This is a Guest Post by Jake @TrendSpider.

In this weekend’s analysis, we take a look at the broad market ETF’s SPY, QQQ, and Bitcoin. In this update, we take a look at how the monthly candles closed for August and what the month of September will start with. Make sure to set your alerts on the moving averages, trendlines, and Fibonacci levels you are watching into next week!

Weekend Broad SPY and BTC Charts

Get Ready For Next Weekend’s Webinar With Brian Shannon on 9/8 at 6 PM EST

Make sure to tune into next weekend’s webinar with Brian Shannon, founder of Alphatrends.net and author of “Technical Analysis Using Multiple Timeframes“. In this webinar, we will focus on using Brian’s “Anchored VWAP” on the platform as well as how you can use anchored VWAP when looking at blue raindrops.

Register Here For the 9/8 Webinar!

Weekend Video: SPY, QQQ, BTC

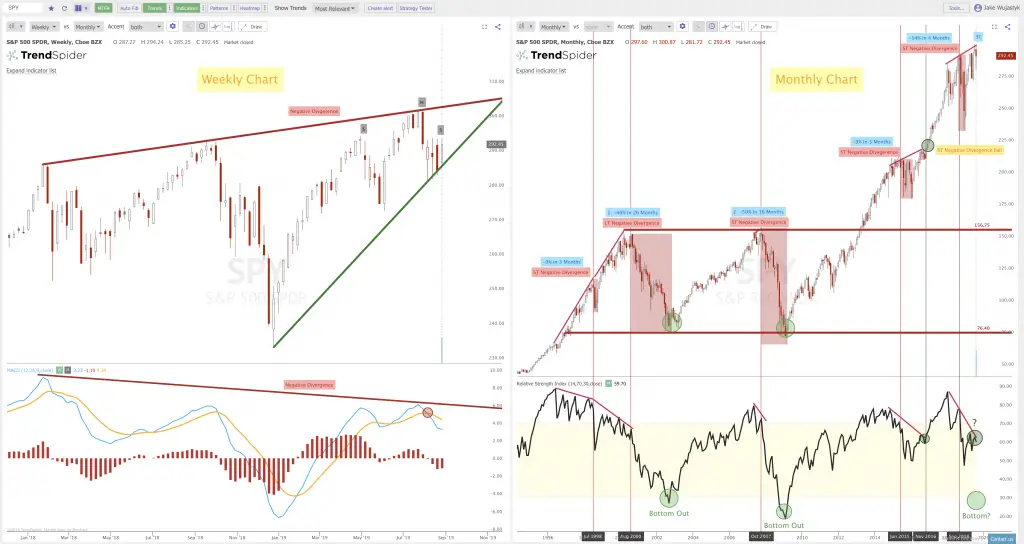

SPY: Weekly vs. Monthly Chart

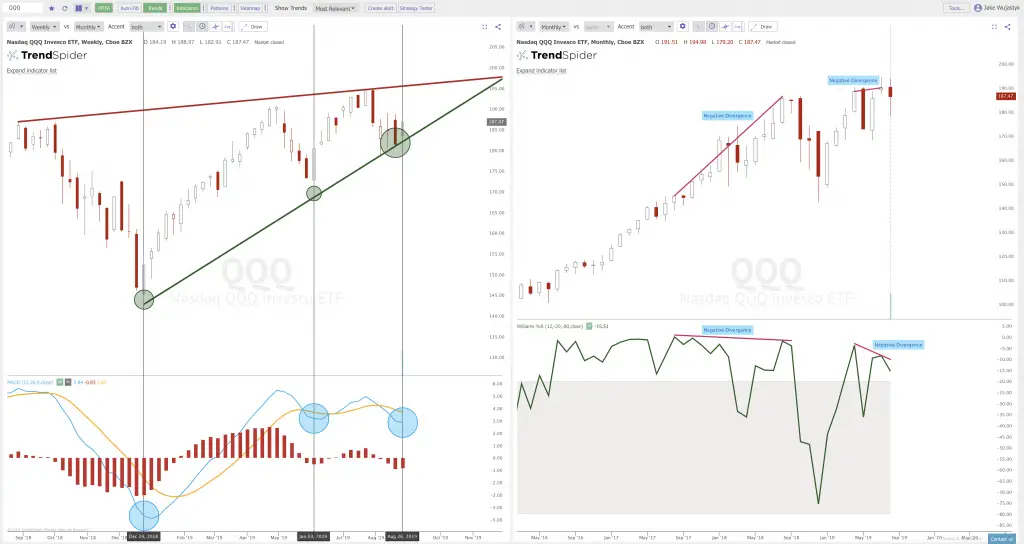

QQQ: Weekly vs. Monthly Chart

BTCUSD: Daily vs. Weekly Chart

Bitcoin Before and After: The Power of The Raindrop(TM)

In this weekends “Before and After”, we take a look at the Bitcoin chart from last week as it broke down through crucial levels of the symmetrical triangle support. You can see how the Raindrop(TM) showed heavy selling volume below the Trendline which then led to continuation down the next day. Learn more about raindrops here.

Related Blog Posts

- Alerts – Add alerts to your trendlines and indicators with sensitivity.

- Raindrops – Visualize volume and price action in a completely new way by visualizing volume flow throughout a specific time period.

- Conditional Criteria Alerts – Create complex conditions to be met between a mix of lower indicators and price action.

- Multi-time frame analysis (MTFA) – Overlay your chart a secondary timeframe with on trendlines, indicators, and Fibonacci levels.

- Trendline Preferences – Customize your trendlines to automate a consistent trendline drawing strategy.

- Add Watchlist – Create your own watchlist and quickly move through charts with automatic analysis on each!

- Automatic Candlestick Recognition – Automatically input your favorite candlestick patterns into the system and have TrendSpider find all the ones on your current chart!

Enjoyed this blog? Make sure to click on the links below to follow us on social media for intra-week chart updates:

StockTwits

Facebook

Twitter

LinkedIn

REMEMBER: These are charts that have interesting technical setups based on automated technical indicator analysis included. Charts and analysis provided for educational reasons only. TRENDSPIDER IS A CHART ANALYSIS PLATFORM. IT IS NOT INTENDED TO BE TRADING OR INVESTING ADVICE. ALWAYS DO YOUR OWN DUE DILIGENCE USING MULTIPLE SOURCES OF INFORMATION AND/OR SEEK THE ADVICE OF A LICENSED PROFESSIONAL BEFORE TRADING OR INVESTING. Please read our full risk disclaimer on our website by clicking here.