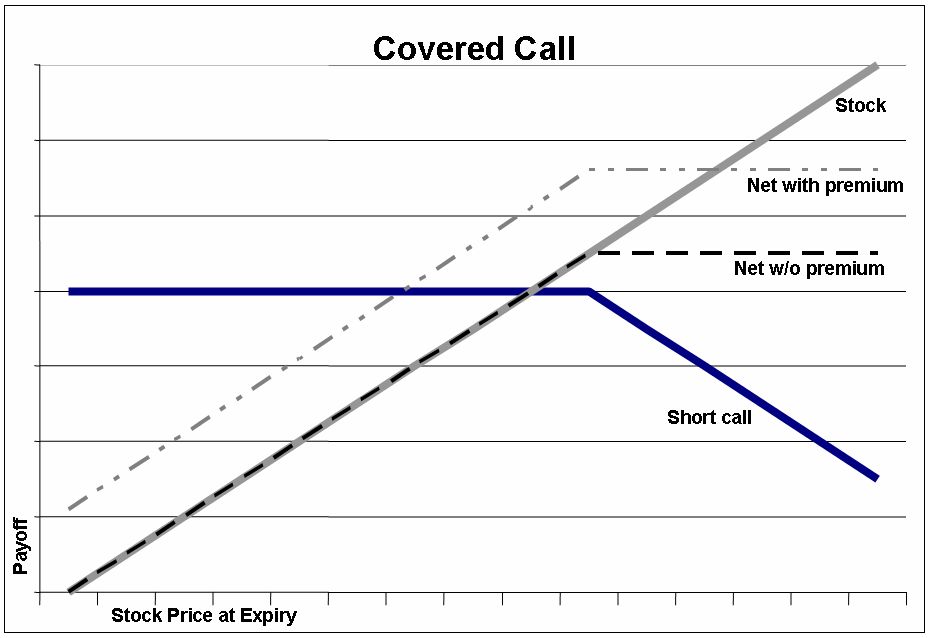

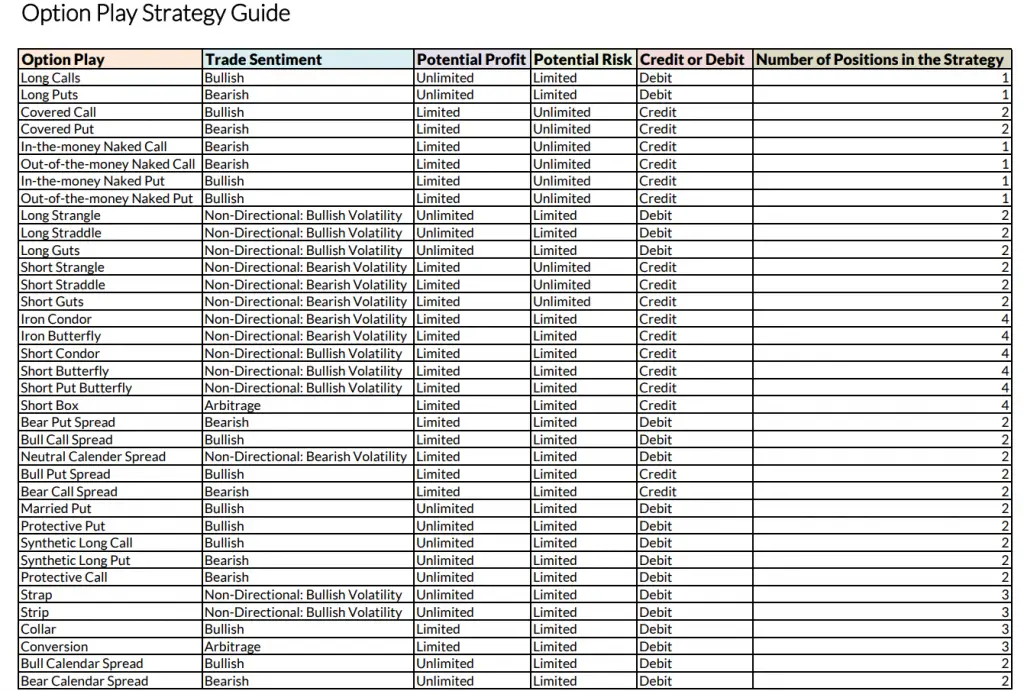

Covered calls are an income strategy for options traders and investors to earn money on stocks they plan to hold over the duration of a short-call option contract. This option play is created when an out-of-the-money call is sold on a current stock position. The trader collects the premium for the contract sold and will […]

Covered Calls for Beginners (Options Trading Strategy Guide) Read More »