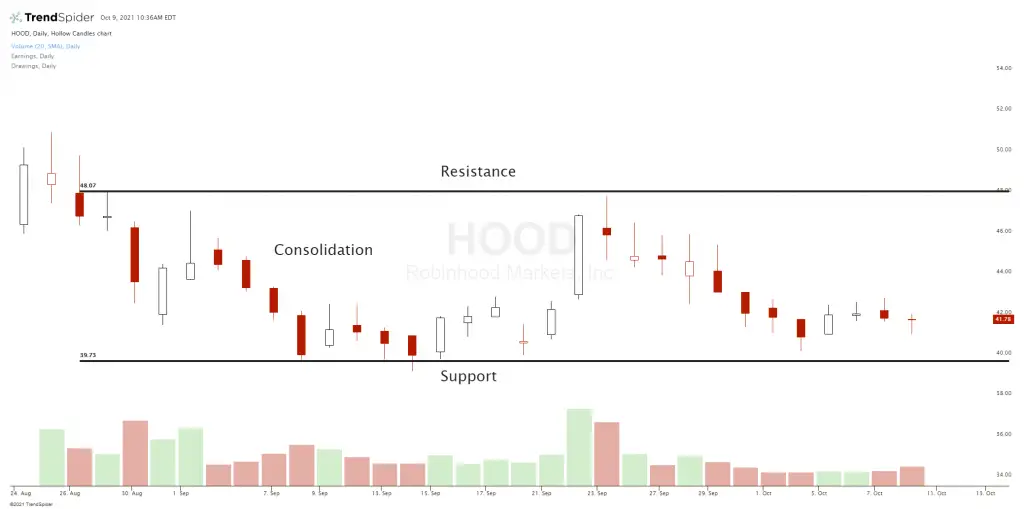

A consolidating stock is one that forms a trading range on its chart. A stock under consolidation will have defined resistance above price action and support below that acts as barriers to short-term movement. Stocks and markets go through different cycles of uptrends, downtrends, trading ranges, and volatility, the consolidation period is the one where a trading range is formed. It is a normal part of any market cycle to spend time not trending. The majority of time for any chart is spent in a range with only approximately 20% of the time spent in a sustained trend.

A consolidating stock has found equilibrium where buyers step in to enter at support and sellers step in to exit at resistance. Current supply and demand must be worked through before a chart can resume sustained directional movement in one direction.

In a wide consolidation swing traders can buy support and sell resistance. In a tight consolidation most traders wait for a break of resistance or support to see which way the chart is likely to move during the next swing or trend outside the current boundaries.

A breakout of the range is a signal for the potential of an end to the consolidation and the beginning of a new trend or swing in price. Breakouts end consolidation moving prices to the upside over resistance signaling a potential uptrend. Breakdowns end consolidation to the downside under support signaling the potential for a new downtrend.